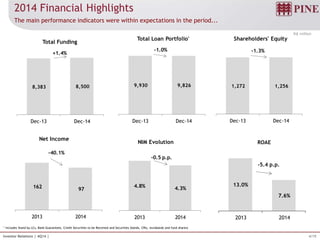

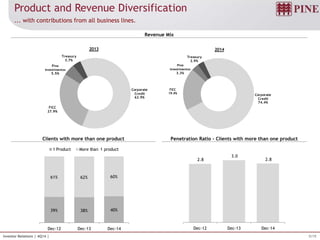

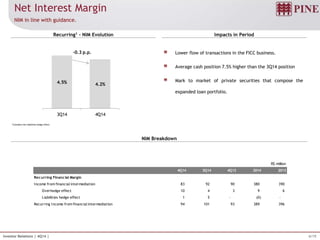

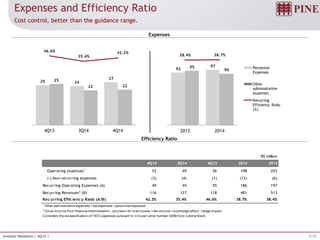

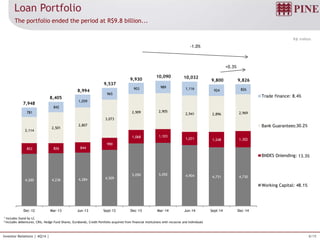

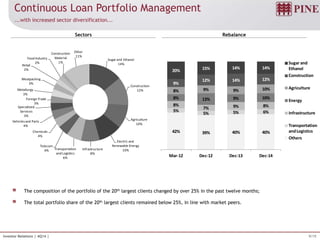

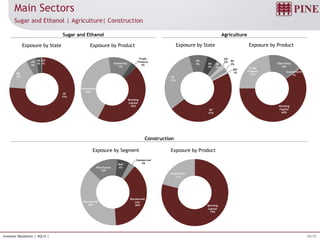

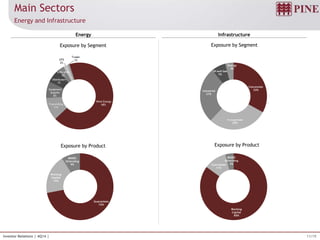

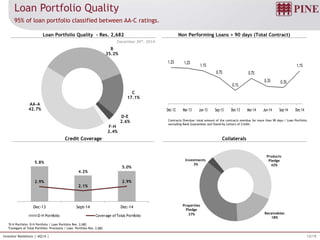

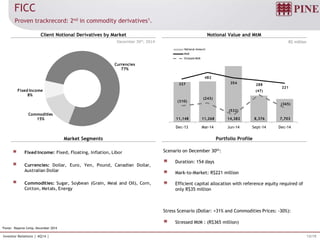

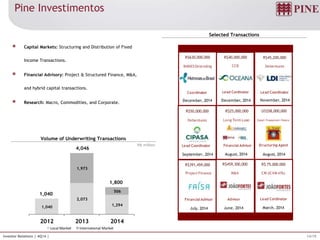

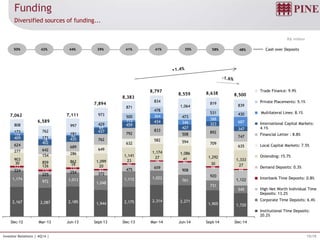

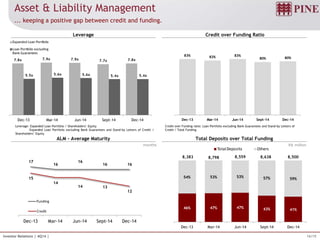

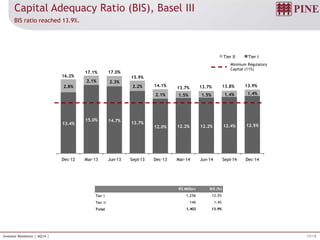

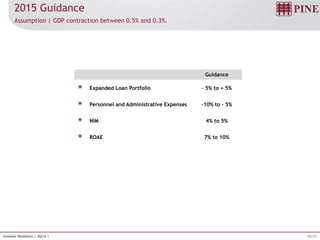

This document summarizes a conference call discussing the 2014 earnings results of an unnamed bank. The key highlights and financial results discussed include: diversified revenue sources, a reduction in funding costs, an increase in the capital ratio, expansion of loan portfolio sectors, continued management of loan portfolio quality, the FICC business performance, Pine Investimentos transaction volume, diversified sources of funding, and guidance for 2015 that was within expectations. The document provides an agenda and discusses the bank's performance across multiple business lines and financial metrics for the year.