Office Insight and Statistics: Fort Worth (2019-Q2)

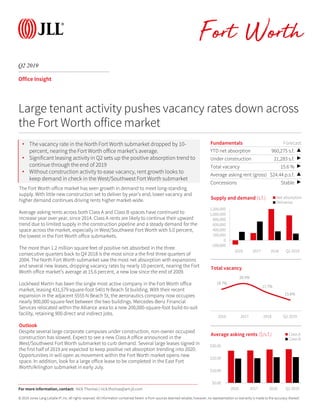

- 1. © 2019 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. The Fort Worth office market has seen growth in demand to meet long-standing supply. With little new construction set to deliver by year’s end, lower vacancy and higher demand continues driving rents higher market-wide. Average asking rents across both Class A and Class B spaces have continued to increase year over year, since 2014. Class A rents are likely to continue their upward trend due to limited supply in the construction pipeline and a steady demand for the space across the market, especially in West/Southwest Fort Worth with 5.0 percent, the lowest in the Fort Worth office submarkets. The more than 1.2 million square feet of positive net absorbed in the three consecutive quarters back to Q4 2018 is the most since a the first three quarters of 2004. The North Fort Worth submarket saw the most net absorption with expansions and several new leases, dropping vacancy rates by nearly 10-percent, nearing the Fort Worth office market’s average at 15.6 percent, a new low since the end of 2009. Lockheed Martin has been the single most active company in the Fort Worth office market, leasing 431,579 square-foot 5401 N Beach St building. With their recent expansion in the adjacent 5555 N Beach St, the aeronautics company now occupies nearly 900,000 square feet between the two buildings. Mercedes-Benz Financial Services relocated within the Alliance area to a new 200,000-square-foot build-to-suit facility, retaining 900 direct and indirect jobs. Outlook Despite several large corporate campuses under construction, non-owner occupied construction has slowed. Expect to see a new Class A office announced in the West/Southwest Fort Worth submarket to curb demand. Several large leases signed in the first half of 2019 are expected to keep positive net absorption trending into 2020. Opportunities in will open as movement within the Fort Worth market opens new space. In addition, look for a large office lease to be completed in the East Fort Worth/Arlington submarket in early July. Q2 2019 Fort Worth Office Insight Fundamentals Forecast YTD net absorption 960,275 s.f. ▲ Under construction 21,283 s.f. ▶ Total vacancy 15.6 % ▶ Average asking rent (gross) $24.44 p.s.f. ▲ Concessions Stable ▶ -200,000 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 2016 2017 2018 Q2 2019 Supply and demand (s.f.) Net absorption Deliveries Large tenant activity pushes vacancy rates down across the Fort Worth office market 18.7% 20.4% 17.7% 15.6% 2016 2017 2018 Q2 2019 Total vacancy $0.00 $10.00 $20.00 $30.00 2016 2017 2018 Q2 2019 Average asking rents ($/s.f.) Class A Class B For more information, contact: Nick Thomas | nick.thomas@am.jll.com • The vacancy rate in the North Fort Worth submarket dropped by 10- percent, nearing the Fort Worth office market’s average. • Significant leasing activity in Q2 sets up the positive absorption trend to continue through the end of 2019 • Without construction activity to ease vacancy, rent growth looks to keep demand in check in the West/Southwest Fort Worth submarket

- 2. Fort Worth Q2 2019 Office Statistics Building Count Inventory (s.f.) Total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average direct asking rent ($ p.s.f.) YTD Completions (s.f.) Under Development (s.f.) Market Totals Fort Worth CBD 56 9,215,271 55,124 34,455 0.4% 15.3% 15.9% $28.38 0 0 Downtown Fort Worth 56 9,215,271 55,124 34,455 0.4% 15.3% 15.9% $28.38 0 0 Arlington/East Fort Worth 95 6,396,663 69,726 90,901 1.4% 11.1% 11.3% $18.98 0 0 HEB/Haltom City 59 4,510,043 -15,492 103,543 2.3% 14.4% 14.6% $18.03 0 0 North Fort Worth 32 3,794,499 551,105 539,707 14.2% 18.5% 18.5% $22.48 200,000 21,283 West/Southwest Fort Worth 73 5,301,560 56,262 84,053 1.6% 6.2% 7.0% $25.52 27,850 0 Westlake/Southlake 59 4,643,510 28,612 107,616 2.3% 27.9% 29.2% $27.38 30,000 0 Suburban Fort Worth 318 24,646,275 690,213 925,820 3.8% 15.0% 15.5% $23.04 257,850 21,283 Fort Worth 374 33,861,546 745,337 960,275 2.8% 15.1% 15.6% $24.44 257,850 21,283 Class A Fort Worth CBD 18 5,688,408 40,036 19,289 0.3% 16.6% 16.9% $30.96 0 0 Downtown Fort Worth 18 5,688,408 40,036 19,289 0.3% 16.6% 16.9% $30.96 0 0 Arlington/East Fort Worth 15 2,020,812 9,788 38,238 1.9% 10.4% 11.0% $21.65 0 0 HEB/Haltom City 10 1,402,307 -4,350 773 0.1% 17.1% 17.6% $19.77 0 0 North Fort Worth 8 1,331,531 87,875 97,291 7.3% 31.3% 31.3% $21.82 200,000 21,283 West/Southwest Fort Worth 15 1,883,852 34,151 30,756 1.6% 4.3% 5.0% $28.69 0 0 Westlake/Southlake 15 2,308,411 12,972 98,641 4.3% 43.1% 44.3% $28.14 0 0 Suburban Fort Worth 63 8,946,913 140,436 265,699 3.0% 21.7% 22.4% $25.52 200,000 21,283 Fort Worth 81 14,635,321 180,472 284,988 1.9% 19.7% 20.2% $27.38 200,000 21,283 Class B Fort Worth CBD 38 3,526,863 15,088 15,166 0.4% 13.2% 14.3% $23.31 0 0 Downtown Fort Worth 38 3,526,863 15,088 15,166 0.4% 13.2% 14.3% $23.31 0 0 Arlington/East Fort Worth 80 4,375,851 59,938 52,663 1.2% 11.4% 11.5% $17.58 0 0 HEB/Haltom City 49 3,107,736 -11,142 102,770 3.3% 13.2% 13.2% $17.32 0 0 North Fort Worth 24 2,462,968 463,230 442,416 18.0% 11.6% 11.6% $23.00 0 0 West/Southwest Fort Worth 58 3,417,708 22,111 53,297 1.6% 7.2% 8.2% $23.81 27,850 0 Westlake/Southlake 44 2,335,099 15,640 8,975 0.4% 13.0% 14.3% $24.67 30,000 0 Suburban Fort Worth 255 15,699,362 549,777 660,121 4.2% 11.1% 11.5% $20.61 57,850 0 Fort Worth 293 19,226,225 564,865 675,287 3.5% 11.5% 12.0% $21.15 57,850 0 Note: Statistical set include Class A and Class B single- and multi-tenant office buildings 20,000 square feet and larger, excluding fully owner-occupied, medical office, and buildings owned by government entities. Nick Thomas | Senior Analyst, Research 201 Main Street, Suite 500, Fort Worth, TX 76102 | tel +1 817 334 8128 | nick.thomas@am.jll.com © 2019 Jones Lang LaSalle IP, Inc. All rights reserved.