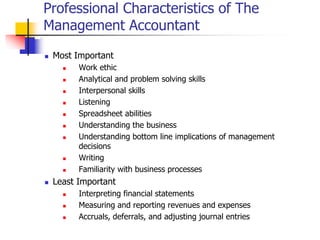

Management accounting provides information to managers for planning, control, and evaluation. It has become increasingly important as organizations face new trends like customer focus, quality focus, and short product life cycles. Management accounting is less regulated than financial accounting and provides decision support and control support. The goals of management accounting are to improve value and enhance decision making. It uses a single accounting system for multiple purposes like decisions, control, and taxes. Professional certifications in management accounting emphasize competencies like problem solving, communication, and ethics.