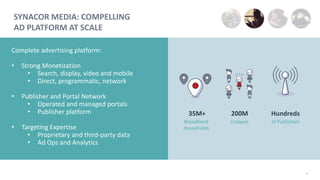

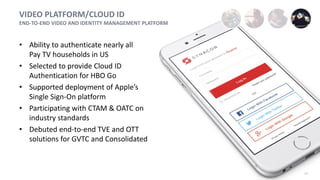

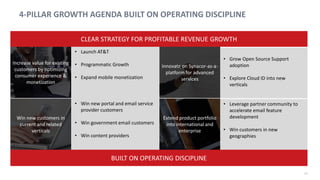

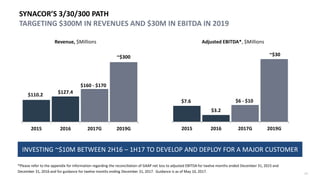

Synacor is a digital technology company that enables cable and telecom providers to better engage with consumers through portal experiences, email/collaboration, video platforms, and advertising solutions. The document outlines Synacor's growth strategy focused on recurring and fee-based revenue streams, and targets $300 million in revenue and $30 million in EBITDA by 2019 through winning new customers, expanding existing customer relationships, and growing advertising and open source support offerings. Financial guidance projects 2017 revenue of $160-170 million and adjusted EBITDA of $6-10 million.