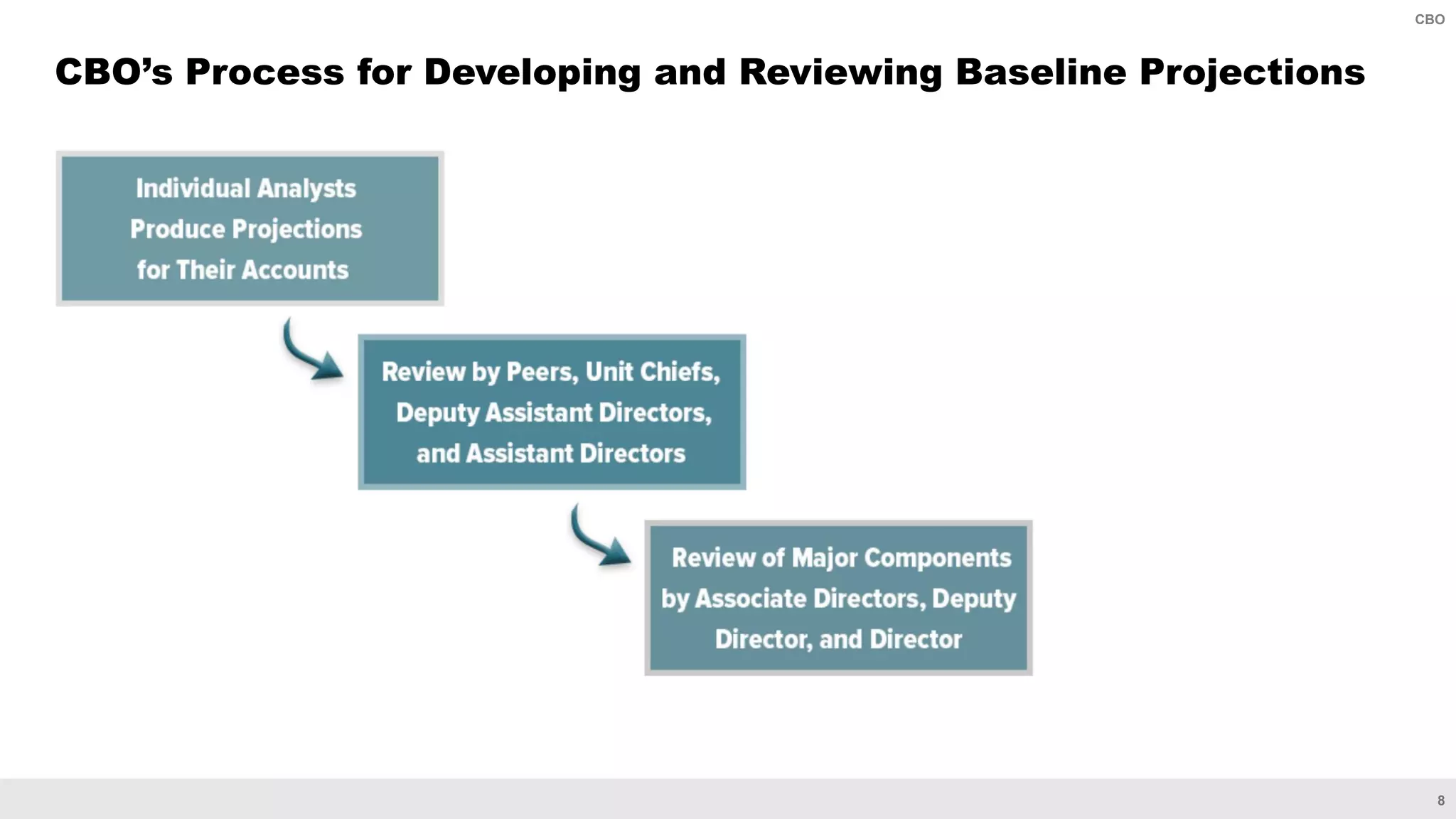

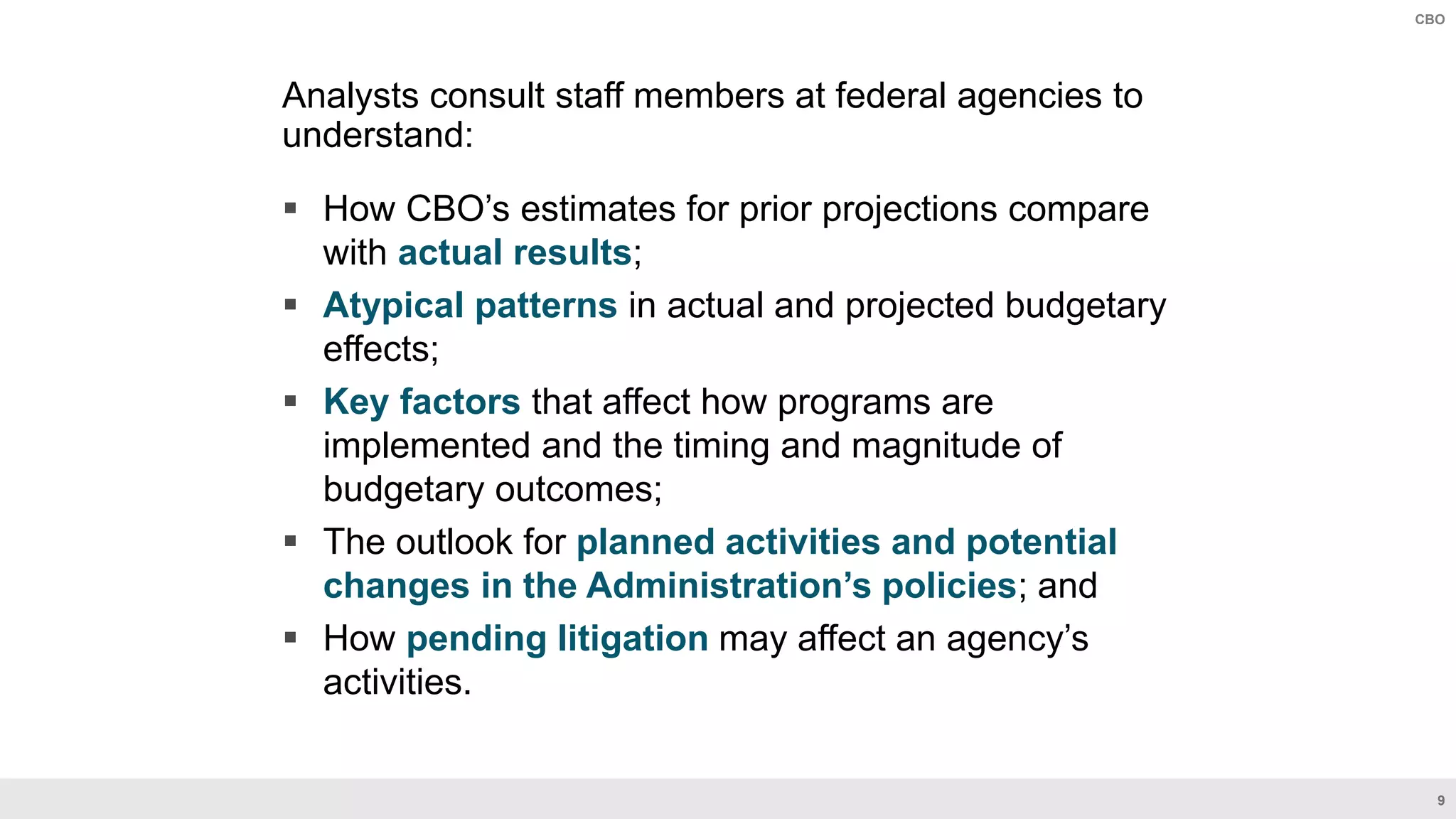

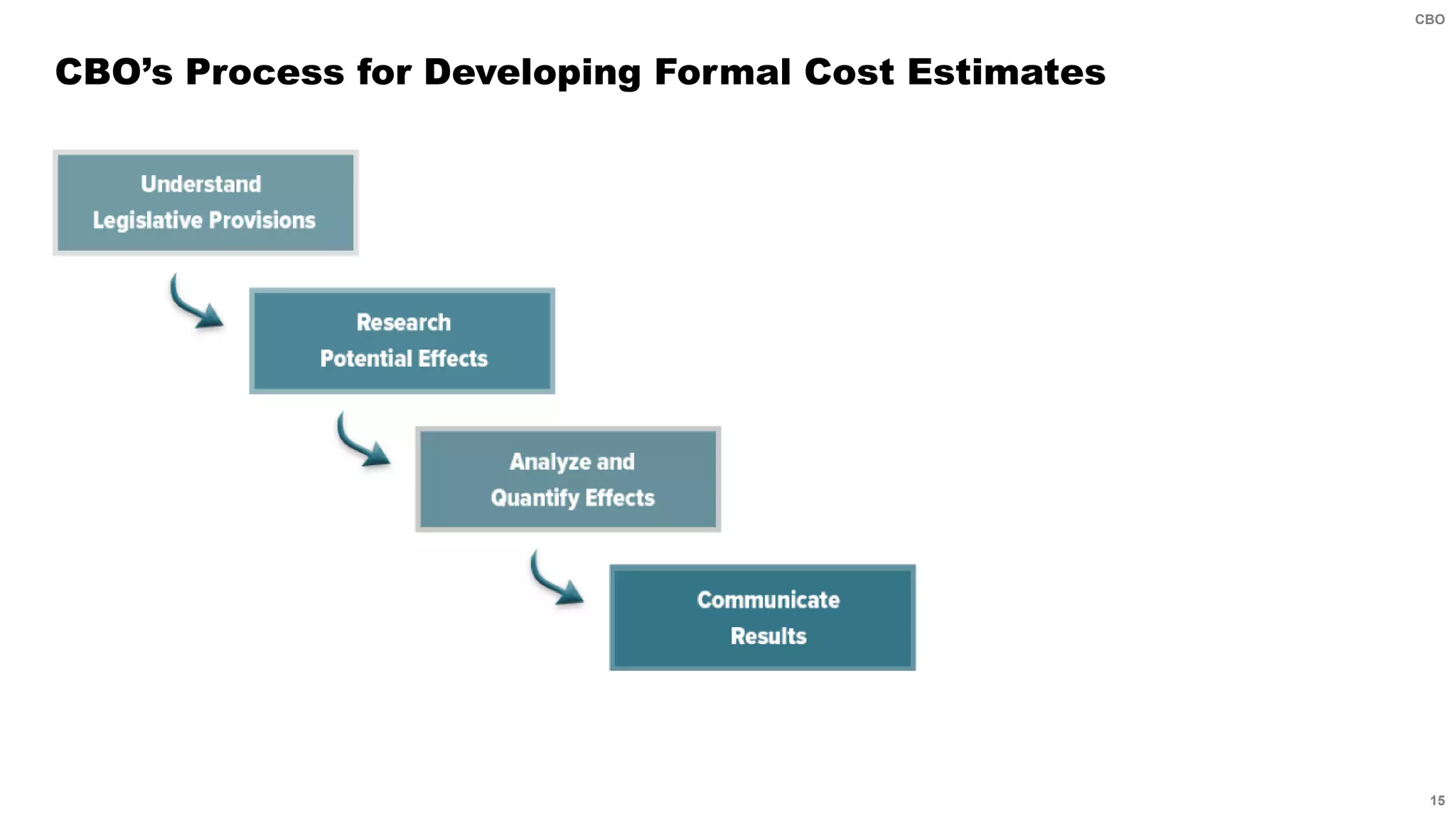

The Congressional Budget Office (CBO) was established by the Congressional Budget Act of 1974 to provide baseline budget projections and cost estimates for legislation, ensuring communication and data sharing with federal agencies. CBO analysts consult with various experts and agencies to understand budgetary impacts and inform their projections, which serve as benchmarks for Congress. In preparing cost estimates, CBO employs a structured process involving analysis of proposed legislation and the behavioral impacts it may have on affected entities.