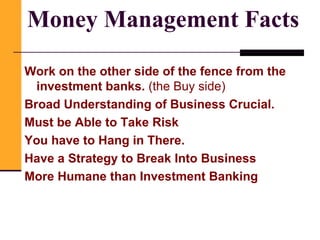

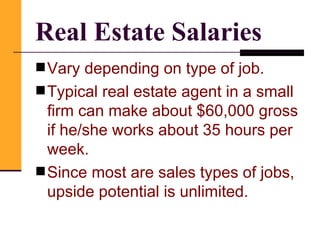

The document provides an overview of various careers in finance including corporate finance, commercial banking, investment banking, financial planning, insurance, money management, and real estate. It describes typical job roles, requirements, skills needed, and salaries for each career path. Corporate finance careers include financial analyst, credit manager, and controller, with salaries ranging from $23k-$47k for analysts and $30k-$105k for managers. Commercial banking opportunities include credit analyst, loan officer, and branch manager, paying $27k-$100k depending on experience. Investment banking requires strong analytical, communication, and teamwork skills and long work hours, with analyst roles being common entry points.