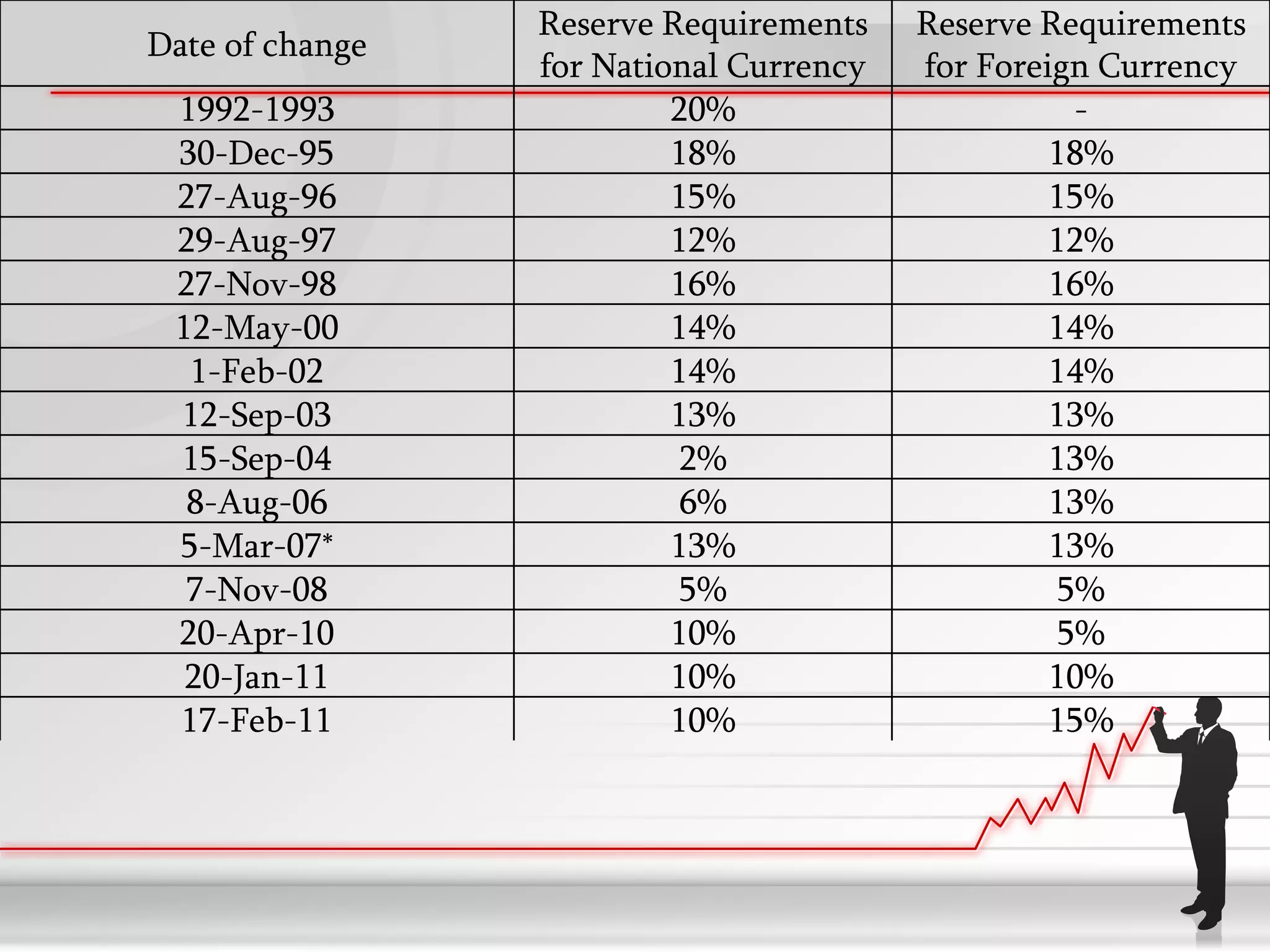

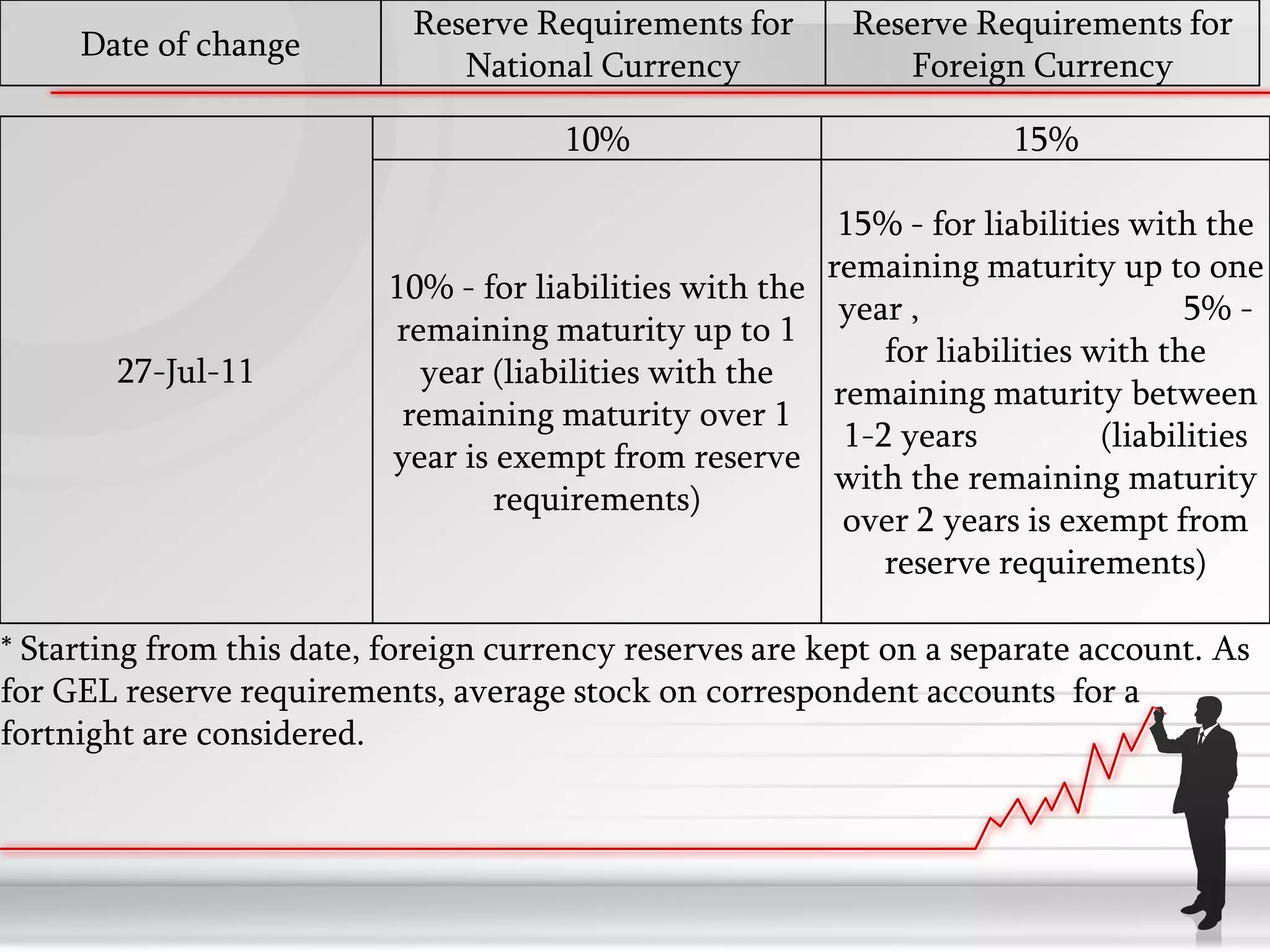

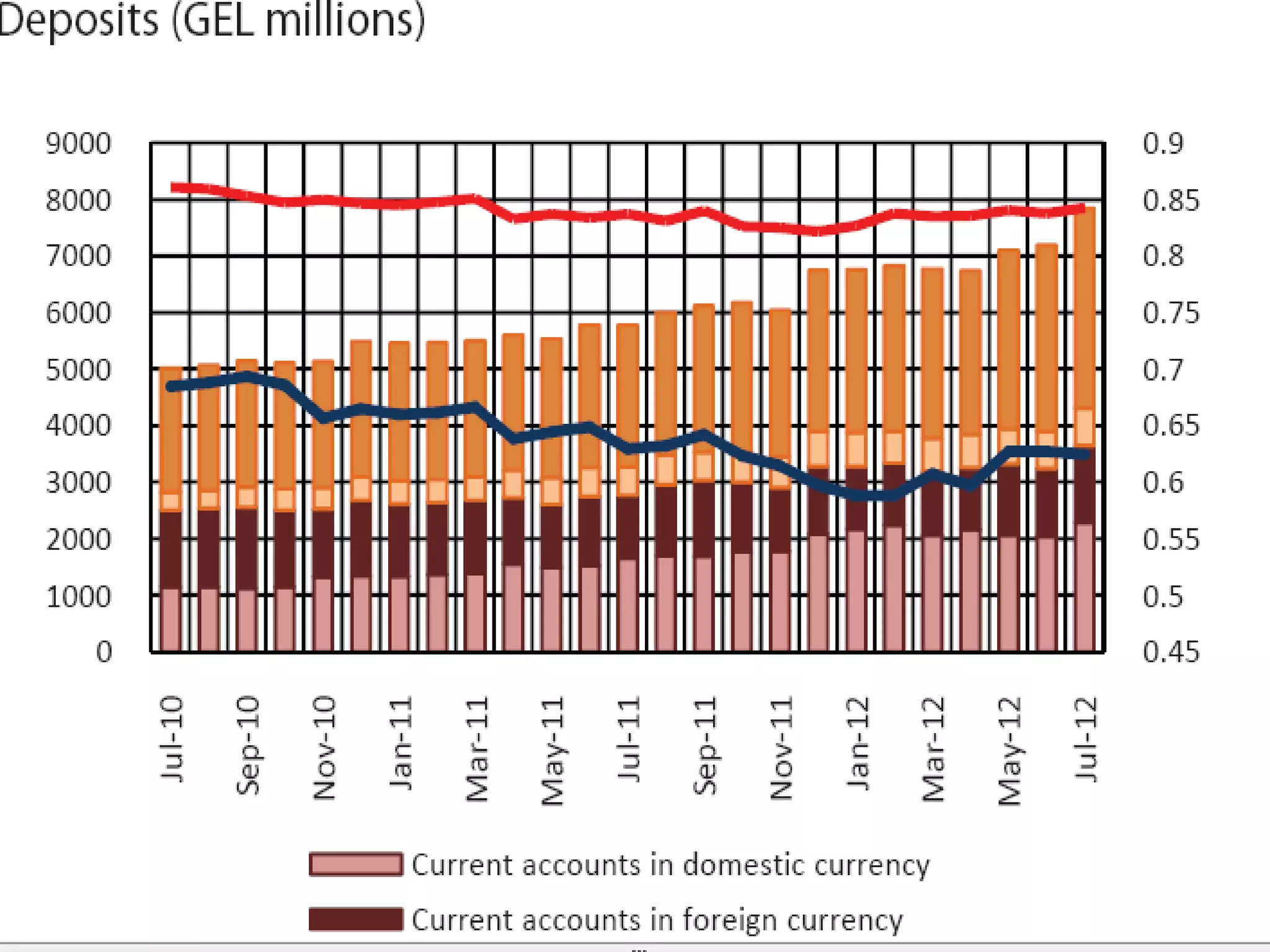

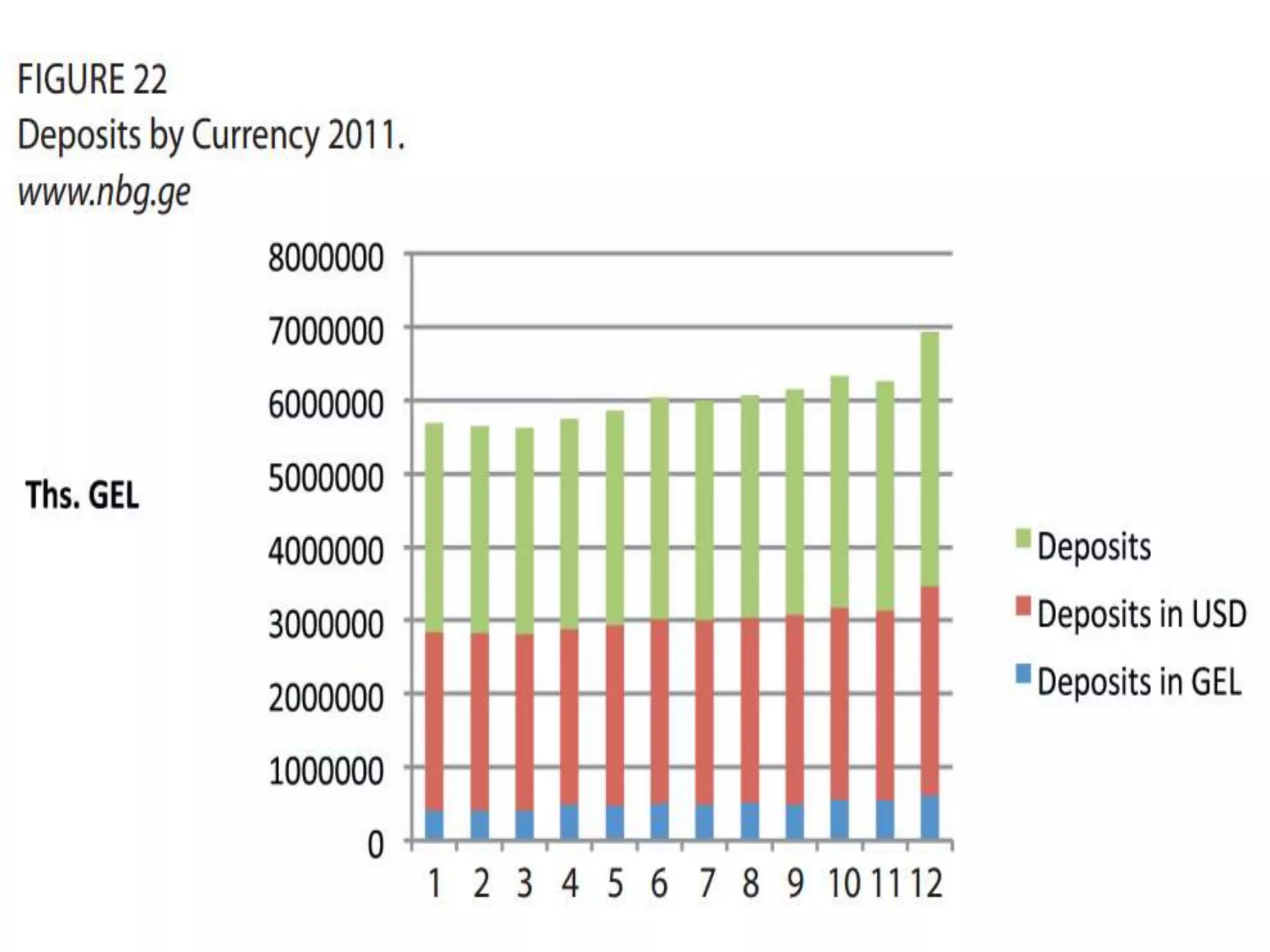

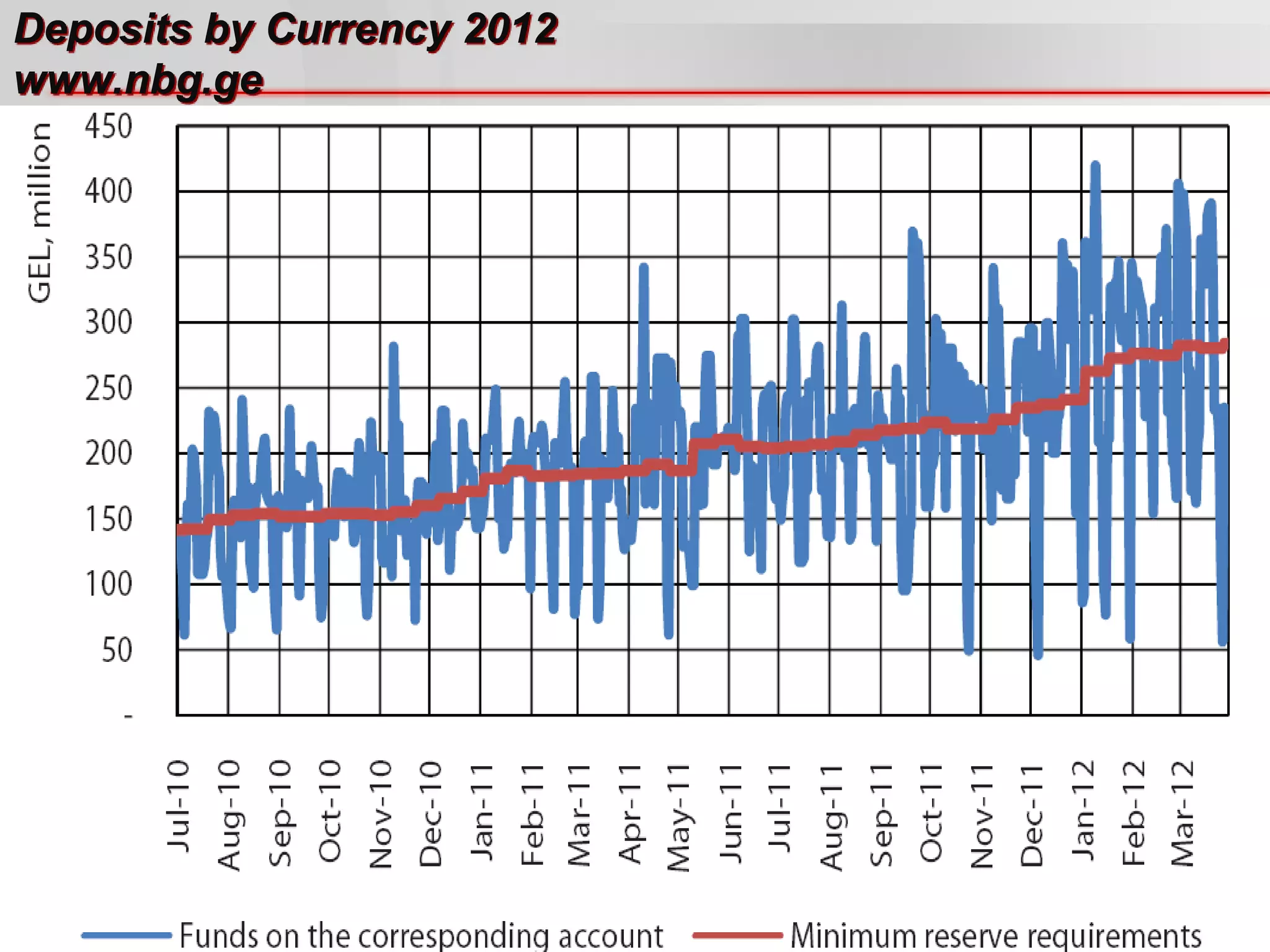

The document summarizes reserve requirements in Georgia as established by the National Bank of Georgia (NBG). It discusses the history and objectives of NBG's reserve requirement policy, including the rates that are currently set at 10% of liabilities in national currency and 15% for foreign currencies. The document also outlines how minimum reserve requirements are calculated and maintained, including accrual of interest paid on reserve balances. Key points covered include exemptions for longer term liabilities and a lower 5% rate for foreign currency liabilities with remaining maturities between 1-2 years.

![The rates of the monetary policy instruments

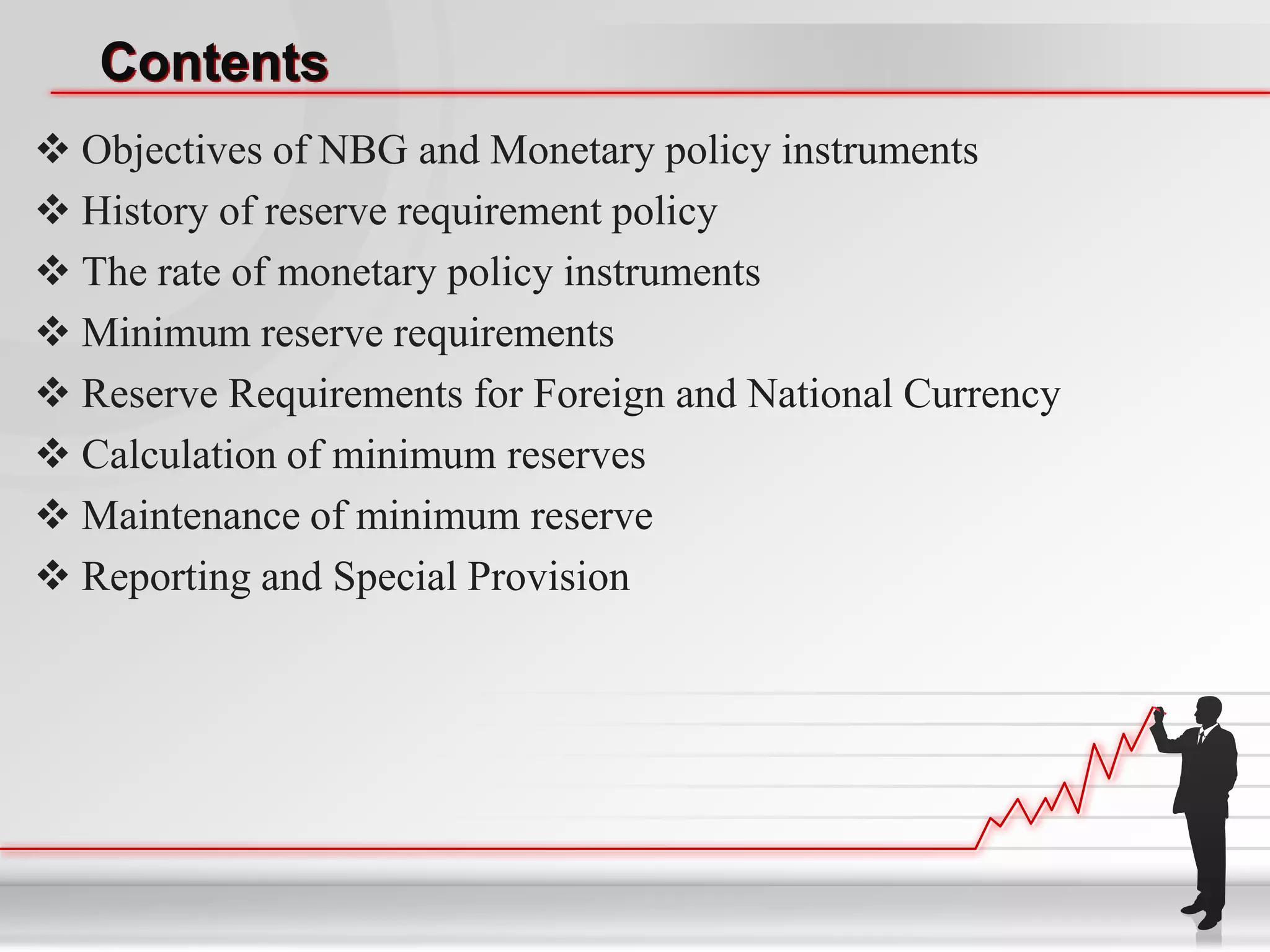

[Last update: 13.02.2013] Maturity Rate (%)

Refinancing loan 7 days 4.75%

Guaranteed refinancing loan 7 days (4.75+1) %

Overnight deposits 1 day (4.75-1.5) %

Overnight loans 1 day (4.75+1.5) %

Certificates of deposit 3/6 months Defined by auction

Treasury securities 1/2/5/10 years Defined by auction

Liabilities in

Liabilities in Foreign

National

Currency

Currency

Reserve requirements* 10.0% 15.0%](https://image.slidesharecdn.com/minimumreserverequirementpolicyingeorgia-130320135942-phpapp02/75/Minimum-reserve-requirement-policy-in-georgia-10-2048.jpg)