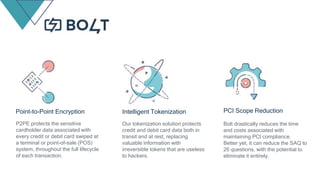

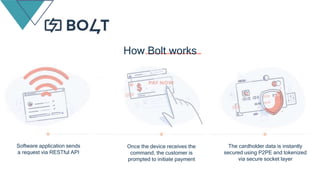

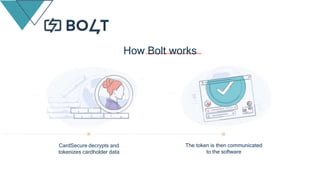

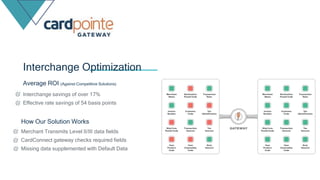

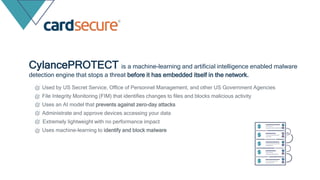

CardConnect, a subsidiary of Fiserv, offers a secure payment processing platform supporting over 150 currencies across 37 countries, enhancing operational efficiency and reducing costs for businesses. Their services include a comprehensive PCI-compliant payment gateway, tokenization, and encryption solutions that protect credit card transactions and simplify compliance management. Additionally, CardConnect provides developer-friendly API integrations, streamlined merchant enrollment capabilities, and robust customer support to enhance user experiences across various sales channels.