1. Capital gains tax is levied on profits from the sale of capital assets such as property, stocks, or other assets held for over a year. There are two types of capital gains: short-term gains taxed at ordinary income rates and long-term gains taxed at lower capital gains rates.

2. Some key exemptions from capital gains tax include reinvesting proceeds from selling a primary residence into another home under Section 54, reinvesting into specified infrastructure bonds under Section 54EC, and selling agricultural land and reinvesting into similar land under Section 54B.

3. Income from other sources includes various types of passive income like dividends, interest, rental income, lottery winnings,

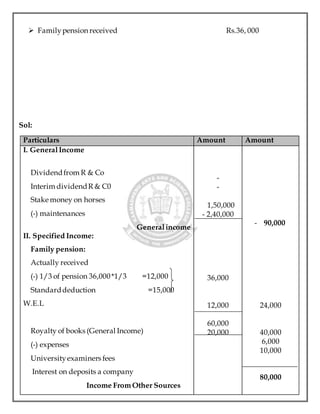

![Net ShortTerm CapitalGain XXX

# Long term capital gain

Particulars Amt Amt

Sales Consideration

Less: Exp in relation Totransfer

(Brokerage,commission)

Net Consideration

Less: Indexed Cost Acquisition

Less: Indexed Cost of improvement

Less: Exp. on Purchase

xxx

xxx

xxx

xxx

xxx

xxx

xxx

Long term capital gain/ loss

Less: Exemptionu/s54,54B,54EC,54F

Net Long Term Capital Gain

XXX

XXX

XXX

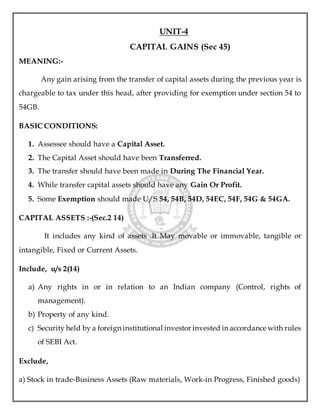

FULL VALUE OF CONSIDERATION:

The word “Full value” refers to “whole price” without any deduction

whatsoever an it does not refer to adequacy or inadequacy of price bargained for.

“Consideration”refers to the amount received by the transferor in lieu of the assets he

gives up.

C.I.I [COST OF INFLATION INDEX]-](https://image.slidesharecdn.com/unit4-200207101334/85/CAPITAL-GAIN-4-320.jpg)

![To avoid the inflation effect, the value of the capital assets is brought to present

value using the cost of inflation index.

In short, the central govt. having regard to 75% of average rise in the consumer price

index for the immediately preceding previous year to such previous year.

The Base year for the capital inflation index is first April 1981(100) @ now it’s based on

financial year of 2001-02 (100)

# COA: [COST OF ACQUISITION]

‘Cost of acquisition’ of an asset is the amount paid by the assessee to acquire it.

All the capital expenses paid for acquiring the title to the property are termed as the

cost of acquisition.

‘Indexed Costof Acquisition’-(48) Indexed cost of acquisition means an amount

which bears to the cost of acquisition the same proportion as cost inflation index for

the year in which the asset is transferred bears to the cost inflation index for the first

year in which the asset was held by the assessee.

COST OF ACQUISITION

Before 2001-02 After 2001-02

Actual cost Actual cost x CII of sale year/ CII of

acquisition

Or F.M.V W.E.H x CII of Sale year

CII OF 2001-02

#COI: [COST OF IMPROVEMENT] 49 (1)](https://image.slidesharecdn.com/unit4-200207101334/85/CAPITAL-GAIN-5-320.jpg)

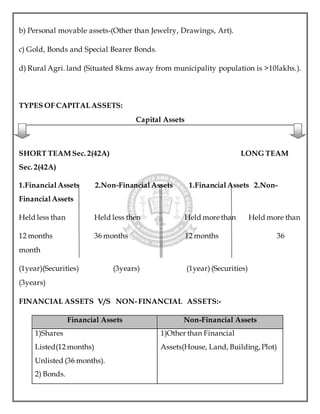

![‘Cost of Improvement’ any expenditure incurred toincrease the value of capital

asset ( making any addition/alteration).

‘Indexed Costof Improvement’-Indexed cost of improvement means an amount

which bears to the cost of improvement the same proportion as cost inflation index for

the year in which the assetis transferred bears to the cost inflation index for the year in

which the improvement to the asset took place.

INDEXED COST OF IMPROVEMENT

Before 2001-02 After 2001-02

Ignore Actual cost x CII of sale year/CIIof

improvement

NOTE:-

1) If given W.D.V (Written down Value)take only W.D.V not Actual cost.

2) Current CII 280 (2018-19). CII for [2001-02]=100.

# RelevantProvisionsIn relation to CII:

1. Indexing of Long term assets only.

2. No indexing of long term debentures and bonds.

3. No indexing of Short-term capital assets.

4. No Indexing of depreciable assets.

5. No Indexing of share of NR.

EXEMPTIONFROM CAPITAL GAIN:-

1) Sec 54-Sale ofResidentialProperty and PurchaseofanotherResidentialProperty:-](https://image.slidesharecdn.com/unit4-200207101334/85/CAPITAL-GAIN-6-320.jpg)

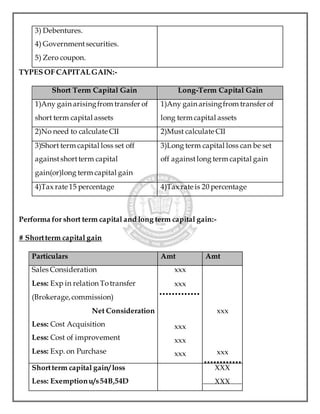

![2) Sec 54B-Sale of an agricultural land and purchase of another agriculture land:-

3) Sec 54D-Compulsory acquisition of land and Building:

If any land and Building acquired by compulsorily by any government.

4) Sec 54EC-investment in specified bonds:-

If the amount is invested “REC (Rural Electrification Corporation (or) NHAI

(National Highways Authorityof India) with in a Period of 6months from the date of

transfer.

FOR SHORT TERM CAPITAL GAIN:-

Mr. Ghosh sold a house on 01.09.2018 for Rs. 12, 00,000. This house was

inherited by him during 2014-15 Rs.70,000 . Mr. Ghosh spent Rs.50,000 on renovation

of the house in 2015-16. Fair market value Rs.1,50,000.

[C.I.I for 2014-15- 240, 2015-16 – 254, 2016-17 – 264, 2018-19 – 280]

SOL:-

Computationofcapital gain (P.Y.2018-19)

Particulars Amt Amt

Sales Consideration

Less: Exp in relation Totransfer

(Brokerage,commission)

Net Consideration

Less: Cost Acquisition

Less: Cost of improvement

Less: Exp. on Purchase

12,00,000

-

50,000

70,000

-

12,00,000

1,20,000](https://image.slidesharecdn.com/unit4-200207101334/85/CAPITAL-GAIN-7-320.jpg)

![Shortterm capital gain/ loss 10,80,000

NOTE:-

1) If any advance money forfeited has been deducted from cost of acquisition as it was

forfeited prior to 1.4.2014.

2) No need to take [F.M.V] value after given [2001-02].

FOR LOND TERM CAPITAL GAIN:-

SUM1:-

Mr. Vasudav sold a house on 1.9.18 for Rs.12, 00,000.This house was inherited by

him during 2001-02, from his father who had constructed it in 1981-82 for Rs 50,000.

Mr. Ganesh spend Rs.70,000 on renovation of the house in 2006-07, FMV of the house

as on 1.4.01 was Rs.1,50,000.

Compute the amount of capital gain assuming does not quality for any

exemption:-[CII=2001-02=100, 06-07=122, 2010-11=167, 2018-19=280.]

SOL:-

Particulars Amt Amt

Full value of consideration.

(-)Exp on transfer of c. assets

Net Consideration

(-)indexed cost of acquisition

(-)indexed cost of improvement

4,20,000

1,60,665

12,00,000

_

12,00,000

580,665](https://image.slidesharecdn.com/unit4-200207101334/85/CAPITAL-GAIN-8-320.jpg)

![6,19,335

Workings:

= Actual cost

or F M V W E H X CII of sale of year/ CII of 2001-02

50,000or 1, 50,000W.E.H = 1,50,000

= 1, 50,000X 280/100 = 4,20,000

= Actual cost x CII of sale year/CIIof improvement

= 70,000 X 280/ 122 = 1,60,655

INCOME FROM OTHER SOURESS [U/C 56 to 59]

Meaning:-

Any incomes which could not be categorized/ taxable under any other head shall be

taxed under this head, known as income from other sources.

Typesof income:-

INCOME (Sec-56)

Generalincome sec 56(1) Specified income sec 56 (2)

1. Directors fees (other than business) 1.Diridend from:

a) foreign company

2. Examinorshipfees b) co-operative company](https://image.slidesharecdn.com/unit4-200207101334/85/CAPITAL-GAIN-9-320.jpg)

![Stamp value taxable F.M.V value

Taxable

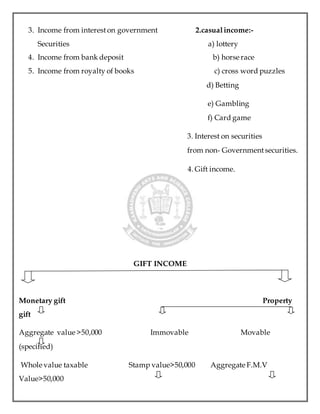

GIFT INCOME:-

Any monetary value/ property value received with any consideration from

someone.

Meaning ofRelative:-

1. Spouse of the individual

2. Brother or sister of the individual

3. Brother in law/ sister in law

4. Brother or sister of spouse of the individuals

Meaning ofproperty:-

Exemptionfrom income from other sources: - U/S 57.

Any sum of money or property received:-

a) From any relative (or) ,

b) One the occasion of marriage ofthe individuals.

c) Under a will or by way of inheritance

d) From any local authority or.

e) From employer, (A university or other educational institutions).

f) By an H.U.F from its member.

Performa for Income From Other Sources:

1. Shares & securities,

2. Jewellary

3. Archaeologicalcollations

4. Drawings

5. Paintings

6. Immovable property means,

[Land, Building, plot]

PARTICULARS Amt Amt](https://image.slidesharecdn.com/unit4-200207101334/85/CAPITAL-GAIN-11-320.jpg)

![I Generalincome: sec6(1)

Directors fees

Examinorshipfees

Income from intereston governmentsecurities

Income from bank deposits

Income from royalty of books

Income from agriculture outside India

Less: expenses relating above

Legal taxes

Collection charges

Generalincome

II Specified income sec 56(2)

A Dividend:

I] Dividend from foreign company

II] Dividend from co-operative company

Less: collection charges

B Casualincome: [30%TDS]

A] lotteries :[> 10,000 Rs]T.D.S

In case of received [actual amount * 100/100-30]

B] Cross Word Puzzles

C] Betting

D] Gambling

E] Card Games

F] Horse Race [> 5,000 Rs]T.D.S

Actual amount *100/(100-30)[If given as received

only]

Less: Expense On Horse:

C] Interest on securities: [TDS 10 %]

i) Debenture on commercial from

ii) Shares of a LTD Actual Amount*100

‘ 100-10

iii)Bonds 15% of Non-governmentCompany

D] Family Pension:

Actual amount

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

XXX

(A)

XXX

XXX

XXX](https://image.slidesharecdn.com/unit4-200207101334/85/CAPITAL-GAIN-12-320.jpg)

![Casualincome:

Any amount received by without any effort, where as lack basic. Such, card games,

lottery, horse race….etc…

TDS: Tax Deductible Sources: [u/s 193]

Before making payment of interest on securities, it is the duty of the security-

issuing authority to deduct tax at source. On such interest payable at the rates in force

during the previous year.

For income from othersources:

Sum1

Compute Income From Other Sources from following particulars:

Interest on deposits with A company Rs.10, 000

University remuneration for working as examiner Rs.6, 000

Royalty for writing books Rs.60, 000

He claims to have spent Rs.20, 000 for writing books.

Dividend declaredby R & Co on 1.3.17butpaid on 1.5.17 Rs.6, 000

Interim dividend paid on 1.5.17 Rs.3, 000

Stake money on race horse Rs.1,50,000

Horse are maintainedby nitand expenses spend Rs.2, 40,000

Less: StandardDeduction

# 1/3 of pension received W.E.L

# Rs.15,000

E] Gift Income :u/s56(v)

Receive other than relatives’

Specified income

Income from othersources {A+B)

XXX

XXX

XXX

XXX

(B)

XXX](https://image.slidesharecdn.com/unit4-200207101334/85/CAPITAL-GAIN-13-320.jpg)