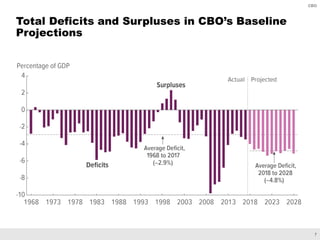

The Congressional Budget Office (CBO) was established to provide objective and nonpartisan analysis to assist Congress in budgetary and economic decisions. CBO's work includes producing long-term budget projections, cost estimates for legislation, and regular reports on economic outlook, while ensuring transparency and objectivity through rigorous review processes. The agency has evolved to meet Congress's changing needs, enhancing its focus on areas like health care and economic analysis.