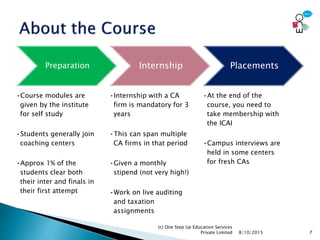

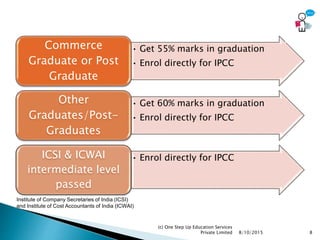

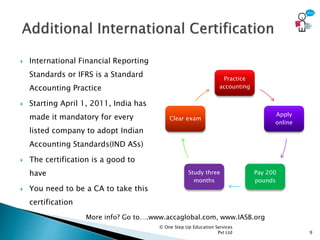

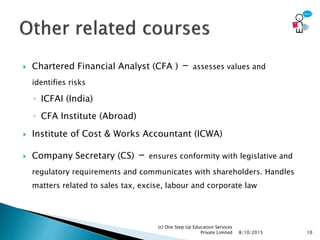

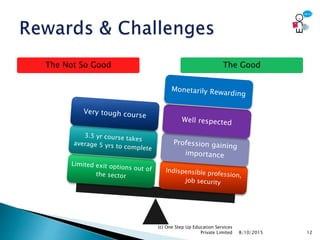

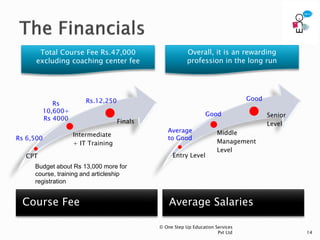

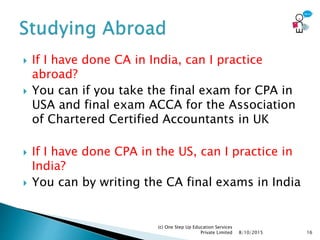

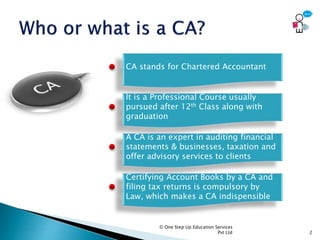

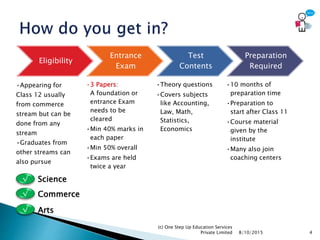

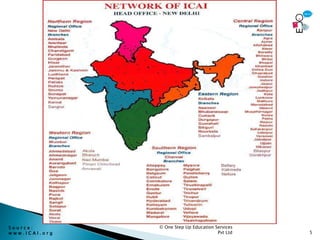

The document outlines the Chartered Accountant (CA) course in India, including eligibility, exam structure, and preparation requirements. It details the three-year program, internship mandates, and potential career paths post-qualification, highlighting the necessity of CA certification for legal auditing and tax purposes. Also included are alternative certifications and their relevance for international practice.

![Duration

•3 years 9 months

•Internship after

passing at least Group I

of IPCC [4 papers].

Group II [3 papers]

•Final exam after 3

years 3 months [In last 6

months of articleship]

•Both inter & final

exams held twice a year

Subjects Covered -

CPT

•Common Proficiency

Test (CPT):

•Paper 1 - Accounting,

Auditing, Law,

Economics, Quantitative

Aptitude

•Integrated Professional

Competence Course

(IPCC) – 6 subjects, 7

papers Cost

Accounting, Financial

Management, Business

& Company Law,

Taxation, IT

•100 hrs of IT training

Subjects Covered -

Final

•Final -

•Group 1 [4papers]-

Advanced Accounting,

Mgmt Accounting,

Advanced Auditing,

Law

•Group 2 [4 papers] -

Cost Mgmt, MIS and

Control Systems,

Direct Taxes, Indirect

Taxes

8/10/2015

(c) One Step Up Education Services

Private Limited 6](https://image.slidesharecdn.com/careercharteredaccountant-150810063402-lva1-app6892/85/Chartered-Accountant-6-320.jpg)