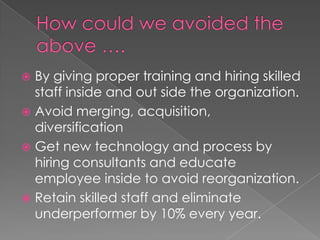

Organizational restructuring aims to make companies work more effectively and efficiently through changes like downsizing, acquisitions, mergers, and strategic alliances. Restructuring strategies are used by organizations to improve performance, enter new markets, gain competitive advantages, and increase profits. Common reasons for restructuring include changes in competitive environments, markets, government policies, and the need for new skills or reduced costs.