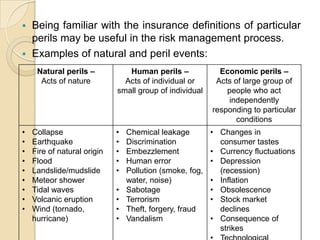

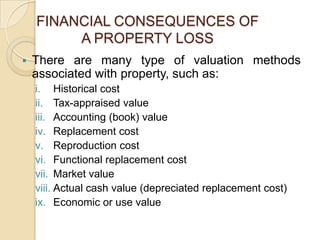

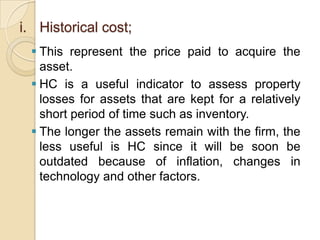

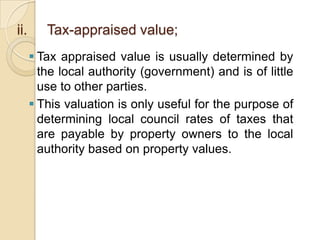

This document discusses analyzing property loss exposures. It identifies the key elements of a loss exposure as the value exposed, the peril causing loss, and potential financial impact. Real property includes buildings and land. Personal property is tangible, like inventory, or intangible. Loss exposures are identified through questionnaires, loss histories, and financial records. Property is valued using various methods like replacement cost or depreciated value. The document outlines various natural, human and economic perils that can cause property losses and their financial consequences.