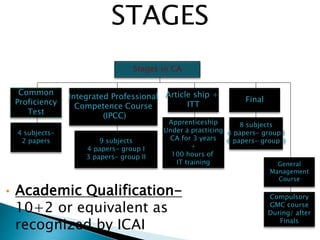

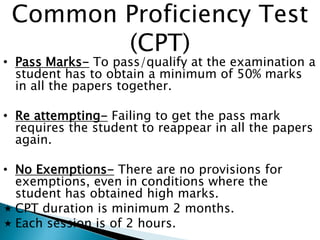

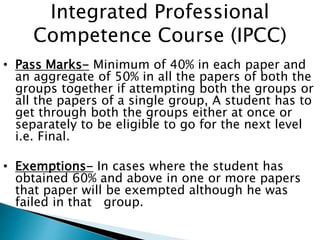

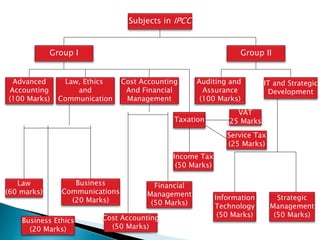

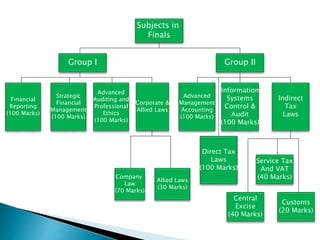

The document summarizes the path to becoming a Chartered Accountant in India. It involves passing the Common Proficiency Test (CPT), the Integrated Professional Competence Course (IPCC) with two groups of subjects, and then the Final exam with two groups. Students must also complete 3 years of apprenticeship training and 100 hours of IT training. The Institute of Chartered Accountants of India (ICAI) regulates the profession and has its headquarters in New Delhi along with 5 regional offices in major cities. Chartered Accountants work in fields like audit, taxation, finance, banking, outsourcing, academics, and the corporate sector.