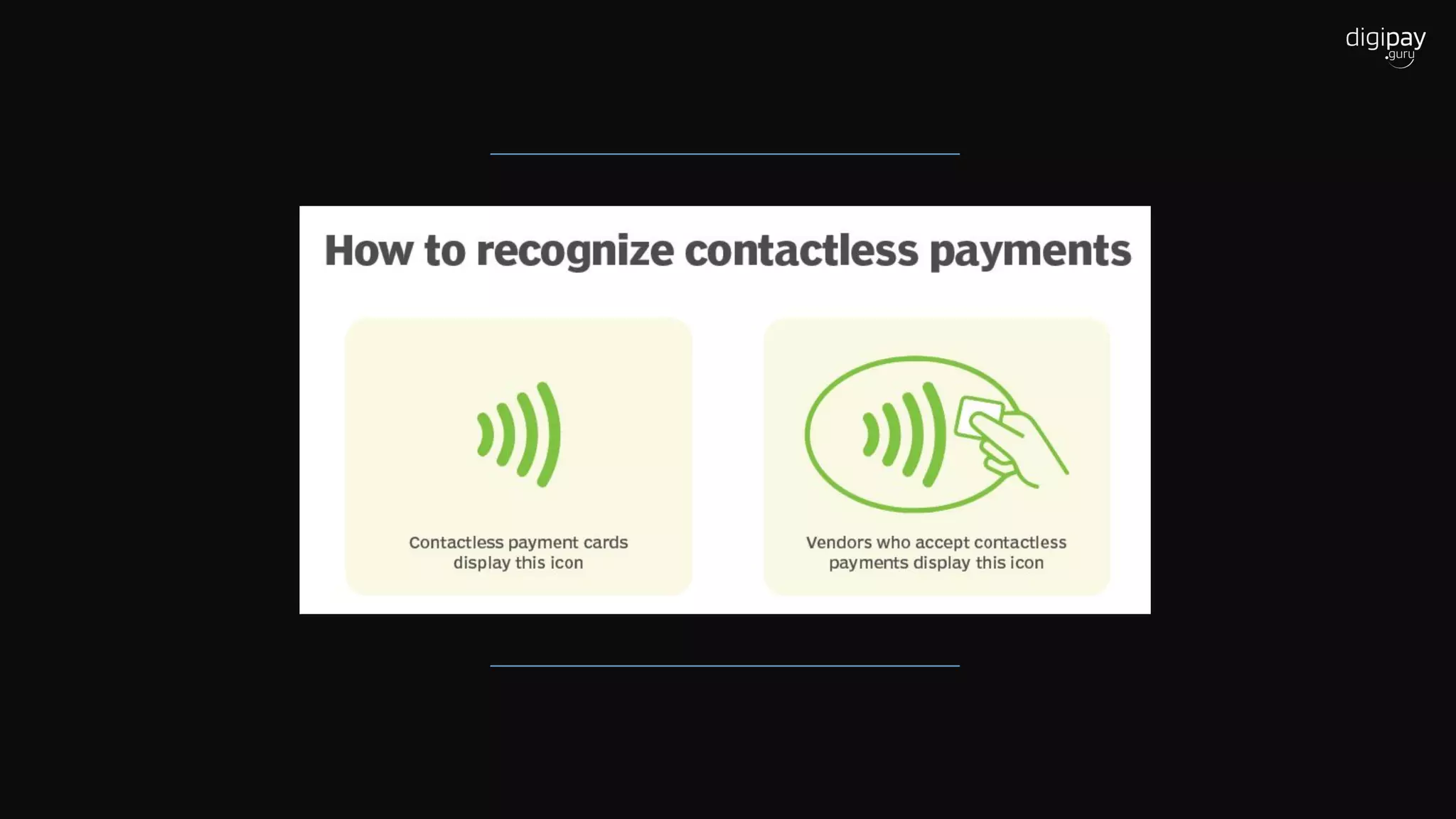

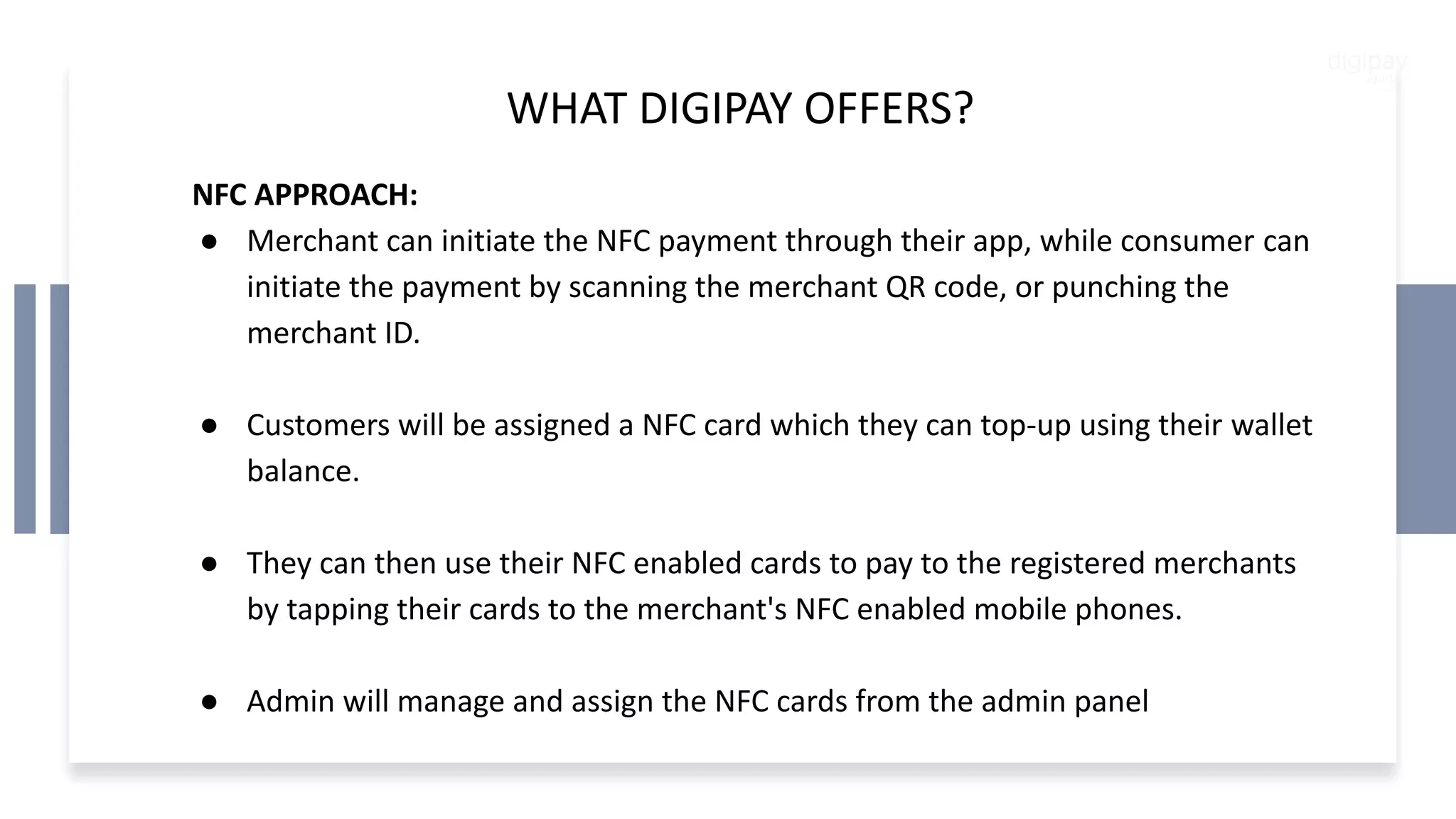

The document discusses the rise of contactless payments, emphasizing their convenience and security, especially in the wake of the COVID-19 pandemic. It covers the benefits, risks, and technology behind contactless payments, as well as insights on global trends and market opportunities. Additionally, it highlights Digipay's offerings in the contactless payment space and the anticipated future growth of this payment method.