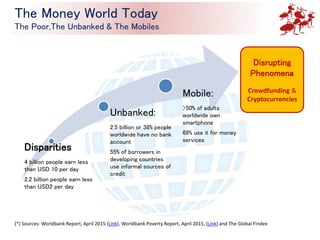

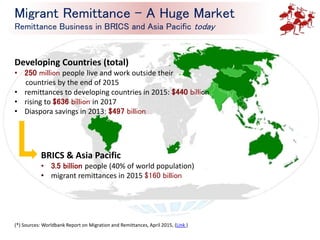

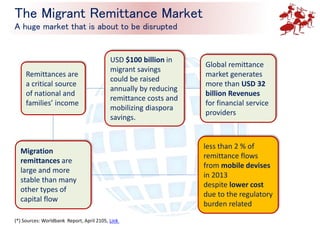

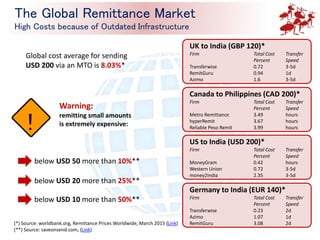

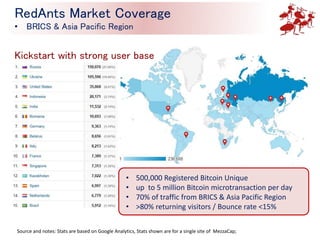

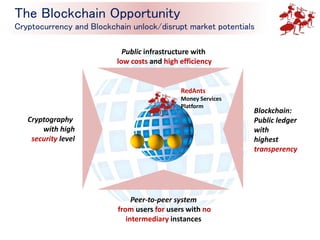

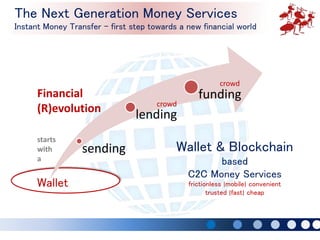

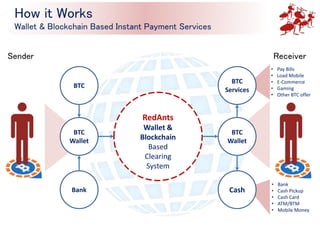

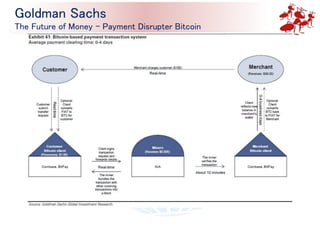

The document discusses the challenges and opportunities in the global remittance market, particularly focusing on the unbanked populations who rely on costly informal credit sources. It highlights the potential of cryptocurrencies and blockchain technology to disrupt the traditional remittance system by offering more efficient, low-cost money services. The document emphasizes that significant savings could be realized by leveraging these technologies to reduce remittance costs and mobilize diaspora savings.