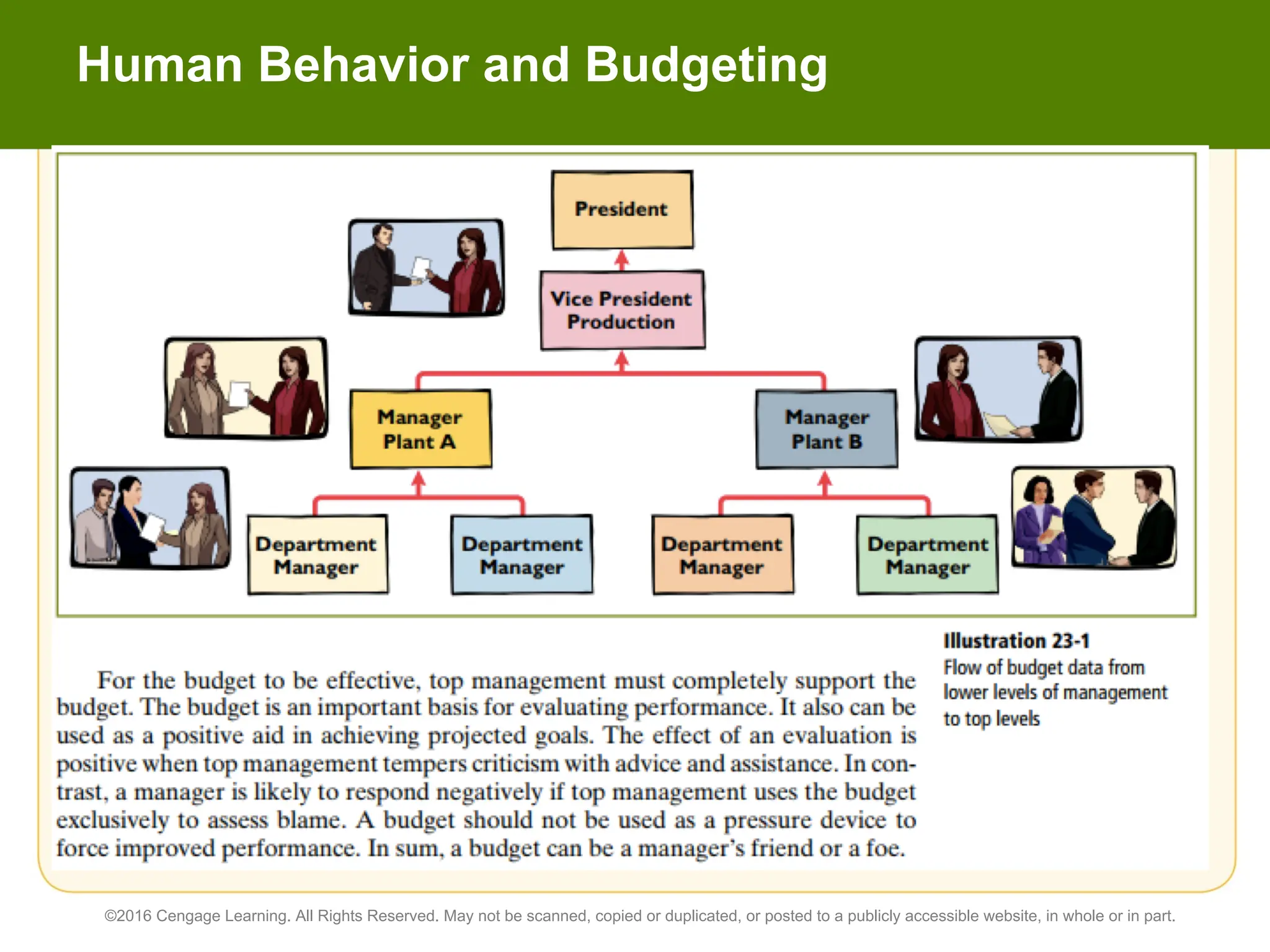

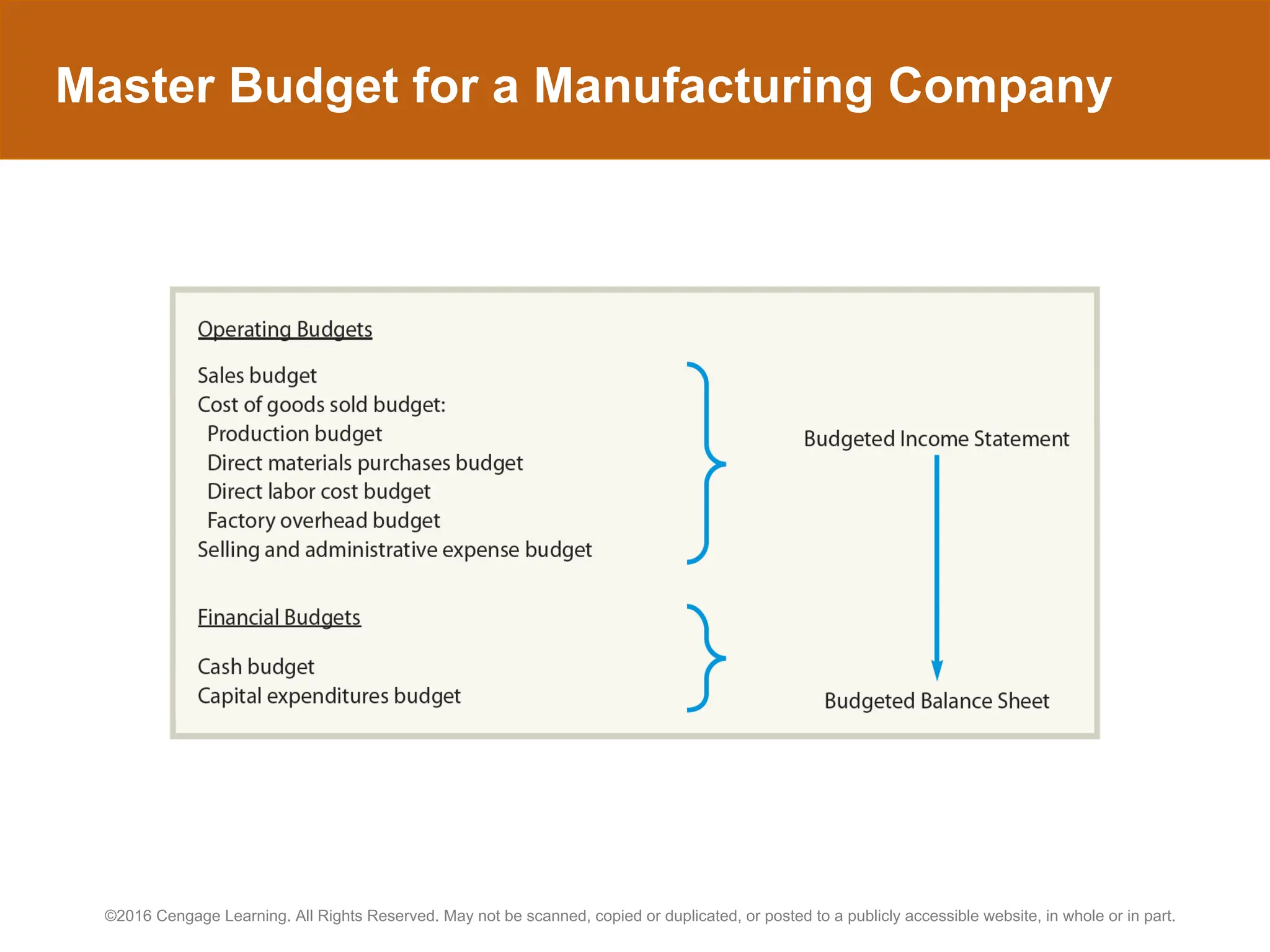

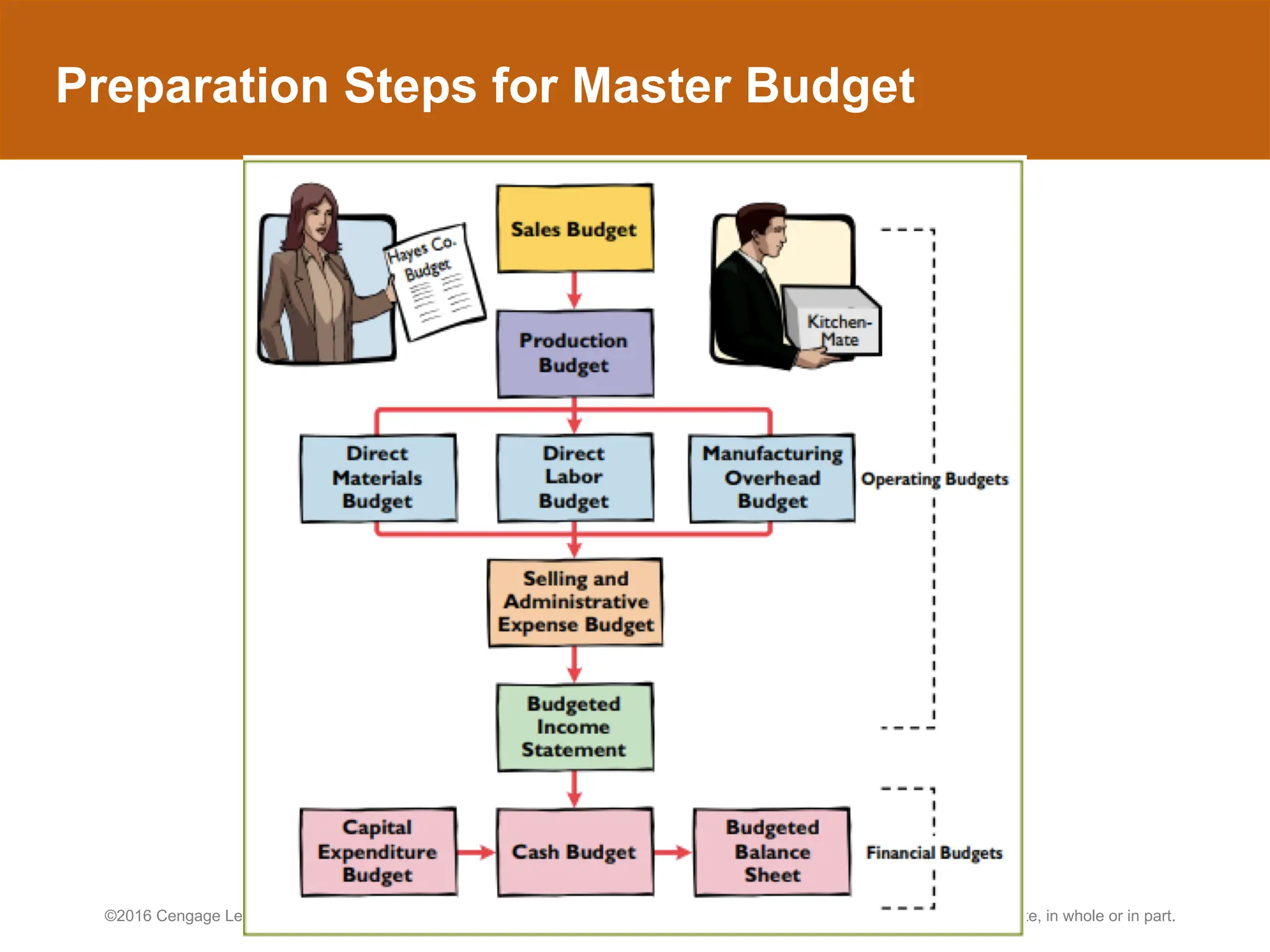

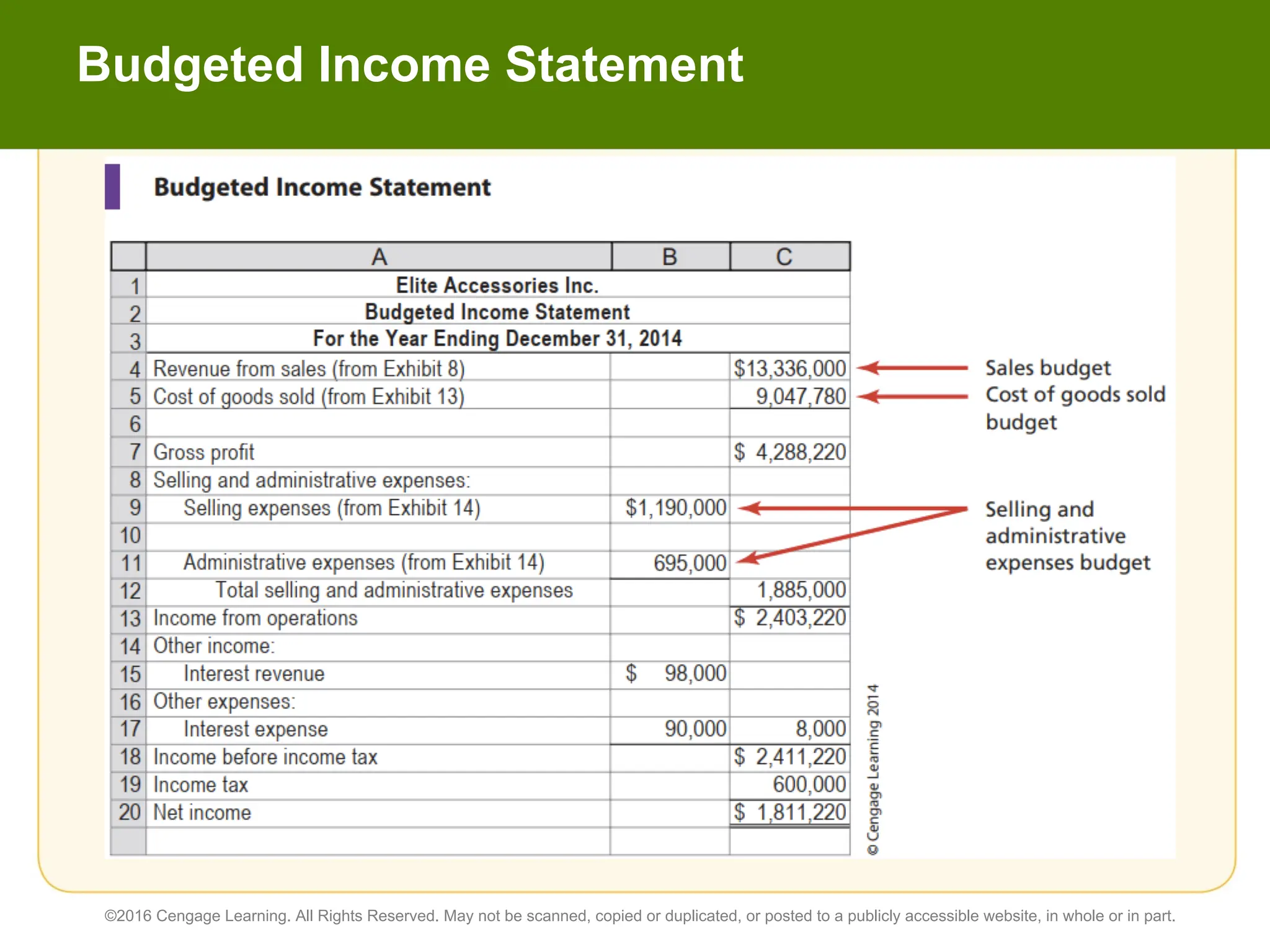

Budgeting plays an important role for organizations of all sizes. This chapter describes budgeting for a manufacturing company, including how budgets affect planning, directing, and controlling. Budgets can involve setting goals, comparing actual performance to goals, and addressing human behavior issues like setting goals too tight or loose. The chapter outlines different budgeting systems including static, flexible, and master budgets which integrate operating and financial budgets.