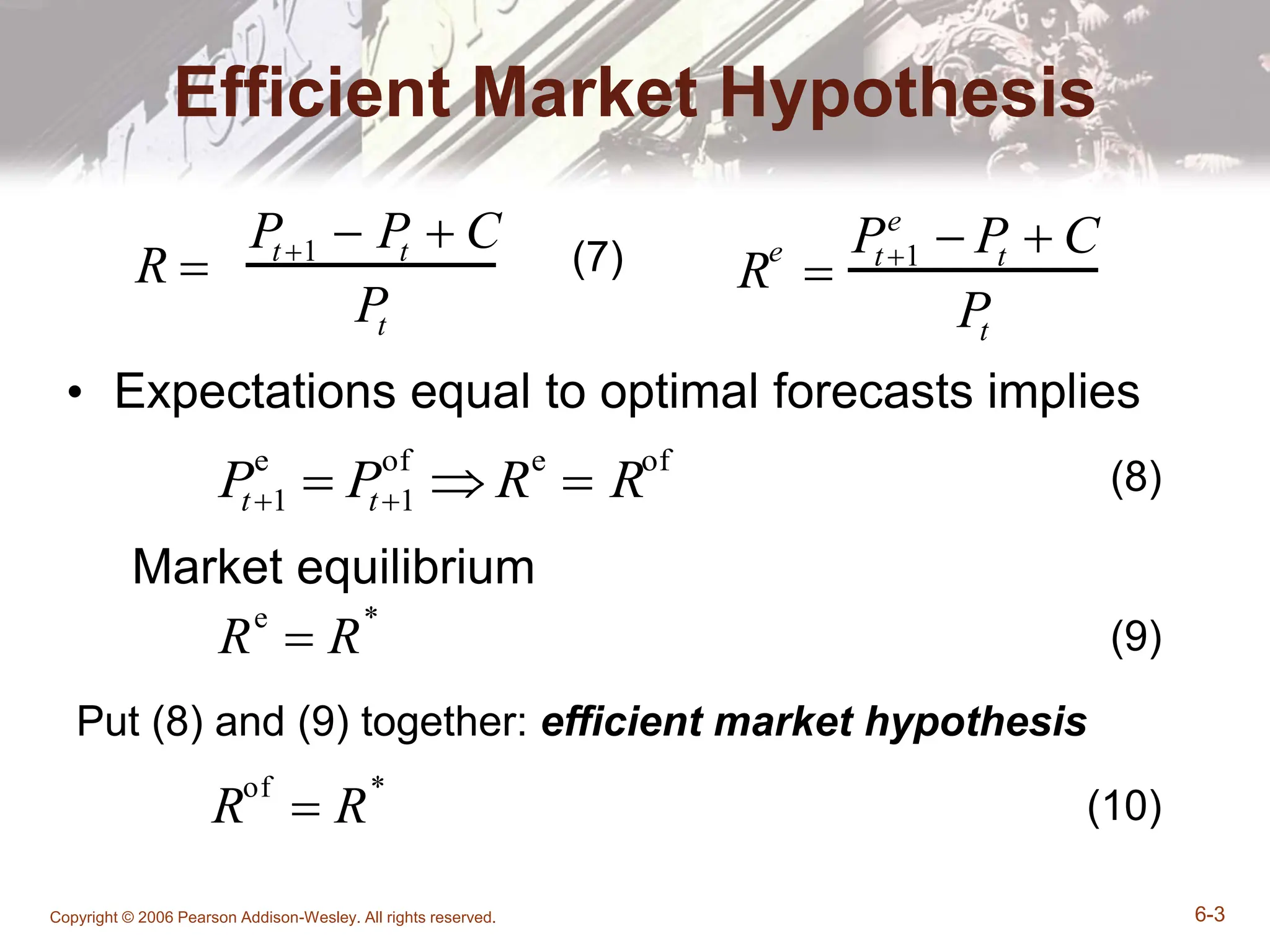

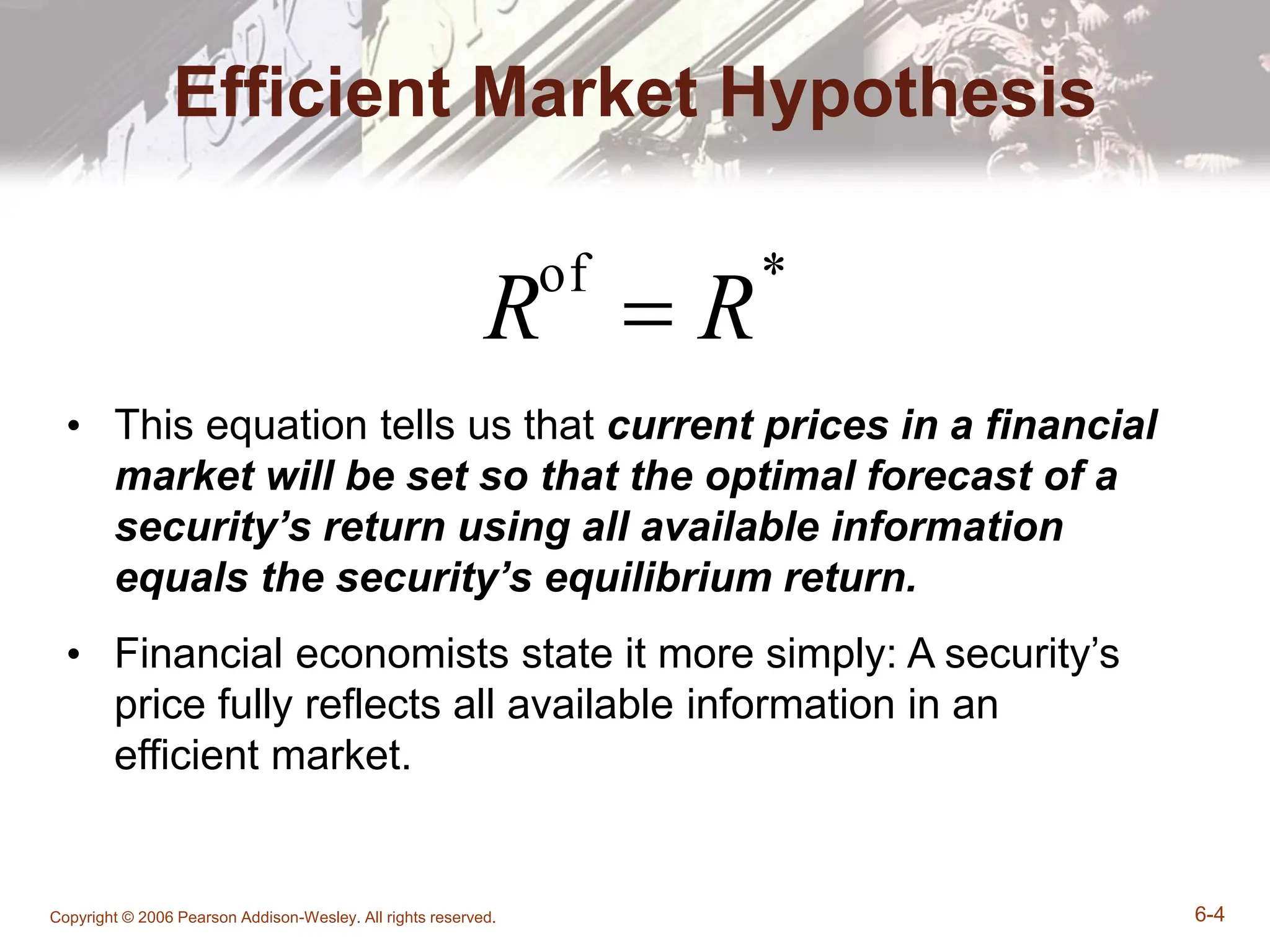

This document discusses the efficient market hypothesis (EMH), which posits that current security prices reflect all available information, thereby eliminating unexploited profit opportunities. It presents both supporting and opposing evidence for EMH, including anomalies like the small-firm effect and excessive volatility, while also addressing implications for investors. Finally, it introduces behavioral finance as a complementary approach to understanding market behavior beyond traditional EMH.