Embed presentation

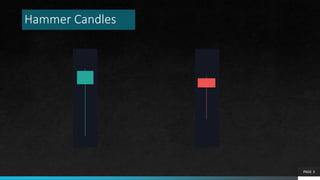

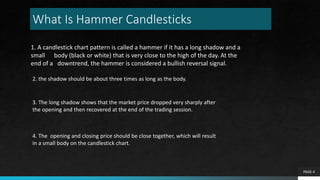

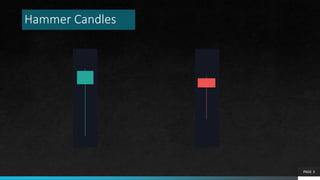

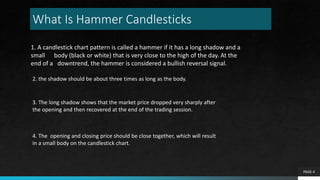

The document discusses hammer candlestick patterns, which are characterized by a long shadow and small body, indicating potential bullish reversals, especially after downtrends. It emphasizes the significance of market emotions and price actions in interpreting these patterns. Key points include the requirement of a long shadow relative to the body and the proximity of the opening and closing prices.