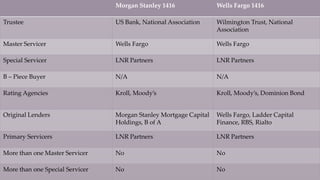

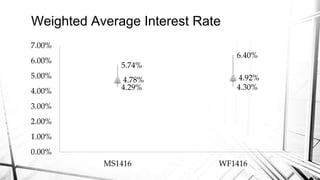

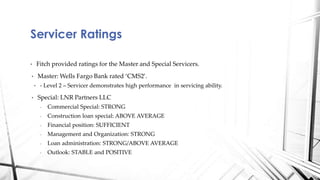

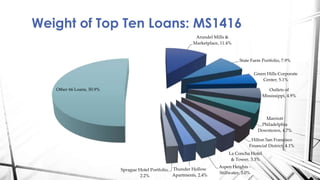

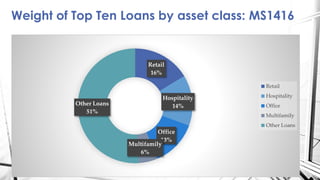

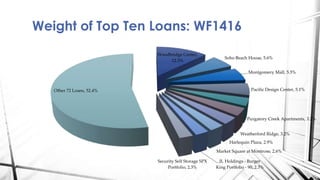

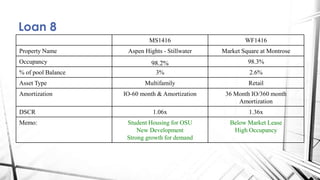

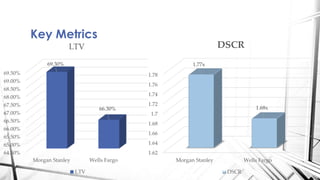

This document compares two commercial mortgage backed securities (CMBS) pools, Morgan Stanley 1416 and Wells Fargo 1416. After analyzing key metrics like weighted average interest rates, maturities, loan-to-value ratios, debt service coverage ratios, and top loan exposures, the author determines that the Wells Fargo 1416 pool is better suited for their clients given its stronger performance across several metrics. The document provides detailed analyses of the top ten loans in each pool.