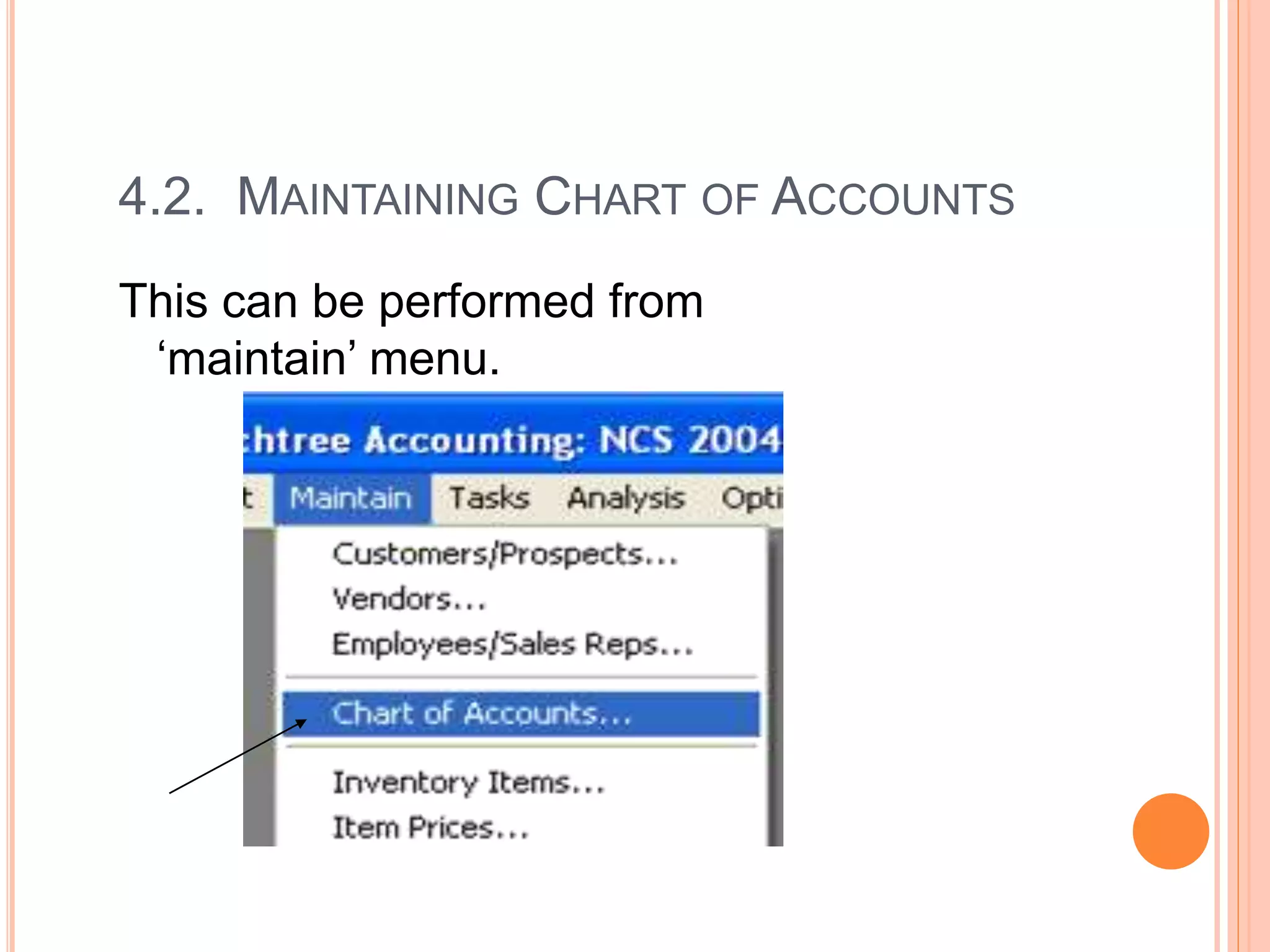

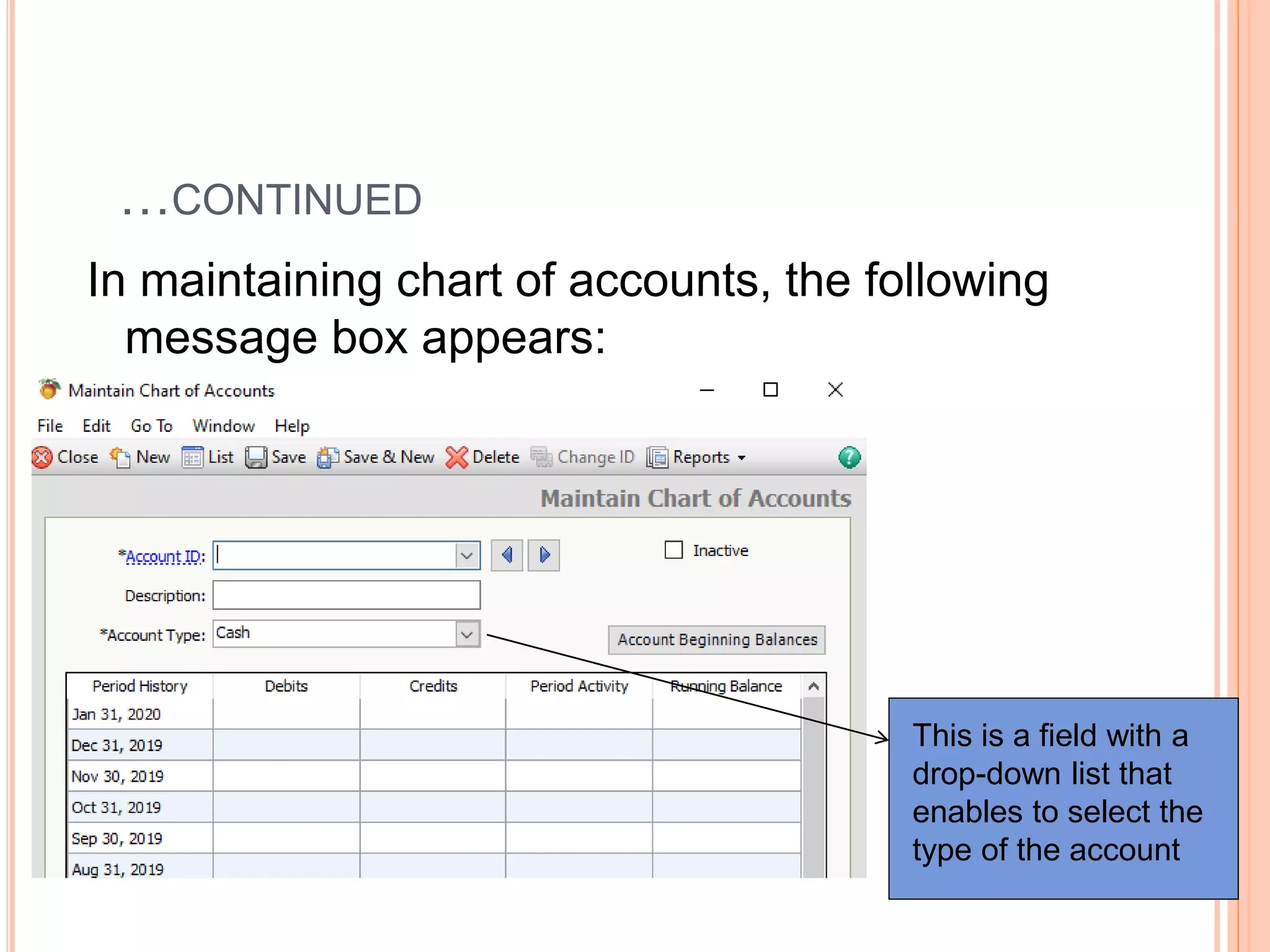

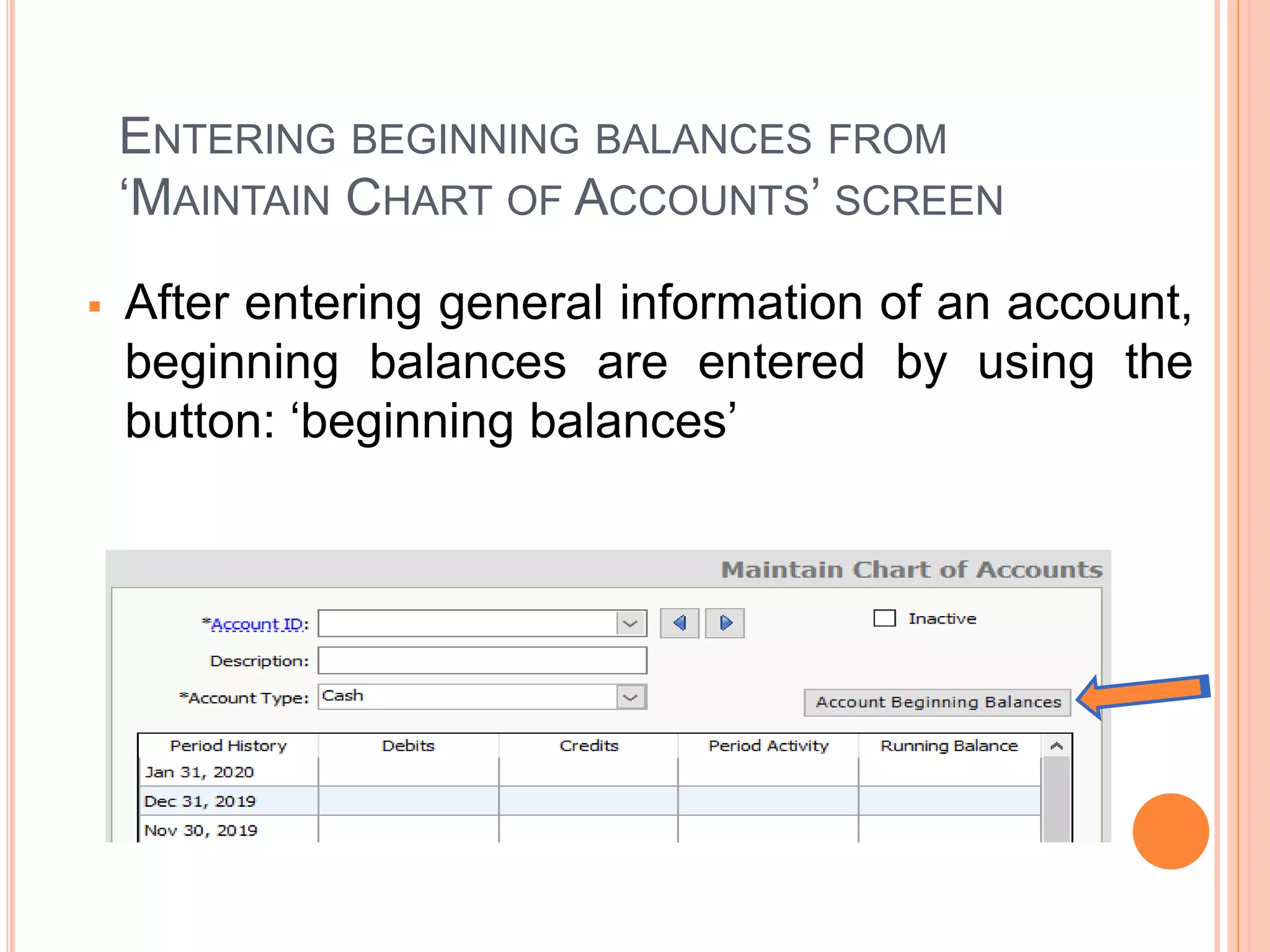

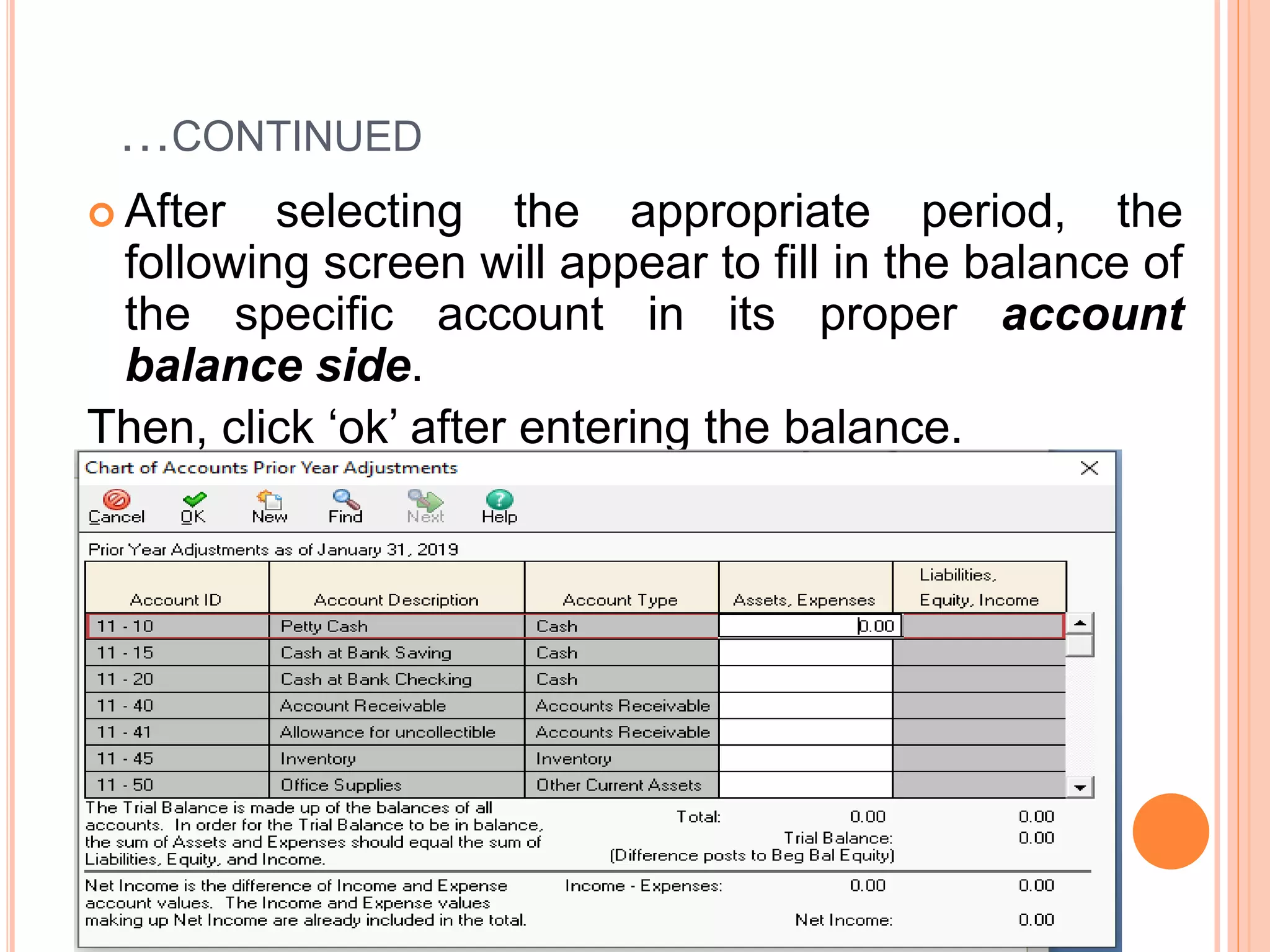

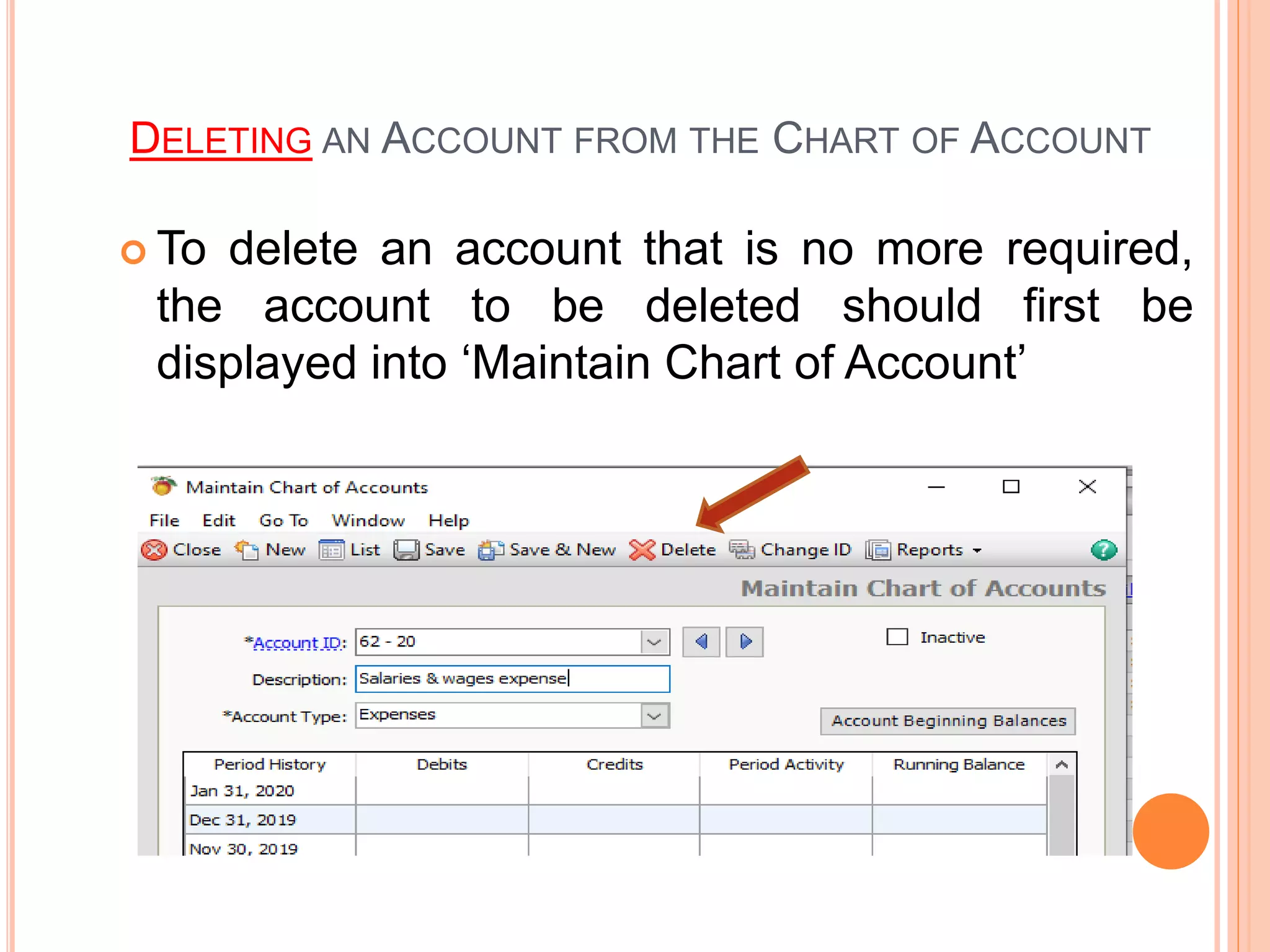

This document discusses maintaining a general ledger in Peachtree accounting software. It explains how to create and manage a chart of accounts, enter beginning account balances, and print reports. Key points include how to select account types when setting up the chart of accounts, two methods for entering beginning balances, and various report specifications like date, zero balances, and included fields/accounts.