Cushman & Wakefield's Canadian Office Statistical Summary Q4 2018

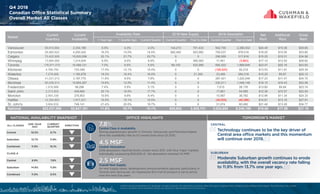

- 1. OFFICE HIGHLIGHTS ALL CLASSES ONE YEAR AGO CURRENT QUARTER DIRECTION Central 10.5% 8.7% Suburban 13.7% 11.9% Combined 11.9% 10.1% CLASS A Central 9.9% 7.8% Suburban 14.8% 11.9% Combined 11.9% 9.5% NATIONAL AVAILABILITY SNAPSHOT Technology continues to be the key driver of Central area office markets and this momentum will continue over 2019. Moderate Suburban growth continues to erode availability, with the overall vacancy rate falling to 11.9% from 13.7% one year ago. CENTRAL TOMORROW’S MARKET Central Class A Availability Strong expansionary growth in Toronto, Vancouver, and Montreal helped drive the availability rate to it’s lowest level since Q1 2015. 7.8% Overall New Supply As new supply eases, development announcements abound, particularly in Toronto and Vancouver. An impressive 16.4 msf of product is set to arrive over the next five years. 2.5 MSF SUBURBAN Q4 2018 Canadian Office Statistical Summary Overall Market All Classes ©2019 Cushman & Wakefield ULC, Brokerage. All rights reserved. The information contained within this report is gathered from multiple sources believed to be reliable. The information may contain errors or omissions and is presented without any warranty or representations as to its accuracy. 4.5 MSF Central Absorption 2018 absorption reached levels unseen since 2011, with four major markets individually surpassing 800,000 sf. Q4 absorption reached 1.6 MSF. 1 Year Ago 1 Quarter Ago Current Quarter Current Quarter Year to Date Current Quarter Year to Date Vancouver 58,610,654 2,334,169 6.5% 4.3% 4.0% 144,210 701,433 942,705 2,286,532 $24.49 $15.36 $39.85 Edmonton 28,885,622 4,200,422 16.2% 15.0% 14.5% 682,492 903,992 705,037 978,018 $18.25 $15.55 $33.80 Calgary 72,422,928 15,020,099 22.1% 21.7% 20.7% 0 0 256,959 317,816 $15.25 $19.31 $34.56 Winnipeg 13,684,959 1,214,934 6.5% 9.0% 8.9% 0 365,000 17,461 (3,883) $17.10 $12.52 $29.62 Toronto 176,971,072 10,489,121 7.0% 6.5% 5.9% 99,100 533,956 692,522 1,889,646 $23.47 $20.16 $43.63 Kitchener 4,766,792 733,346 17.4% 12.1% 15.4% 0 0 (158,525) 92,218 $13.53 $11.81 $25.34 Waterloo 7,278,068 1,160,878 19.3% 16.4% 16.0% 0 21,350 33,489 284,318 $15.25 $9.87 $25.12 Ottawa 41,031,213 3,187,770 11.6% 8.5% 7.8% 0 0 287,421 1,220,246 $17.23 $17.47 $34.70 Montreal 95,038,513 10,854,287 14.6% 12.5% 11.4% 0 0 230,211 1,048,148 $16.15 $16.43 $32.58 Fredericton 1,919,986 98,296 7.4% 5.5% 5.1% 0 0 7,610 28,176 $13.80 $9.94 $23.74 Saint John 2,313,502 409,684 20.1% 18.5% 17.7% 0 0 17,661 54,985 $12.36 $10.57 $22.93 Moncton 2,954,336 278,803 10.8% 9.8% 9.4% 0 0 10,587 38,782 $12.99 $11.34 $24.33 Halifax 12,354,803 1,917,231 15.5% 15.1% 15.5% 0 0 (49,559) (46,286) $14.81 $13.10 $27.91 St. John's 3,804,632 748,141 21.4% 20.5% 19.7% 0 0 31,074 60,482 $21.49 $13.28 $34.77 National 522,037,080 52,647,181 11.9% 10.7% 10.1% 925,802 2,525,731 3,024,653 8,249,198 $19.60 $17.59 $37.19 Market Net Rent Additional Rent Gross Rent Current Inventory Current Availability Availability Rate 2018 New Supply 2018 Absorption

- 2. ©2019 Cushman & Wakefield ULC, Brokerage. All rights reserved. The information contained within this report is gathered from multiple sources believed to be reliable. The information may contain errors or omissions and is presented without any warranty or representations as to its accuracy. Q4 2018 Canadian Office Statistical Summary Central Market All Classes 1 Year Ago 1 Quarter Ago Current Quarter Current Quarter Year to Date Current Quarter Year to Date Vancouver 34,185,356 763,590 5.1% 2.2% 2.2% 93,910 350,106 465,399 1,236,121 $32.32 $19.14 $51.46 Edmonton 17,358,804 1,747,750 15.5% 11.7% 10.1% 616,250 616,250 808,532 1,216,606 $20.52 $17.94 $38.46 Calgary 51,229,809 11,427,944 23.2% 23.2% 22.3% 0 0 (11,211) (19,687) $15.14 $19.74 $34.88 Winnipeg 10,540,049 1,058,857 6.9% 9.8% 10.0% 0 365,000 (24,181) (12,404) $17.49 $13.11 $30.60 Toronto 89,818,048 1,773,641 2.9% 2.4% 2.0% 68,500 68,500 262,545 876,474 $30.72 $24.35 $55.07 Kitchener 2,568,745 487,505 18.3% 13.3% 19.0% 0 0 (144,692) (17,064) $13.11 $13.47 $26.58 Waterloo 1,686,273 116,533 6.2% 6.9% 6.9% 0 21,350 (33) 29,389 $16.65 $12.83 $29.48 Ottawa 18,636,932 1,290,746 9.3% 7.3% 6.9% 0 0 71,891 271,743 $19.68 $19.58 $39.26 Montreal 55,689,494 4,607,471 12.2% 9.6% 8.3% 0 0 193,137 924,774 $18.12 $19.57 $37.69 Fredericton 1,919,986 98,296 7.4% 5.5% 5.1% 0 0 7,610 28,176 $13.80 $9.94 $23.74 Saint John 2,313,502 409,684 20.1% 18.5% 17.7% 0 0 17,661 54,985 $12.36 $10.57 $22.93 Moncton 2,954,336 278,803 10.8% 9.8% 9.4% 0 0 10,587 38,782 $12.99 $11.34 $24.33 Halifax 6,155,436 1,251,303 17.6% 18.5% 20.3% 0 0 (116,068) (169,440) $15.09 $14.46 $29.55 St. John's 1,664,919 421,536 29.1% 27.3% 25.3% 0 0 33,495 57,917 $26.05 $15.35 $41.40 National 296,721,689 25,733,659 10.5% 9.3% 8.7% 778,660 1,421,206 1,574,672 4,516,372 $21.15 $20.24 $41.39 Market Additional Rent Gross Rent 2018 AbsorptionAvailability Rate Current Inventory Current Availability 2018 New Supply Net Rent Q4 2018 Canadian Office Statistical Summary Central Market All Classes

- 3. ©2019 Cushman & Wakefield ULC, Brokerage. All rights reserved. The information contained within this report is gathered from multiple sources believed to be reliable. The information may contain errors or omissions and is presented without any warranty or representations as to its accuracy. Q4 2018 Canadian Office Statistical Summary Suburban Market All Classes 1 Year Ago 1 Quarter Ago Current Quarter Current Quarter Year to Date Current Quarter Year to Date Vancouver 24,425,298 1,570,579 8.6% 7.3% 6.4% 50,300 351,327 477,306 1,050,411 $20.57 $12.95 $33.52 Edmonton 11,526,818 2,452,672 17.4% 19.9% 21.3% 66,242 287,742 (103,495) (238,588) $16.57 $13.78 $30.35 Calgary 21,193,119 3,592,155 19.4% 18.2% 16.9% 0 0 268,170 337,503 $16.12 $15.71 $31.83 Winnipeg 3,144,910 156,077 5.2% 6.3% 5.0% 0 0 41,642 8,521 $14.69 $9.57 $24.26 Toronto 87,153,024 8,715,480 11.2% 10.7% 10.0% 30,600 465,456 429,977 1,013,172 $15.90 $15.71 $31.61 Kitchener 2,198,047 245,841 16.2% 10.6% 11.2% 0 0 (13,833) 109,282 $14.42 $7.74 $22.16 Waterloo 5,591,795 1,044,345 23.2% 19.3% 18.7% 0 0 33,522 254,929 $15.15 $9.65 $24.80 Ottawa 22,394,281 1,897,024 13.5% 9.6% 8.5% 0 0 215,530 948,503 $14.61 $15.13 $29.74 Montreal 39,349,019 6,246,816 17.1% 16.5% 15.9% 0 0 37,074 123,374 $13.27 $12.11 $25.38 Fredericton n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Saint John n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Moncton n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Halifax 6,199,367 665,928 13.4% 11.8% 10.7% 0 0 66,509 123,154 $14.52 $11.73 $26.25 St. John's 2,139,713 326,605 15.4% 15.2% 15.3% 0 0 (2,421) 2,565 $17.43 $11.15 $28.58 National 225,315,391 26,913,522 13.7% 12.6% 11.9% 147,142 1,104,525 1,449,981 3,732,826 $15.80 $14.16 $29.96 Market Net Rent Additional Rent Gross Rent Current Inventory Current Availability Availability Rate 2018 New Supply 2018 Absorption

- 4. ©2019 Cushman & Wakefield ULC, Brokerage. All rights reserved. The information contained within this report is gathered from multiple sources believed to be reliable. The information may contain errors or omissions and is presented without any warranty or representations as to its accuracy. Q4 2018 Canadian Office Statistical Summary Overall Market Class A 1 Year Ago 1 Quarter Ago Current Quarter Current Quarter Year to Date Current Quarter Year to Date Vancouver 32,777,703 1,263,848 6.9% 4.5% 3.9% 144,210 701,433 794,959 1,815,610 $27.06 $15.24 $42.30 Edmonton 18,149,419 2,789,249 18.2% 16.5% 15.4% 682,492 903,992 762,249 1,023,816 $20.90 $17.04 $37.94 Calgary 49,657,638 9,799,214 21.8% 21.1% 19.7% 0 0 210,462 349,913 $17.06 $20.41 $37.47 Winnipeg 3,486,925 360,926 7.6% 10.5% 10.4% 0 365,000 6,939 241,936 $25.58 $16.62 $42.20 Toronto 105,042,598 5,854,302 7.0% 6.2% 5.6% 99,100 533,956 412,638 1,632,993 $26.52 $22.09 $48.61 Kitchener 2,081,928 268,810 14.2% 11.8% 12.9% 0 0 (24,146) 27,342 $14.95 $9.47 $24.42 Waterloo 4,180,162 532,881 17.5% 12.9% 12.7% 0 21,350 5,249 238,734 $15.63 $9.72 $25.35 Ottawa 26,237,436 1,450,401 10.1% 6.6% 5.5% 0 0 252,530 1,020,031 $19.96 $19.71 $39.67 Montreal 40,329,080 4,002,808 13.6% 11.1% 9.9% 0 0 115,630 885,326 $19.34 $20.22 $39.56 Fredericton 720,994 35,791 5.9% 5.0% 5.0% 0 0 0 6,862 $14.58 $11.96 $26.54 Saint John 780,461 101,565 13.4% 15.5% 13.0% 0 0 19,097 3,247 $15.09 $14.91 $30.00 Moncton 1,261,210 53,936 7.5% 4.0% 4.3% 0 0 (3,423) 40,361 $15.11 $13.48 $28.59 Halifax 5,400,976 838,264 17.1% 16.3% 15.5% 0 0 40,137 63,085 $17.29 $13.92 $31.21 St. John's 1,016,036 241,137 26.3% 24.1% 23.7% 0 0 3,855 21,093 $26.54 $16.48 $43.02 National 291,122,566 27,593,132 11.9% 10.4% 9.5% 925,802 2,525,731 2,596,176 7,370,349 $22.50 $19.66 $42.16 Market Net Rent Additional Rent Gross Rent Current Inventory Current Availability Availability Rate 2018 New Supply 2018 Absorption

- 5. ©2019 Cushman & Wakefield ULC, Brokerage. All rights reserved. The information contained within this report is gathered from multiple sources believed to be reliable. The information may contain errors or omissions and is presented without any warranty or representations as to its accuracy. Q4 2018 Canadian Office Statistical Summary Central Market Class A 1 Year Ago 1 Quarter Ago Current Quarter Current Quarter Year to Date Current Quarter Year to Date Vancouver 17,313,985 265,238 5.0% 1.4% 1.5% 93,910 350,106 336,806 875,560 $40.74 $20.46 $61.20 Edmonton 12,000,184 1,301,380 17.9% 13.2% 10.8% 616,250 616,250 802,208 1,153,296 $23.16 $19.07 $42.23 Calgary 36,568,927 7,279,956 21.2% 21.2% 19.9% 0 0 16,609 10,955 $16.96 $20.89 $37.85 Winnipeg 3,284,540 345,453 7.9% 10.7% 10.5% 0 365,000 6,939 248,986 $25.97 $17.88 $43.85 Toronto 57,614,689 864,350 2.5% 2.2% 1.5% 68,500 68,500 209,956 659,169 $33.58 $26.87 $60.45 Kitchener 903,212 77,948 7.3% 6.7% 8.6% 0 0 (17,305) (12,068) $15.18 $12.53 $27.71 Waterloo 1,278,504 55,292 2.9% 4.7% 4.3% 0 21,350 4,690 23,787 $20.91 $13.30 $34.21 Ottawa 10,837,160 442,768 5.3% 4.6% 4.1% 0 0 59,789 58,074 $24.70 $23.28 $47.98 Montreal 25,371,375 1,725,867 10.2% 8.4% 6.8% 0 0 86,907 536,721 $21.59 $23.10 $44.69 Fredericton 720,994 35,791 5.9% 5.0% 5.0% 0 0 0 6,862 $14.58 $11.96 $26.54 Saint John 780,461 101,565 13.4% 15.5% 13.0% 0 0 19,097 3,247 $15.09 $14.91 $30.00 Moncton 1,261,210 53,936 7.5% 4.0% 4.3% 0 0 (3,423) 40,361 $15.11 $13.48 $28.59 Halifax 2,513,760 565,002 23.0% 21.9% 22.5% 0 0 (13,659) 14,148 $19.02 $15.87 $34.89 St. John's 963,719 241,137 27.7% 25.4% 25.0% 0 0 3,855 21,093 $27.98 $17.37 $45.35 National 171,412,720 13,355,683 9.9% 8.8% 7.8% 778,660 1,421,206 1,512,469 3,640,191 $26.81 $22.84 $49.65 Market Net Rent Additional Rent Gross Rent Current Inventory Current Availability Availability Rate 2018 New Supply 2018 Absorption

- 6. ©2019 Cushman & Wakefield ULC, Brokerage. All rights reserved. The information contained within this report is gathered from multiple sources believed to be reliable. The information may contain errors or omissions and is presented without any warranty or representations as to its accuracy. Q4 2018 Canadian Office Statistical Summary Suburban Market Class A 1 Year Ago 1 Quarter Ago Current Quarter Current Quarter Year to Date Current Quarter Year to Date Vancouver 15,463,718 998,610 9.0% 8.0% 6.5% 50,300 351,327 458,153 940,050 $22.39 $13.11 $35.50 Edmonton 6,149,235 1,487,869 18.7% 22.7% 24.2% 66,242 287,742 (39,959) (129,480) $18.71 $15.07 $33.78 Calgary 13,088,711 2,519,258 23.3% 20.7% 19.2% 0 0 193,853 338,958 $17.90 $16.03 $33.93 Winnipeg 202,385 15,473 4.2% 7.6% 7.6% 0 0 0 (7,050) $21.24 $9.76 $31.00 Toronto 47,427,909 4,989,952 12.4% 11.2% 10.5% 30,600 465,456 202,682 973,824 $17.91 $16.24 $34.15 Kitchener 1,178,716 190,862 19.6% 15.6% 16.2% 0 0 (6,841) 39,410 $14.85 $7.82 $22.67 Waterloo 2,901,658 477,589 23.9% 16.5% 16.5% 0 0 559 214,947 $15.26 $9.46 $24.72 Ottawa 15,400,276 1,007,633 13.5% 8.0% 6.5% 0 0 192,741 961,957 $16.02 $16.64 $32.66 Montreal 14,957,705 2,276,941 18.3% 15.6% 15.2% 0 0 28,723 348,605 $15.04 $14.71 $29.75 Fredericton n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Saint John n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Moncton n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Halifax 2,887,216 273,262 11.9% 11.3% 9.5% 0 0 53,796 48,937 $15.78 $12.25 $28.03 St. John's 52,317 0 0.0% 0.0% 0.0% 0 0 0 0 $26.00 $11.40 $37.40 National 119,709,846 14,237,449 14.8% 12.7% 11.9% 147,142 1,104,525 1,083,707 3,730,158 $17.79 $15.26 $33.05 Market Net Rent Additional Rent Gross Rent Current Inventory Current Availability Availability Rate 2018 New Supply 2018 Absorption