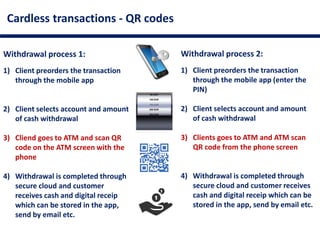

The document outlines the history, opportunities, and challenges of cardless ATMs, emphasizing their importance in enhancing customer loyalty and convenience in modern banking. It describes various transaction methods such as QR codes and NFC technology, highlighting advantages like faster service and reduced security risks. Additionally, it addresses the need for proper infrastructure and consumer adaptation to new technologies for successful implementation.