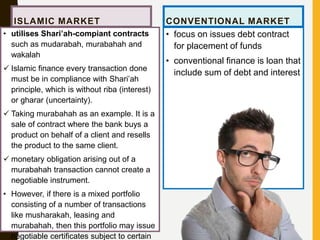

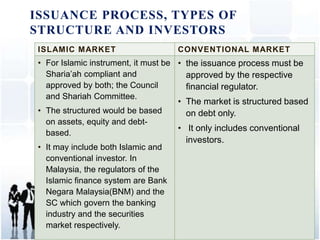

The document discusses the differences between conventional and Islamic negotiable instruments. For conventional instruments, negotiable instruments are governed by the Bills of Exchange Act 1949 and Cheques Act 1957, while Islamic instruments are governed by the Islamic Financial Services Act 2013. Some key types of conventional instruments include bills of exchange, cheques, promissory notes, and bankers' drafts. Islamic negotiable instruments include the Islamic Negotiable Instrument of Deposit (INID), which is based on the al-mudharabah concept, and the Negotiable Islamic Debt Certificate (NIDC).

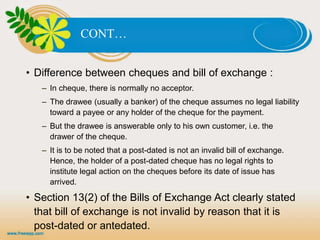

![Yee Chow Fah v Multihorizon Sdn Bhd [1998] 1

LNS 365.

• the Multihorizon Sdn. Bhd (the respondent), on 19th February

1994 drew a crossed post-dated cheques HSBC in the sum of

RM 23,000.00 made payable to cash or bearer dated 23rd

February 1994 and delivered the cheque to Cipta Hikmat

Development Sdn. Bhd for the purchase of timber logs from the

latter.

• As Cipta Hikmat was unable to supply the logs, the respondent

countermanded the payment. In the meantime, the cheque fell

into the hands of Mr. Yee Teck Fah, counsel who argued this

case in front of the judge on behalf of the appellant, who is his

sister.

• The Counsel negotiated the cheque with the appellant and

obtained cash RM 23,000.00 from her in return for the cheque.

On 23rd February 1984, the appellant presented the cheque for

payment and it was dishonoured, having been countermanded

by th respondent.](https://image.slidesharecdn.com/conventionalislamicnegotiableinstrument1-170411055039/85/Conventional-Islamic-Negotiable-Instrument-9-320.jpg)