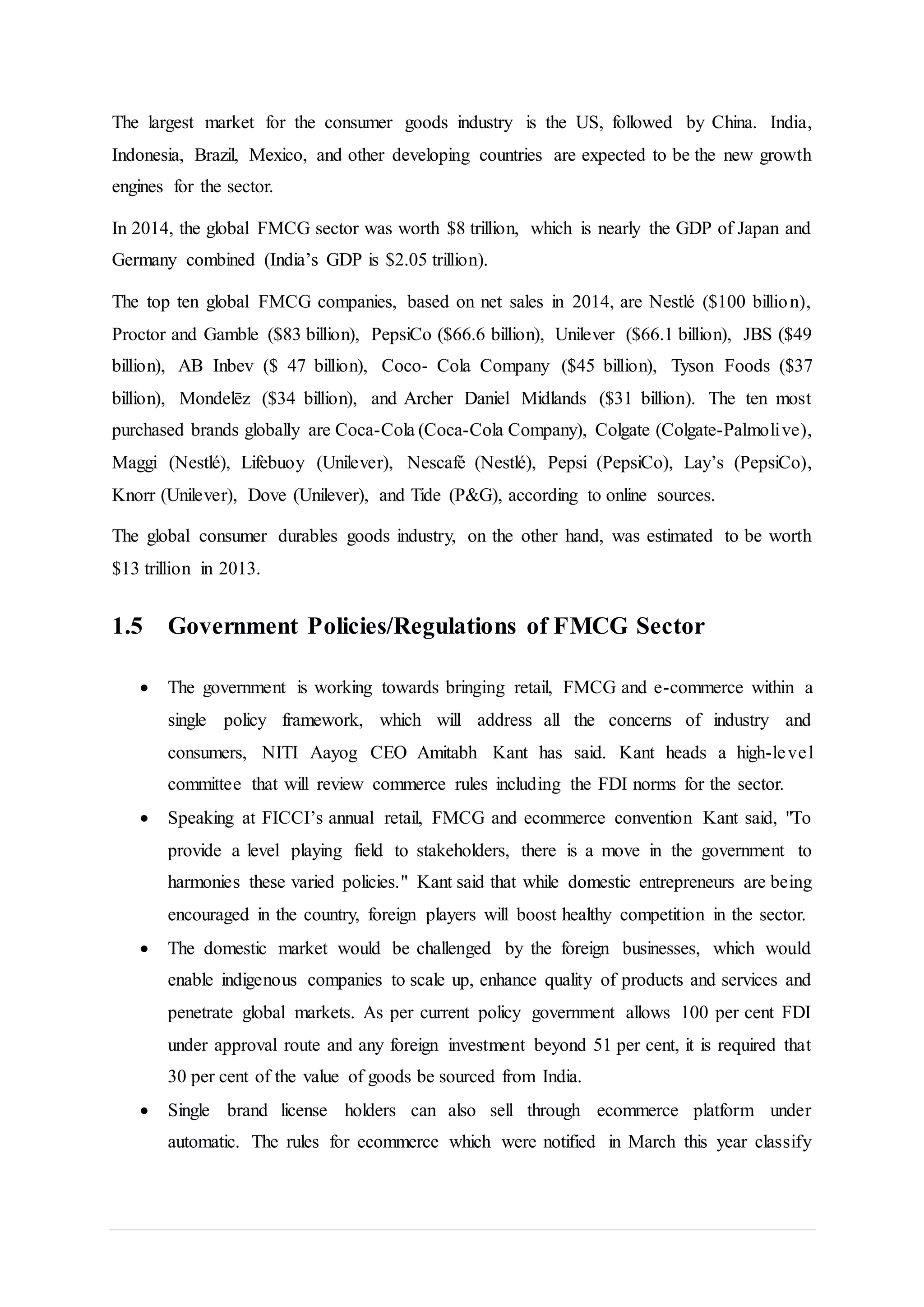

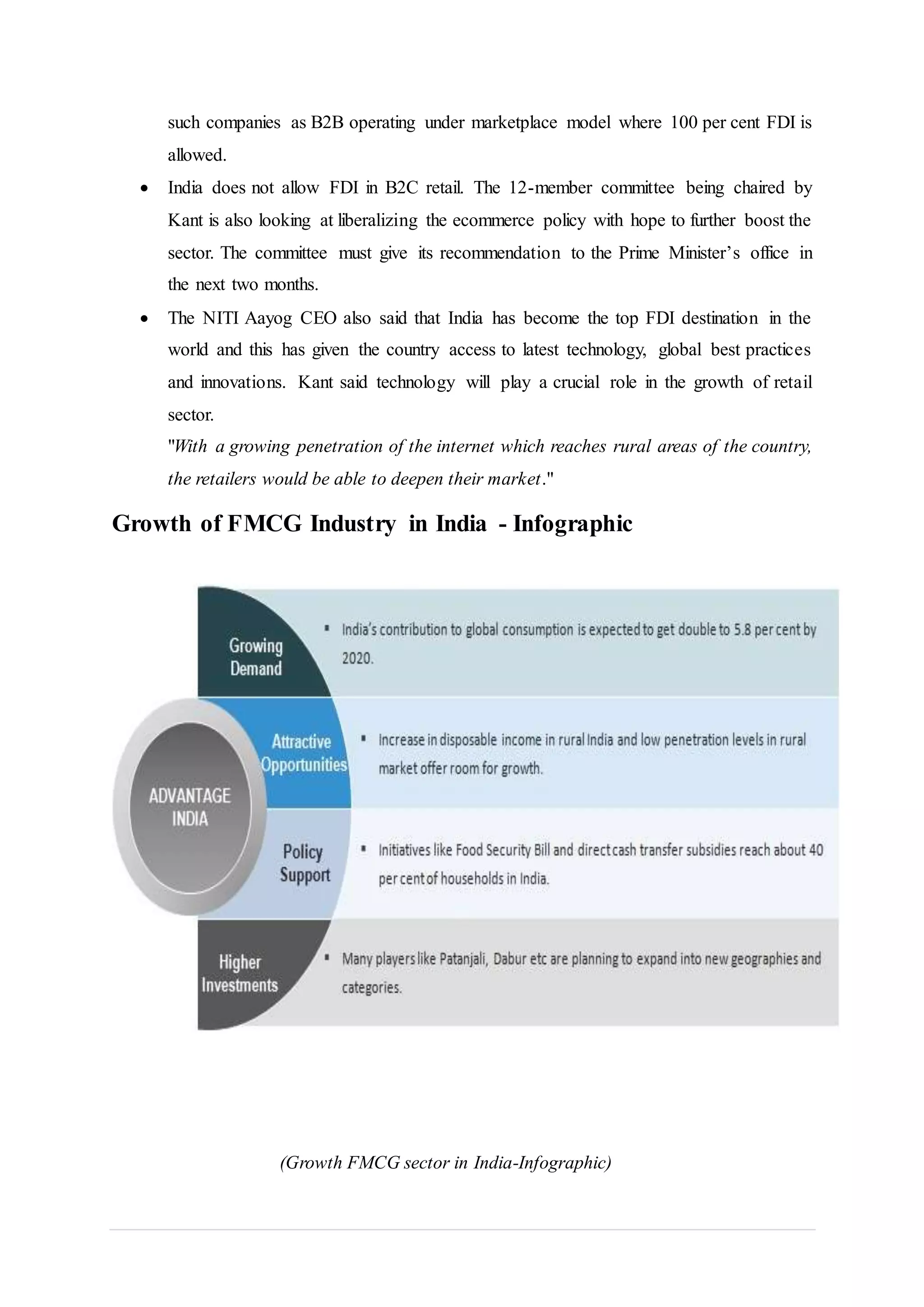

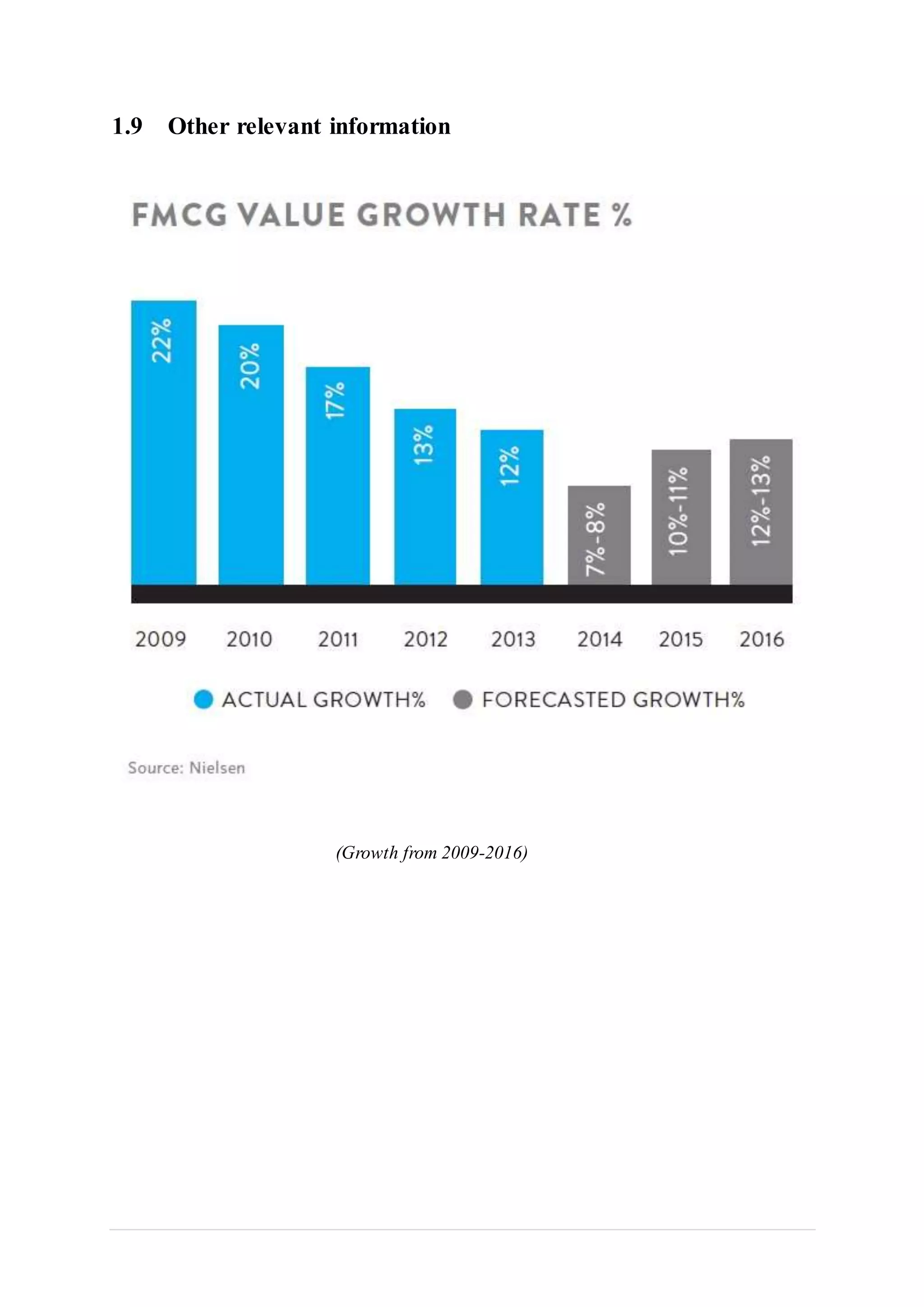

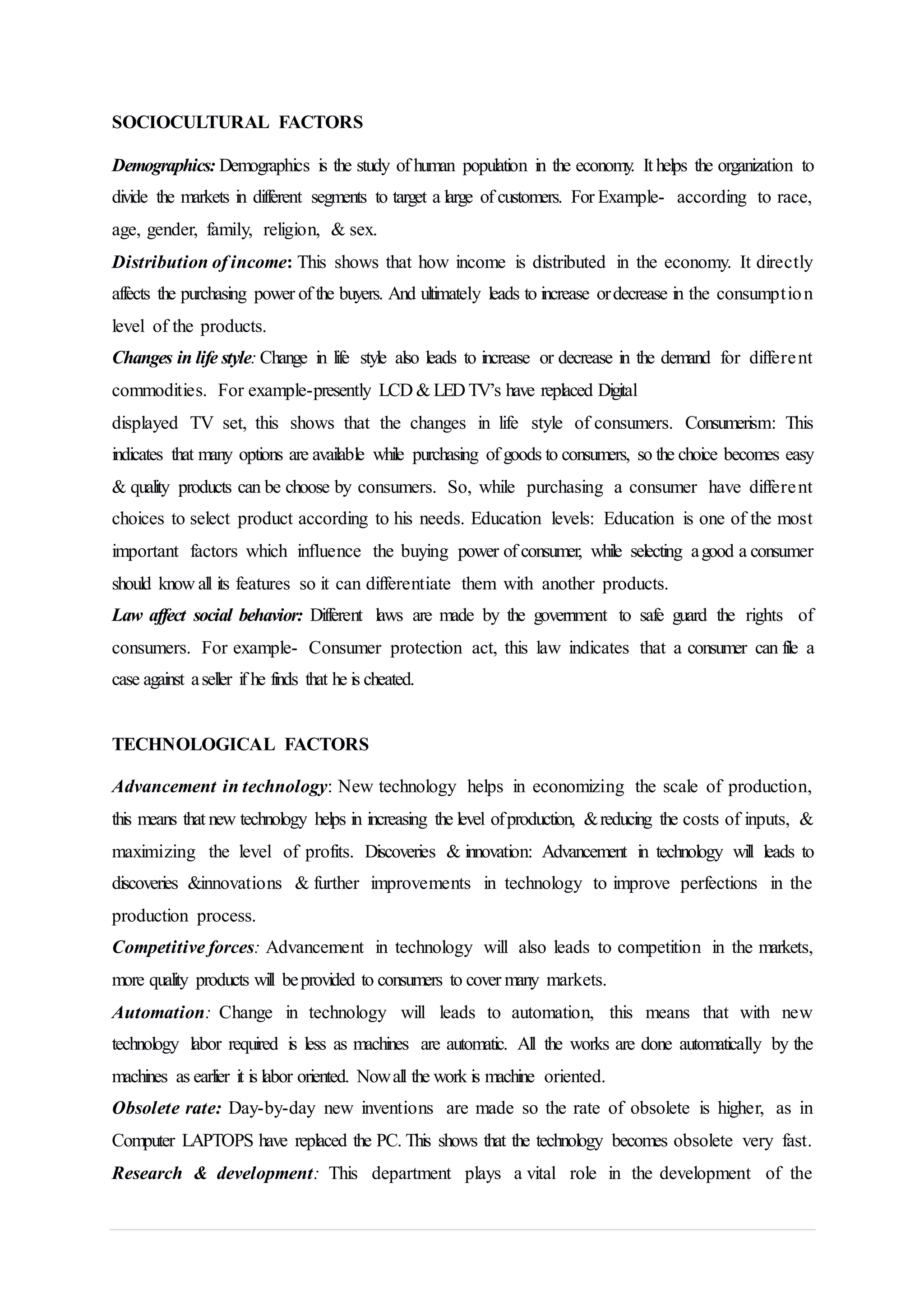

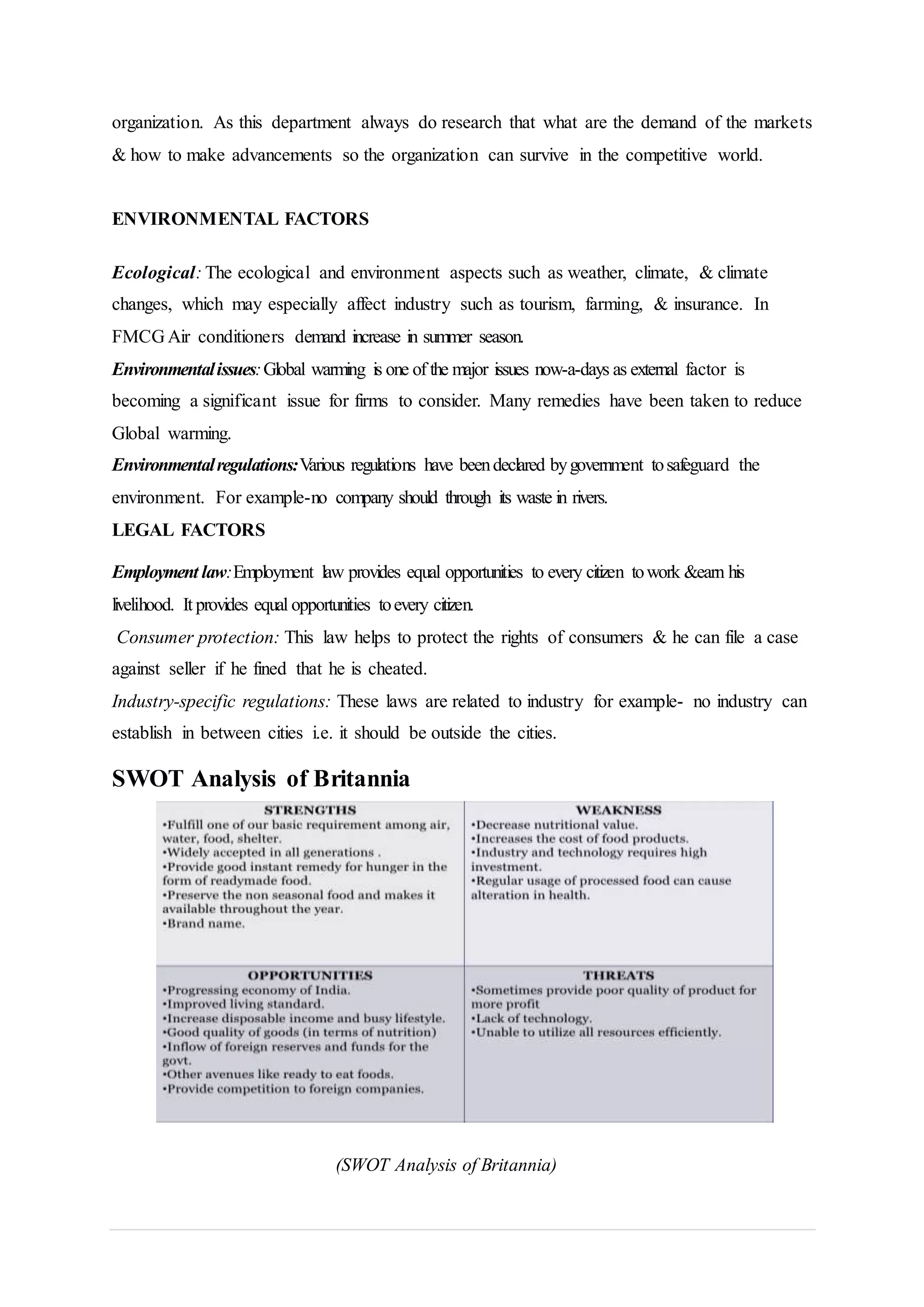

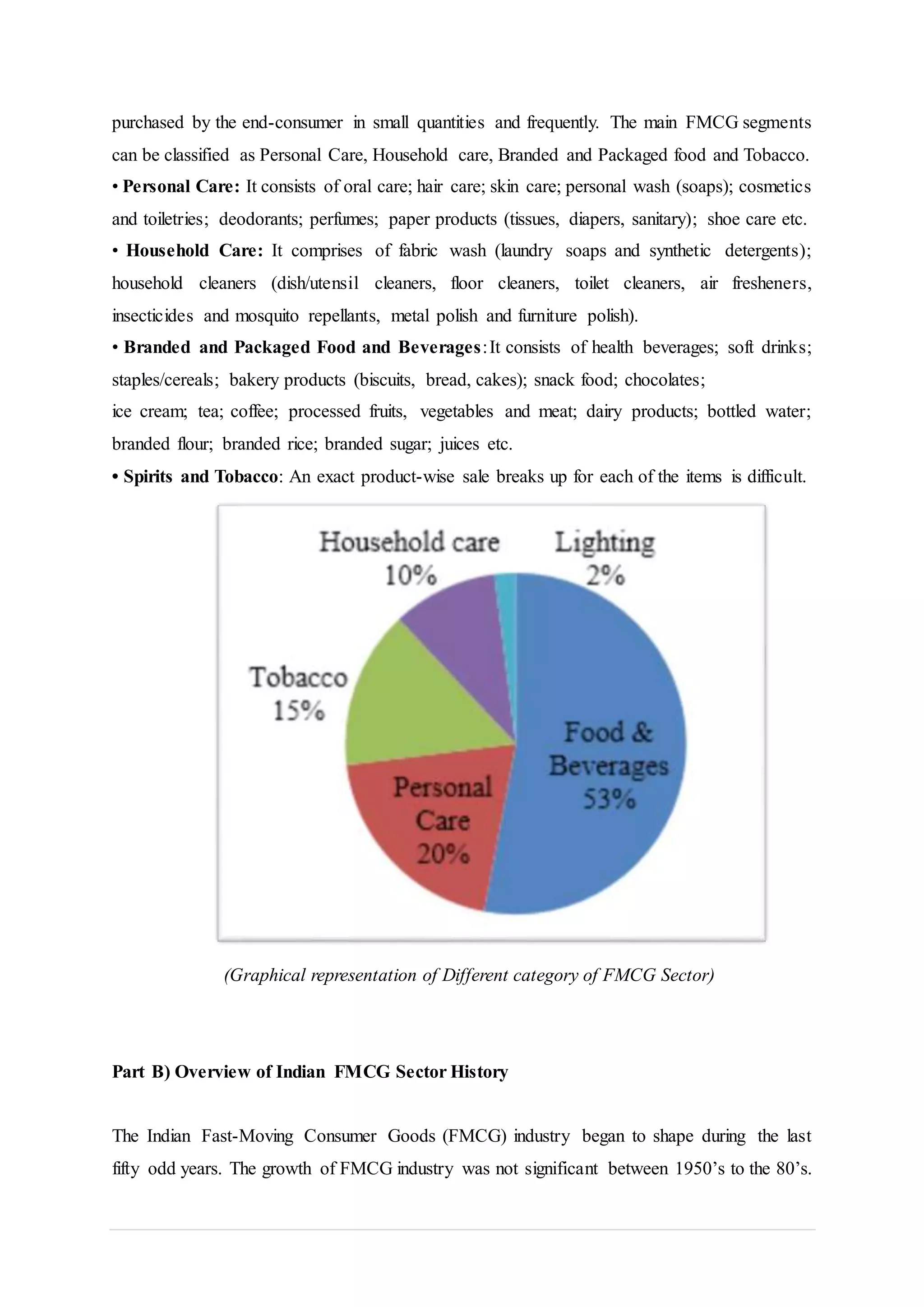

The document outlines a comprehensive analysis of consumer behavior towards two prominent FMCG brands, 'Parle' and 'Britannia'. It discusses the growth dynamics of the FMCG sector in India, key drivers of market expansion, government policies, and competitive landscape, while providing detailed insights into the domestic and foreign competition along with various analytical frameworks like SWOT, PESTLE, and BCG matrices. Additionally, it highlights the significance of rural markets, changes in consumer preferences, and the impact of government regulations on the sector's growth trajectory.