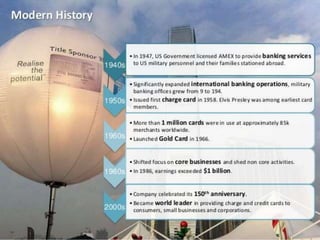

American Express began as an express shipping company in the 19th century and created the first internationally accepted traveler's check in 1891. It evolved into a global payments company, issuing its first charge card in 1958. By the 1960s and 1970s, Amex's charge card business comprised one-third of its total profits and it increased its marketing efforts. Amex positioned itself as a prestigious brand with a focus on trust, security, customer service, and integrity. It maintained an exclusive image and called its customers "card members." While in direct competition with Visa and MasterCard, Amex differentiated itself by issuing its own cards and prioritizing fees and payments processing over transaction volumes.