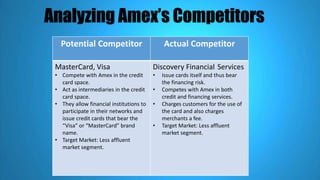

American Express is a global financial services company known for its credit cards, charge cards, and other services. It targets wealthy, elite consumers and positions itself as a luxury brand through exclusive benefits like impeccable customer service and an elusive image cultivated through celebrity partnerships and promotional events. While competitors like Visa and MasterCard issue cards through banks and have a broader target market, American Express self-issues cards and differentiates itself through a membership experience for cardholders. To grow, American Express has expanded its merchant acceptance network and launched new products while maintaining its reputation for quality service and focus on core competencies over a diversified set of financial offerings.