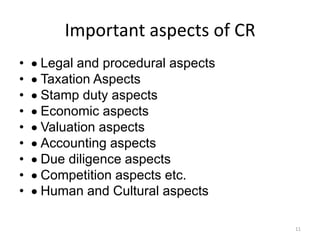

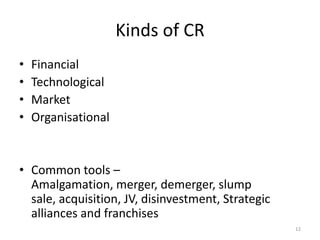

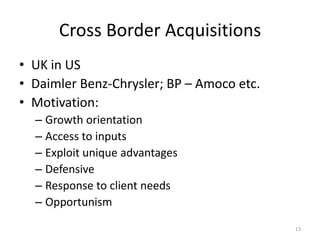

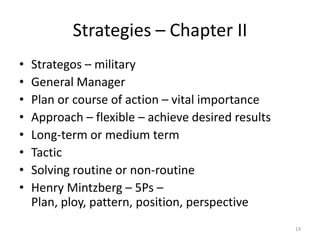

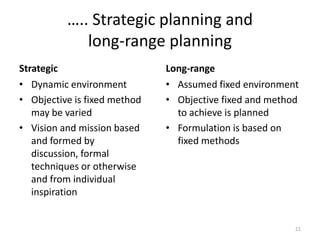

This document discusses corporate restructuring strategies. It begins by covering the different types of restructuring strategies like mergers, acquisitions, takeovers, demergers, and financial restructuring. It then discusses the need for corporate restructuring to increase efficiency and market share. The document also provides context on the regulatory framework and historical background of corporate restructuring in India. It emphasizes that strategic planning and identifying core competencies are important aspects of successfully implementing a corporate restructuring strategy.