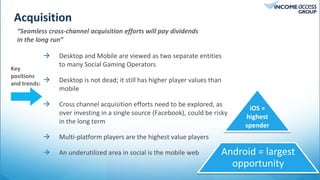

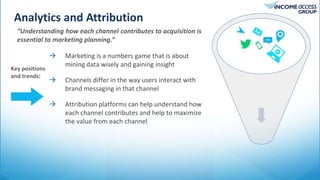

The document discusses the potential crossover between real money gaming (RMG) and social gaming, highlighting the importance of user engagement, acquisition strategies, and advertising methods. It notes that while desktop gaming still retains higher player values than mobile, a focus on multi-platform acquisition and player quality is essential as competition increases. Additionally, leveraging analytics and understanding channel contributions to marketing can enhance acquisition strategies.

![Market Crossover

“Opportunity exists in understanding the crossover between real

money gaming and social gaming”

Social RMG?

Amount of overlap in user profile varies by product

RMG traffic sources can work for social – monetize players

looking for free money.

Social traffic sources can work for real money – low cost

acquisition which increase liquidity and monetize through

strong CRM.

Key

positions

and trends:

- Richard Weil of SciPlay

In the future of the games

industry [...] it will be essential

to devise ways to take

advantage of the social gaming

boom as it intersects with real

money gaming and the bricks

and mortar retail business](https://image.slidesharecdn.com/casualconnect-ldeditsma-140807115830-phpapp02/85/What-Real-Money-Gaming-can-Learn-from-Social-Gaming-3-320.jpg)

![Engagement and CRM

“Technology is the primary engine to support engagement

and CRM, an essential point from an acquisition perspective.”

[Tropicana AC’s] top online

players spend big on

entertainment at their brick

and mortar facility rather

than gaming.

Many brands in social gaming place a higher emphasis on

acquisition volume than player quality

As the industry matures, player quality will become

increasingly important because competition will increase

acquisition cost

Advertising can be used for re-activation and increasing

engagement, in addition to acquisition

Many platforms now allow a robust automated

communication strategy based on player activity

Key

positions

and trends:

Acquisition

Engagement and CRM](https://image.slidesharecdn.com/casualconnect-ldeditsma-140807115830-phpapp02/85/What-Real-Money-Gaming-can-Learn-from-Social-Gaming-4-320.jpg)