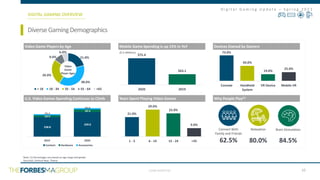

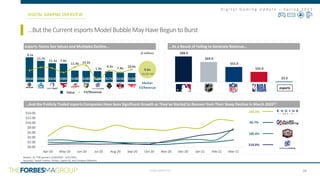

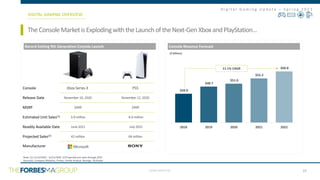

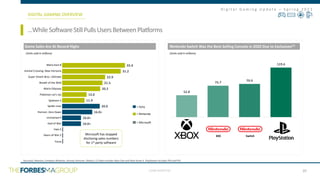

The document discusses an upcoming panel event on the rise and relevance of video games hosted by Forbes M+A. The panel will feature leaders from across the gaming industry including representatives from a venture capital firm, game studio, esports organization, and game development company. It provides background information on the panelists and details about the event including date, time and RSVP information.