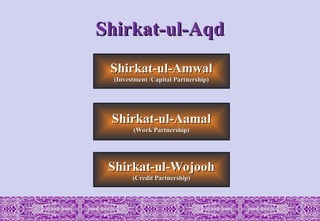

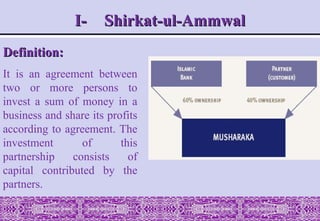

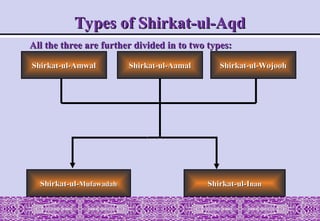

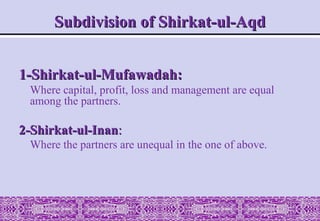

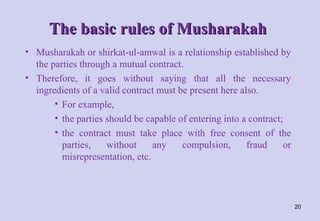

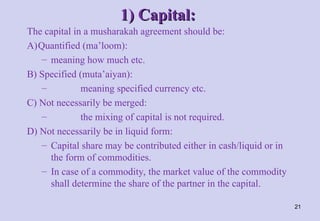

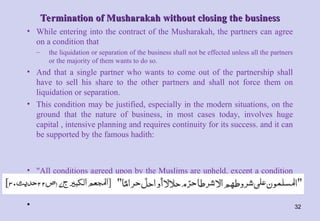

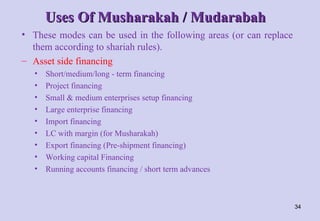

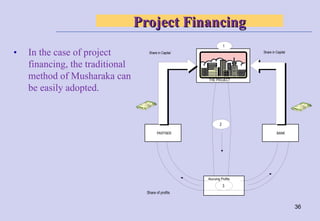

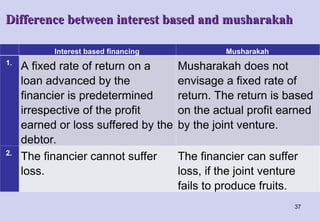

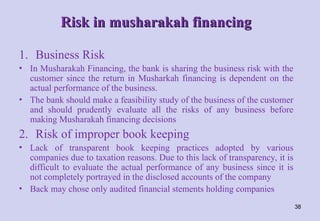

The document provides a comprehensive overview of musharakah, an Islamic financing partnership model, detailing its definitions, types, rules, and application within Islamic finance. It discusses the legitimacy of partnerships, various forms of musharakah, and the rights and obligations of partners, including profit and loss distribution. Additionally, it highlights the risk factors associated with musharakah financing and its practical applications in project and asset financing.