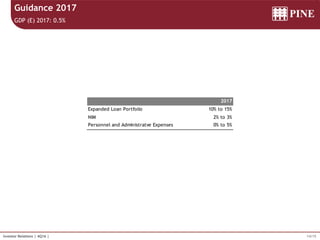

The document summarizes the 4Q16 financial results of Pine Bank. Key highlights include a liquid balance sheet with R$1.2 billion in cash, a BIS capital ratio of 15.4%, and a loan portfolio coverage ratio of approximately 6% due to significant provisions. Expenses declined 7% year-over-year while funding remained diversified. Guidance for 2017 includes expanded loan portfolio growth of 10-15% and a net interest margin of 2-3%.