This document provides a statistical analysis of caravan insurance using IBM SPSS. It analyzes a dataset containing 86 variables related to customers of an insurance company. The analysis aims to predict customers interested in caravan insurance and develop a model using the variables. Key steps include:

1) Preparing the data by categorizing the 86 variables into 9 significant predictors related to customers' lifestyle, age, marital status, income, work, and insurance interests.

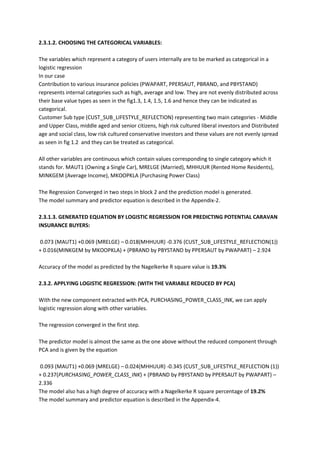

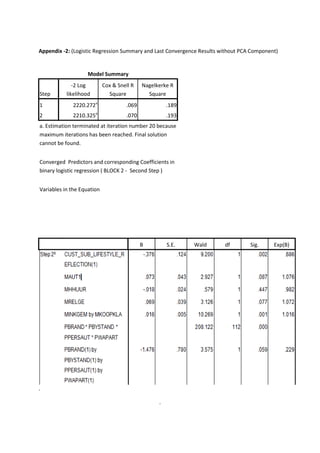

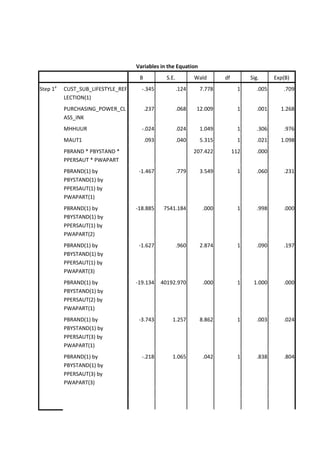

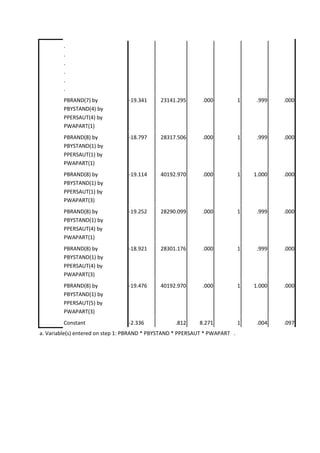

2) Applying logistic regression to predict the likelihood of customers buying caravan insurance based on the categorized variables. Significant variables are selected in two blocks representing social factors and interaction variables.

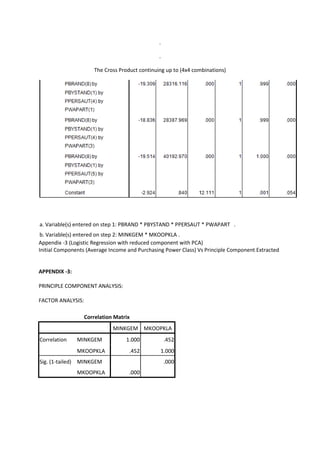

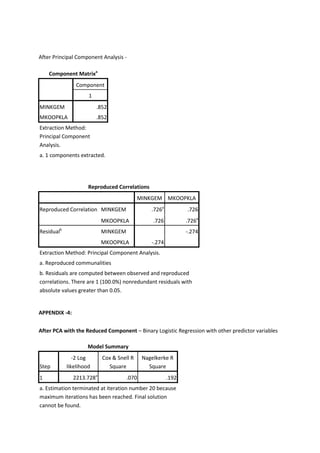

3) Further reducing dimensions by principal component analysis to represent correlated variables with a single