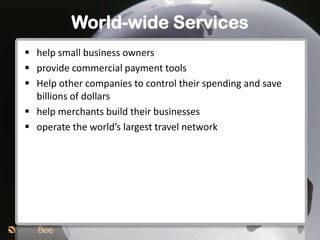

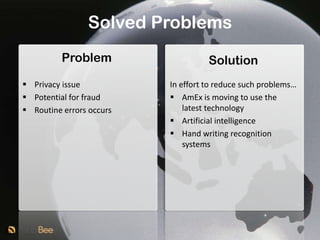

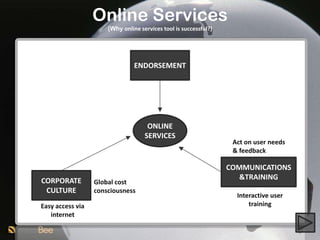

American Express is a global payments company known for being the world's largest travel charge card issuer. It processes millions of transactions daily and provides services to merchants and cardmembers in over 200 countries. While it has faced challenges from increased competition and the potential exclusion from European payment systems, American Express has focused on online services, security, customization and support to solve problems and remain a leading provider of financial and travel services worldwide.