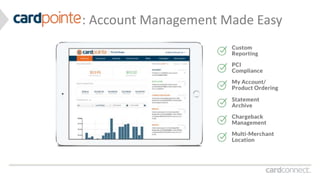

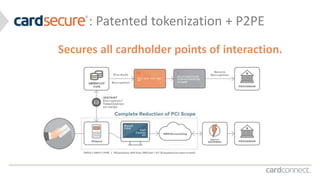

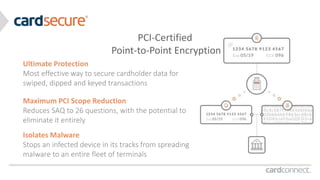

This document summarizes a payment processing company called CardConnect. It outlines their focus on simple, secure and PCI compliant payment solutions. They provide a powerful platform that includes real-time reporting and next-day funding. Their solutions include patented tokenization and point-to-point encryption for security, as well as business intelligence reporting and interchange management to lower costs. They support over 70,000 organizations in processing billions of dollars in transactions each year.