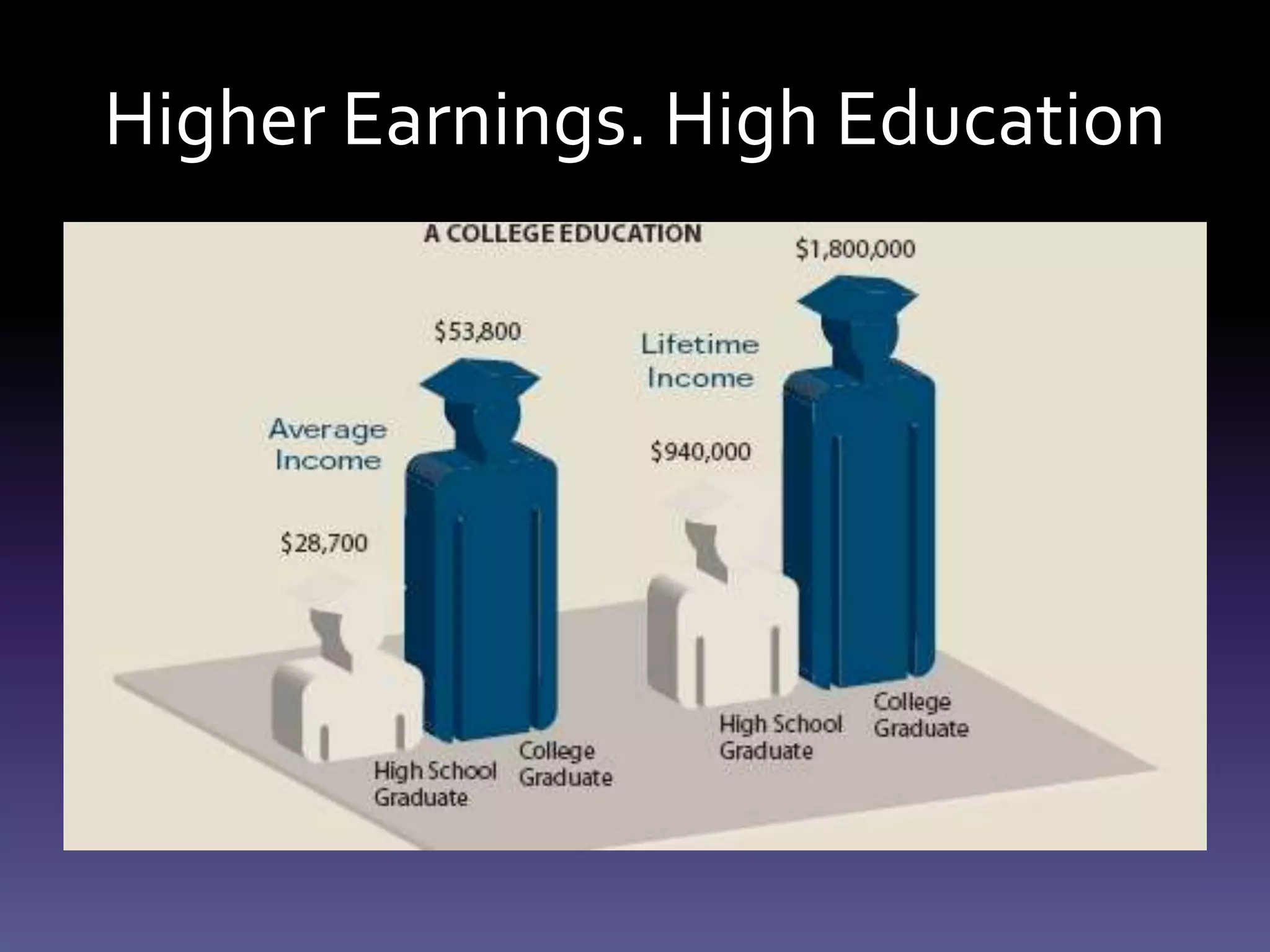

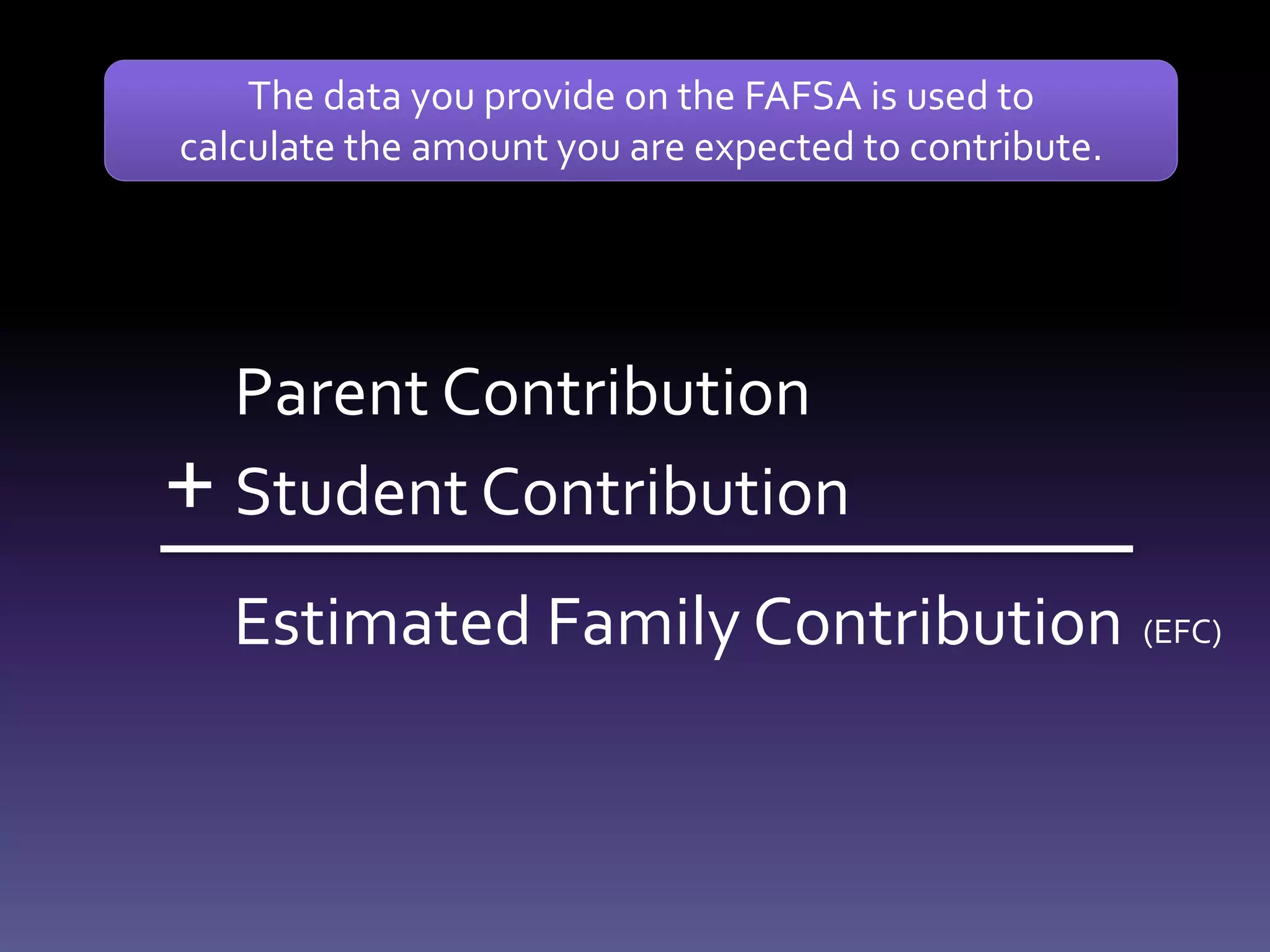

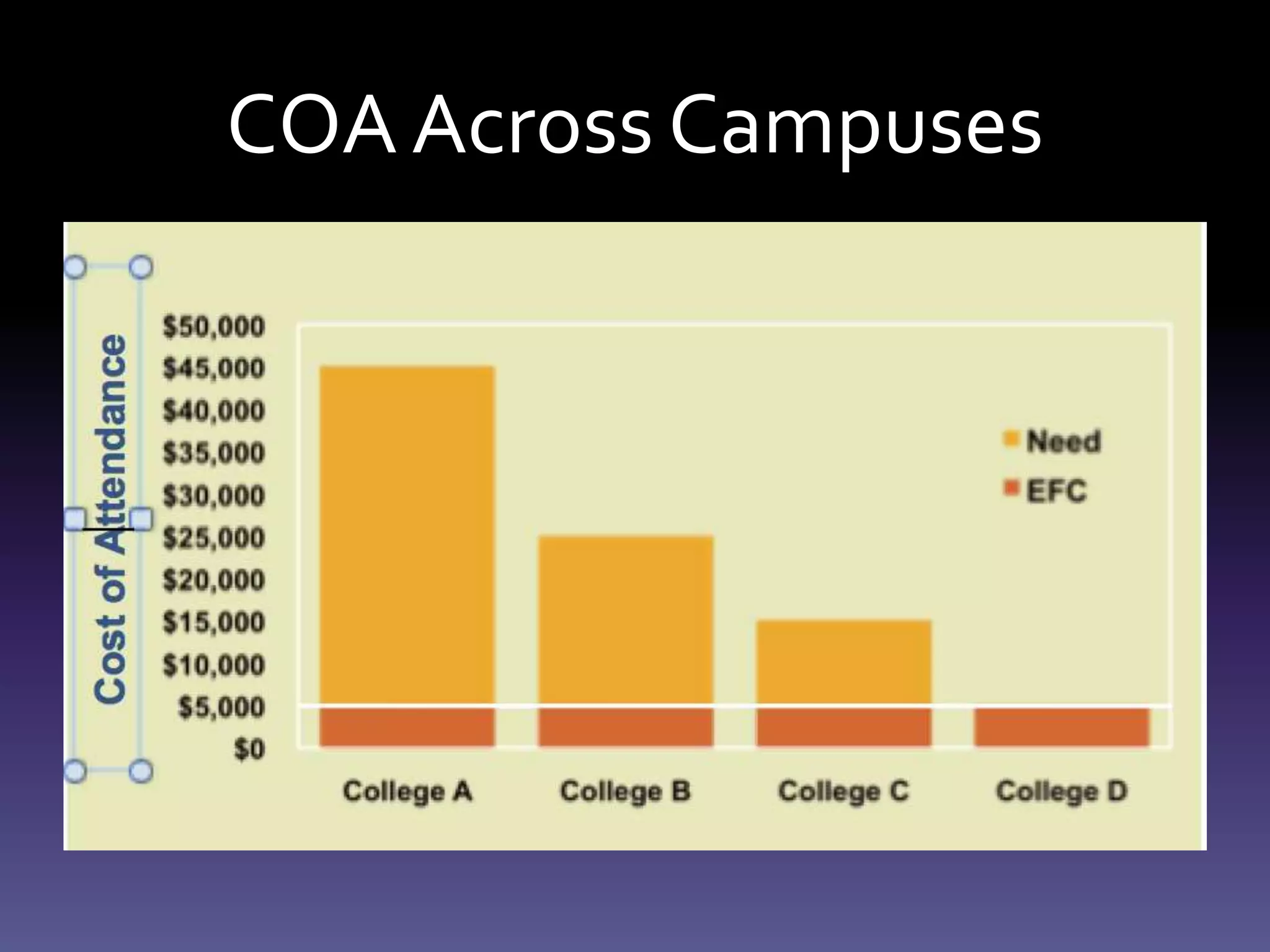

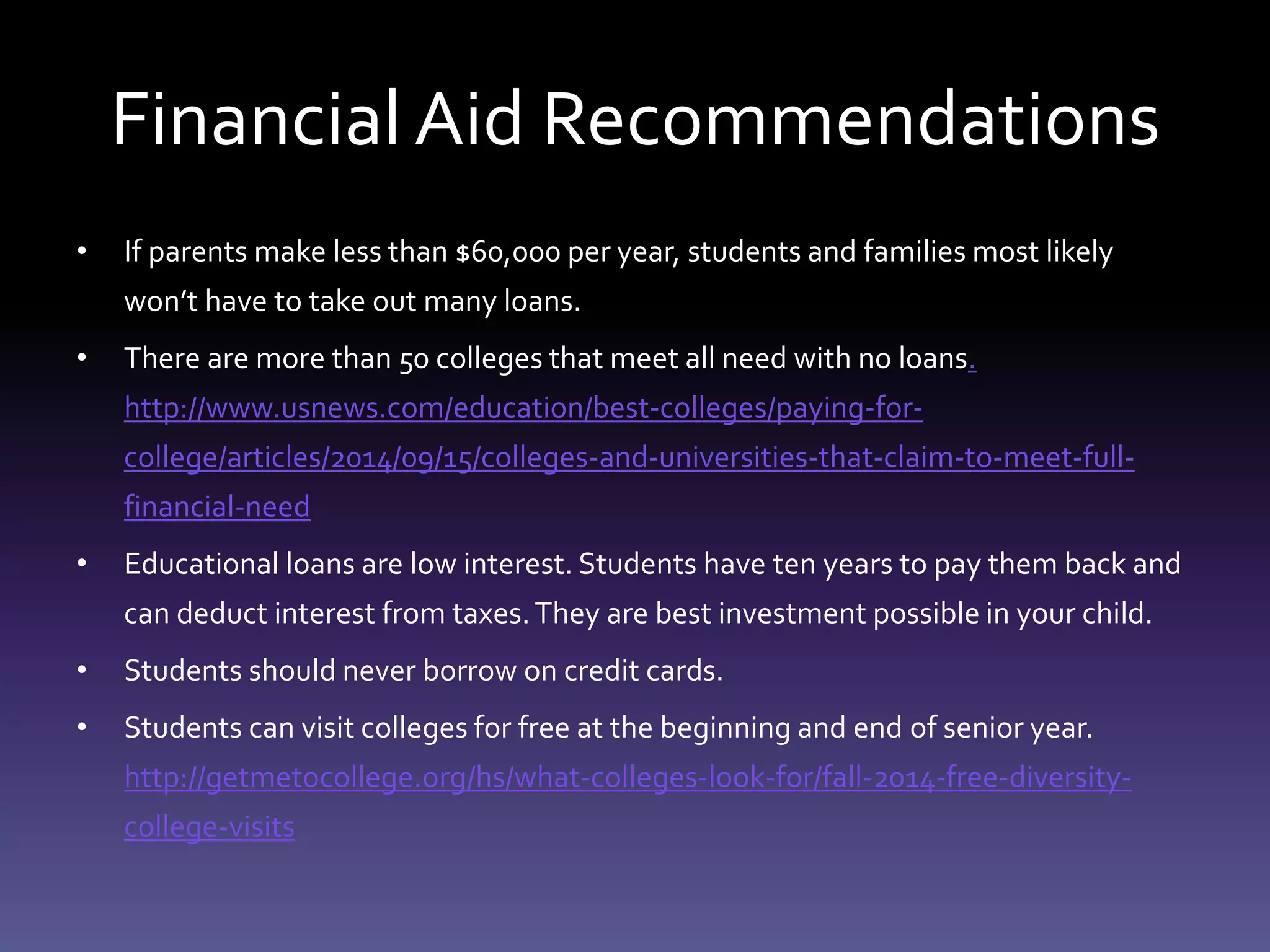

This document discusses how to afford college, including calculating costs of attendance, determining financial need, and types of financial aid. It explains that the total cost of attendance includes direct costs like tuition and fees as well as indirect costs like books and transportation. The Free Application for Federal Student Aid (FAFSA) is used to calculate the estimated family contribution and determine financial need. Financial aid can be need-based, merit-based, or non-need-based. The document provides recommendations for affording college such as saving money, applying early for financial aid, and applying for outside scholarships.