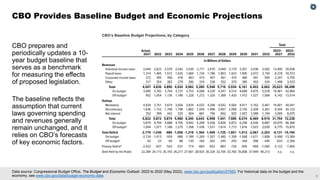

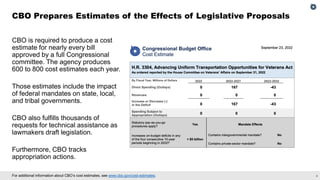

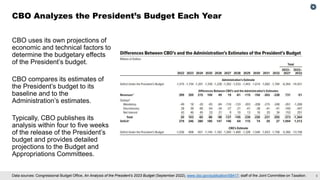

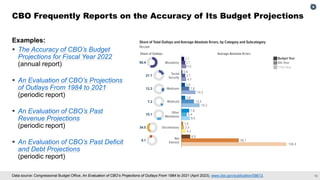

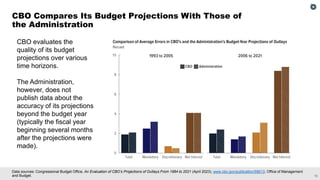

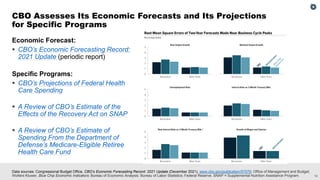

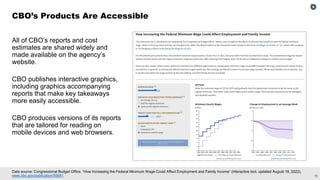

The document is a presentation by Mark Hadley on the role and functions of the Congressional Budget Office (CBO), established to assist Congress with budgetary and economic analysis since 1974. It outlines CBO's processes for data acquisition, budget estimates, cost analyses, and its commitment to transparency in sharing information with Congress and the public. CBO evaluates the accuracy of its projections, maintaining high standards for its estimates and collaborating with federal agencies to enhance data access.