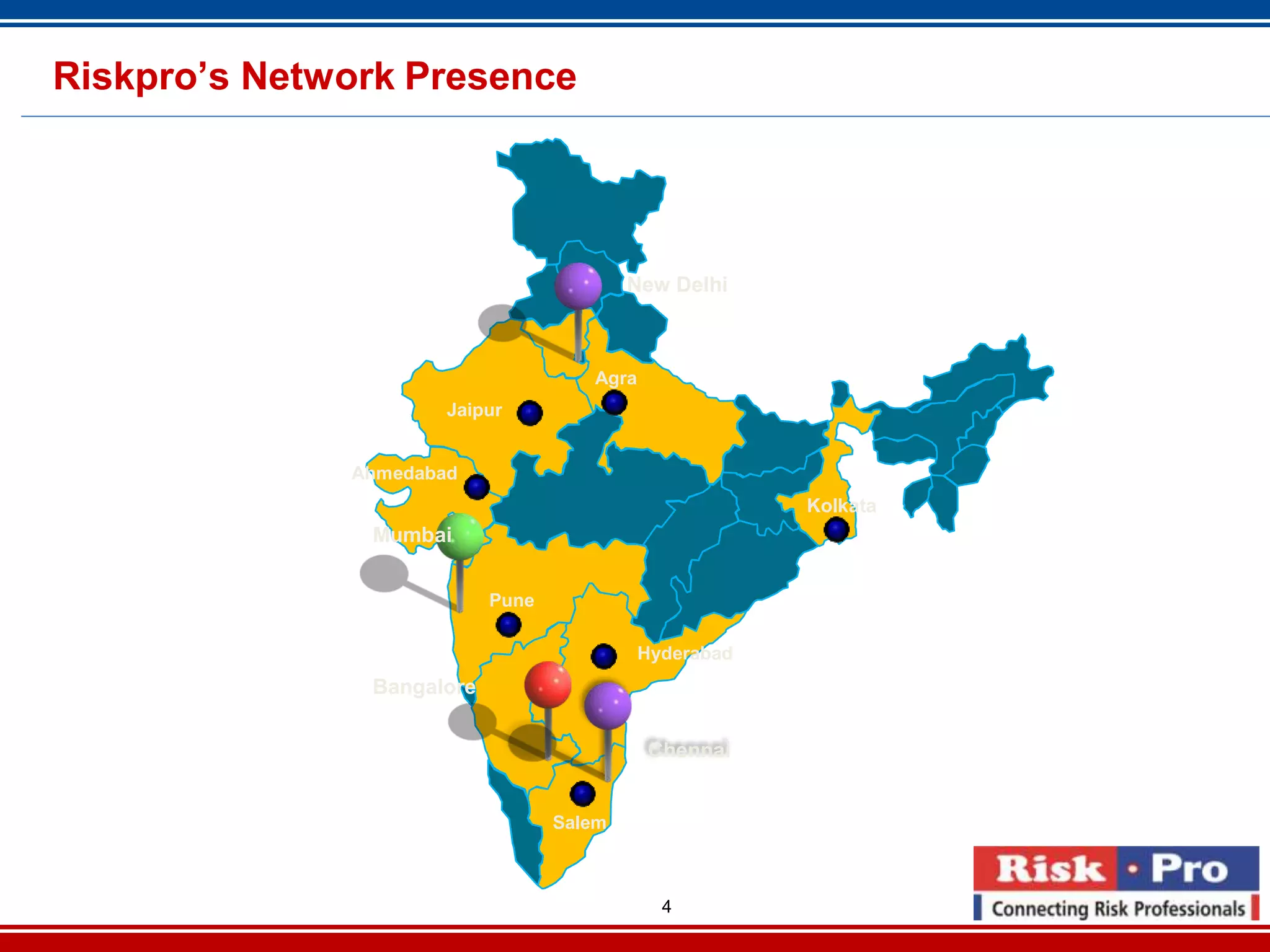

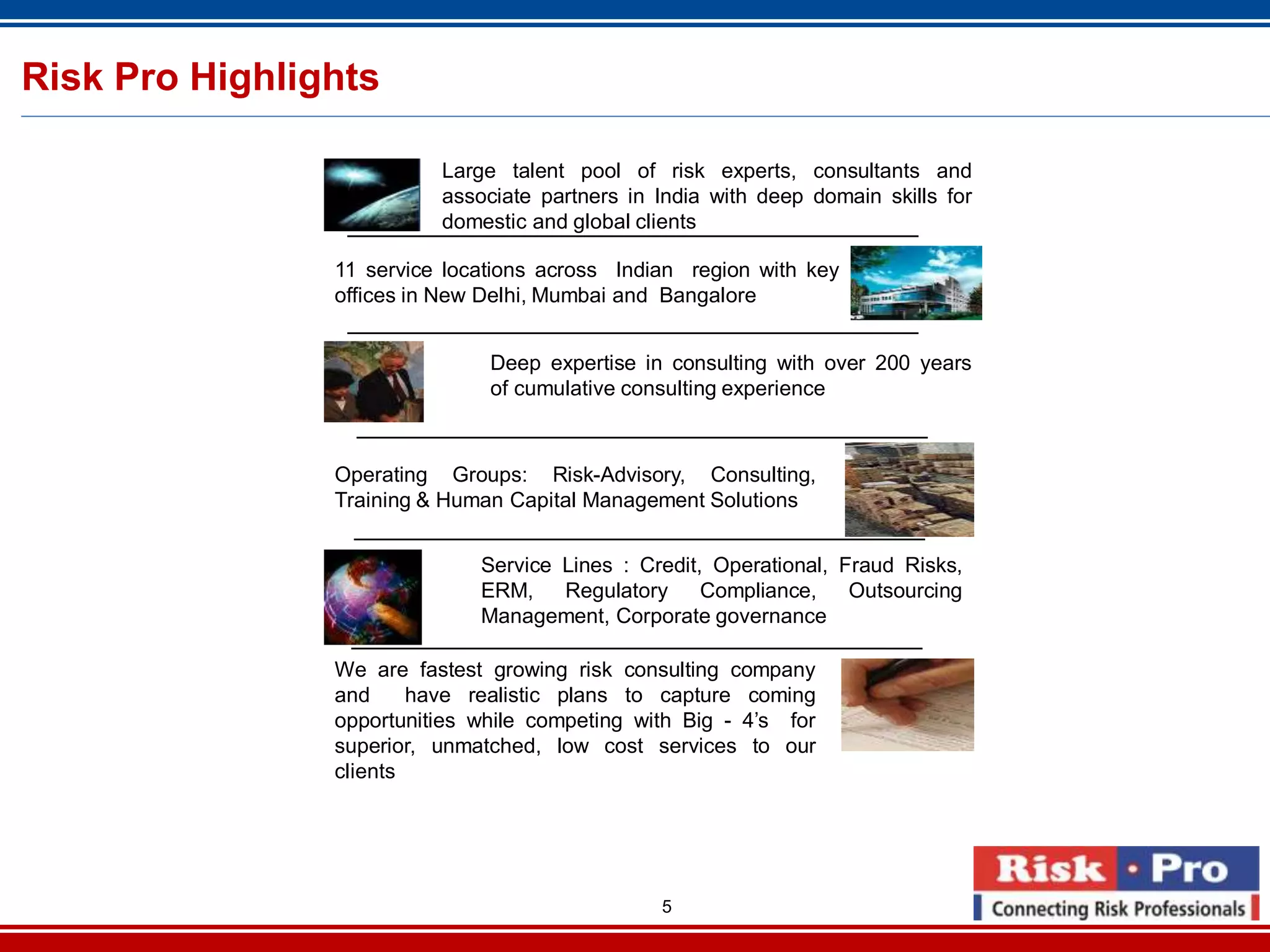

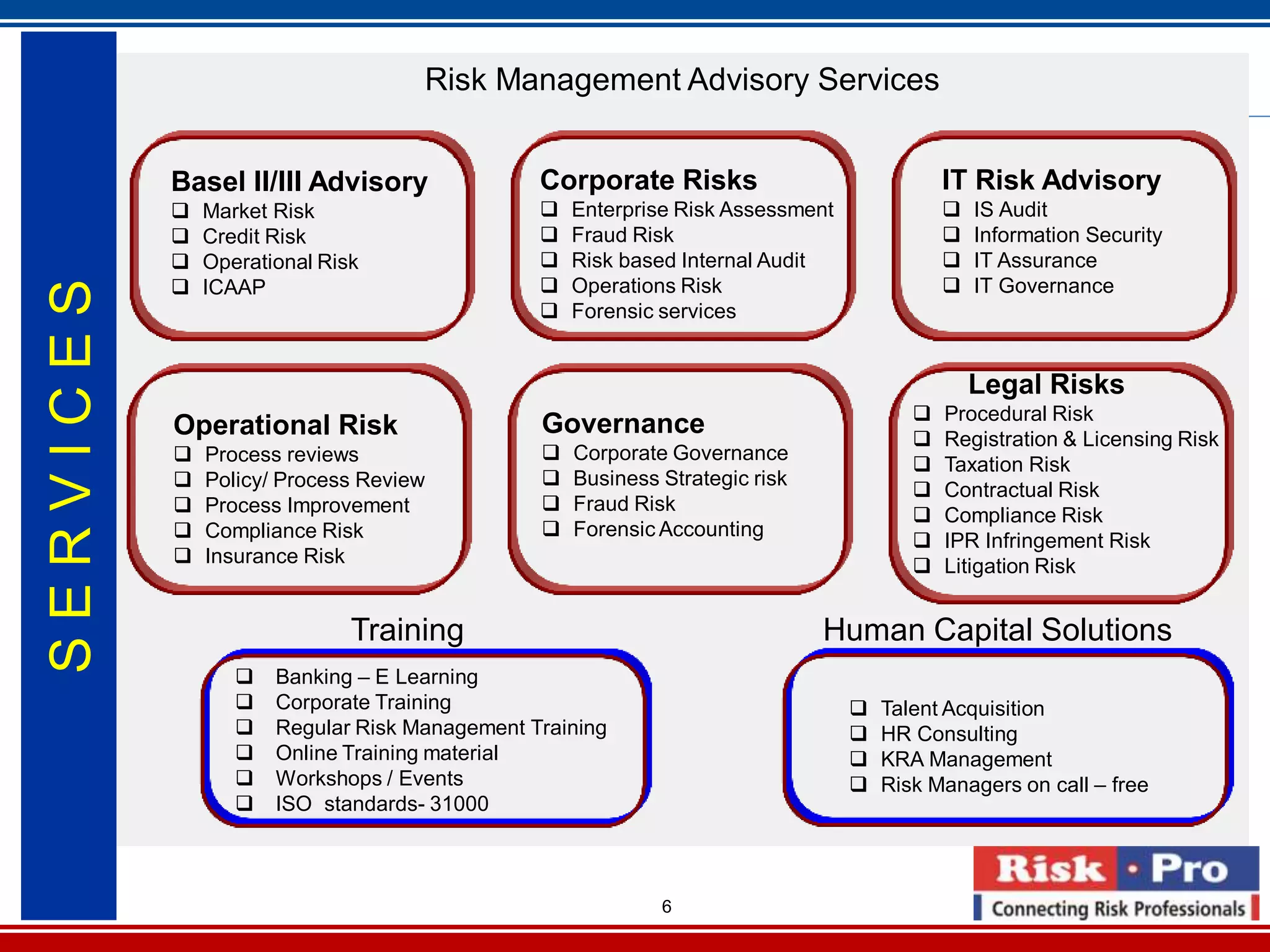

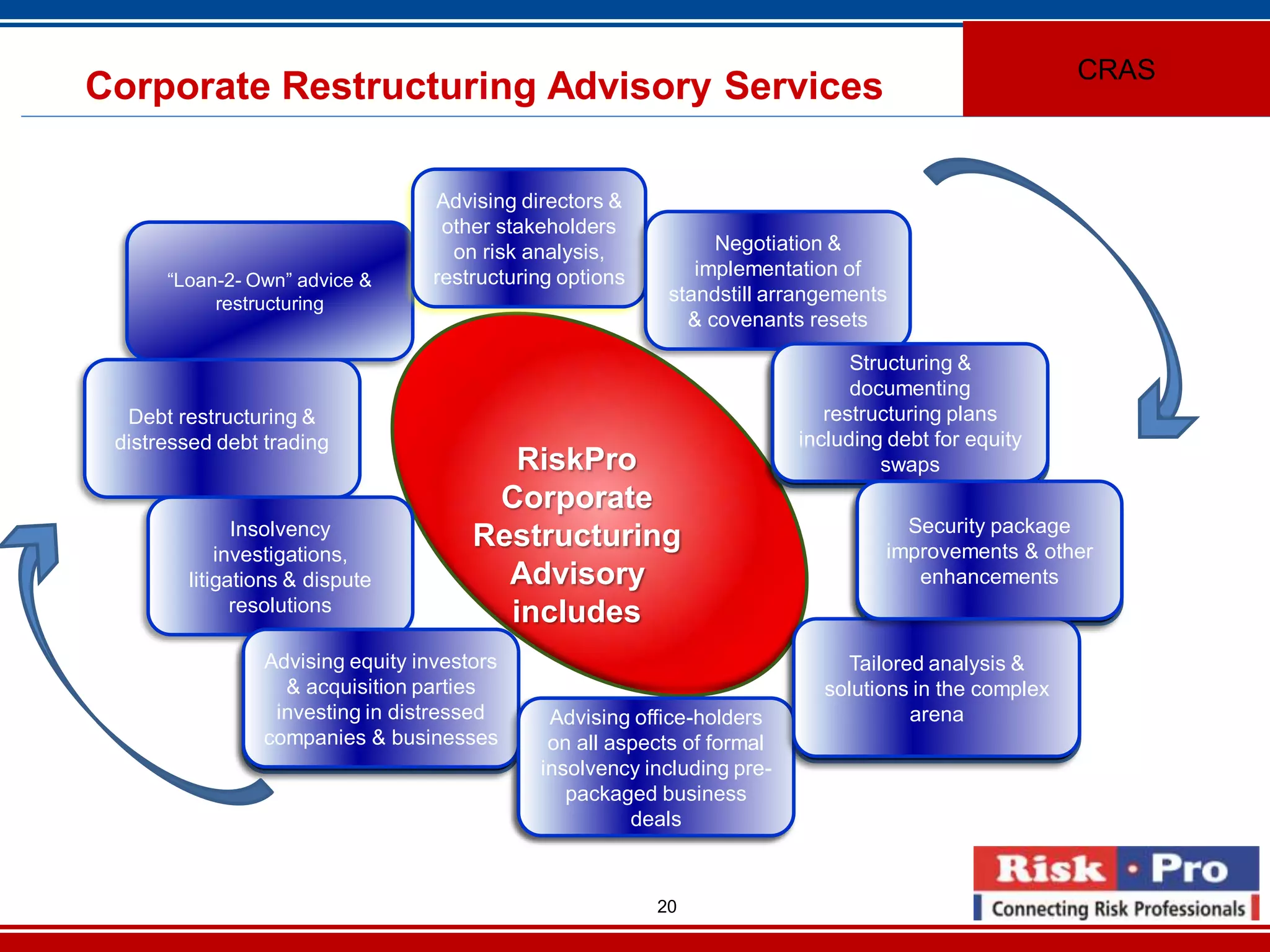

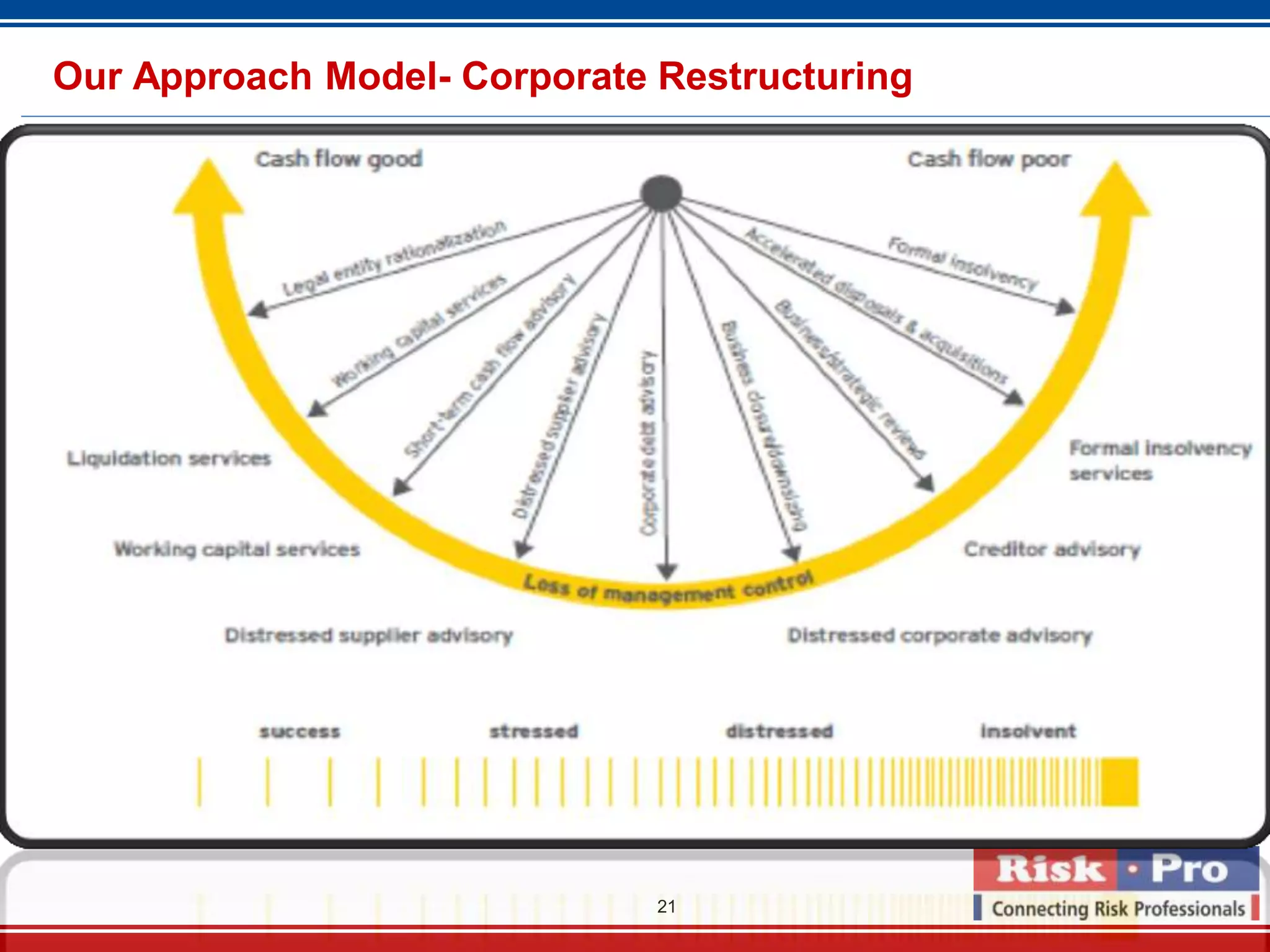

This document provides an overview of Riskpro India, a risk management consulting firm with offices in New Delhi, Mumbai, and Bangalore. It details Riskpro's mission to provide integrated risk management solutions to mid-large sized corporates and financial institutions in India. The document outlines Riskpro's value propositions including affordable services delivered by skilled professionals. It also summarizes Riskpro's service offerings such as Basel compliance advisory, corporate risk advisory, IT risk advisory, and corporate restructuring advisory.

![31

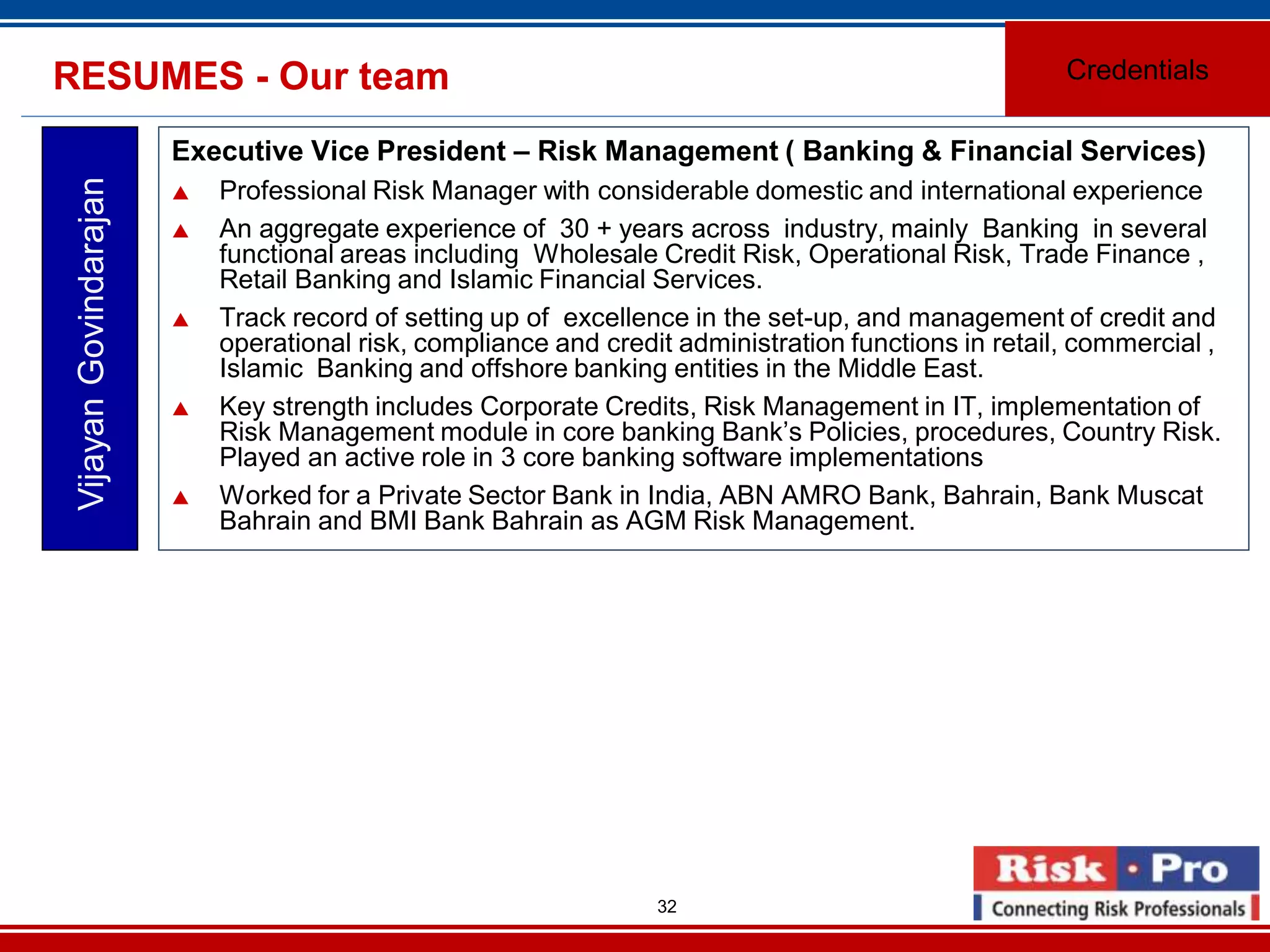

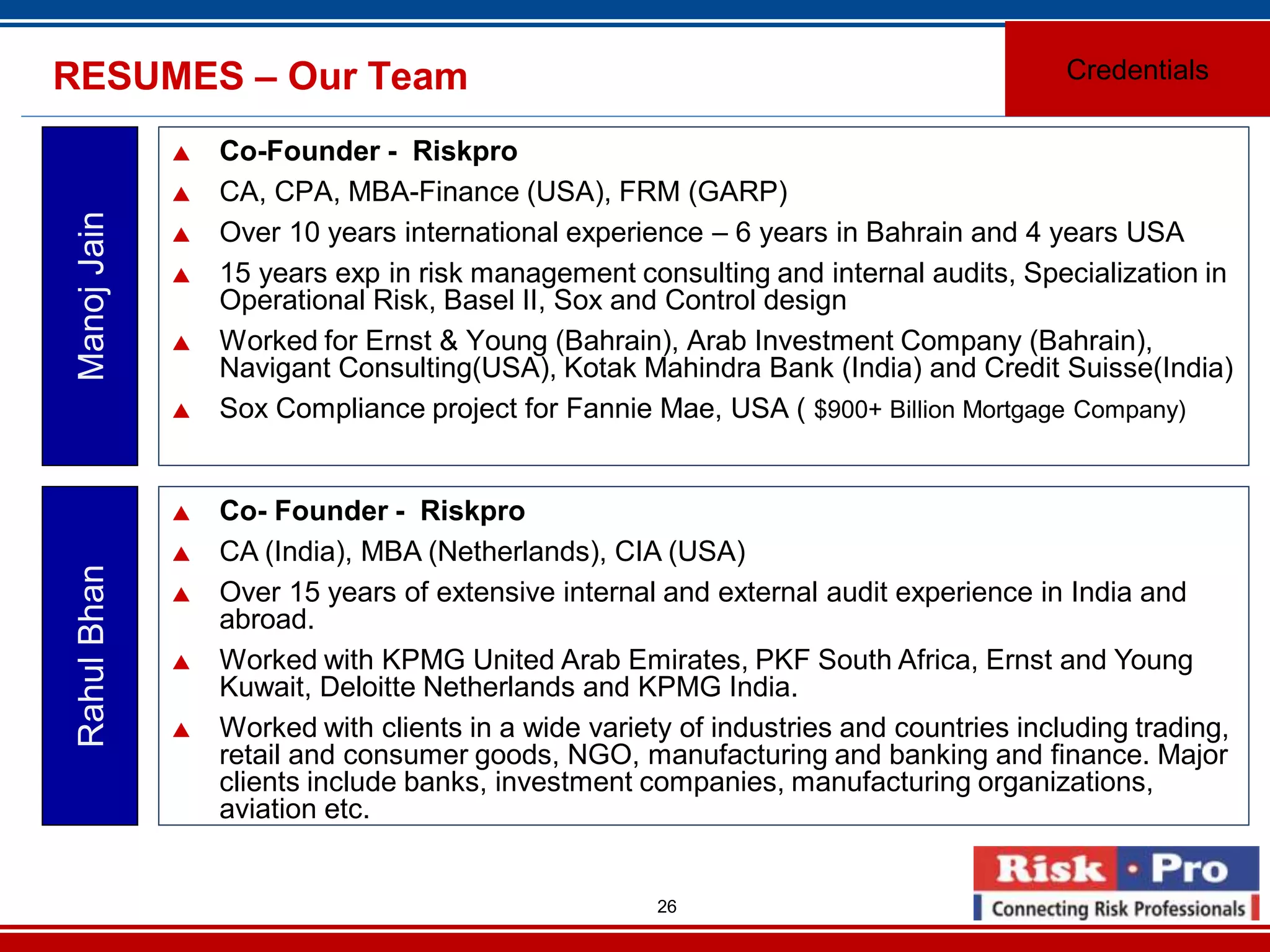

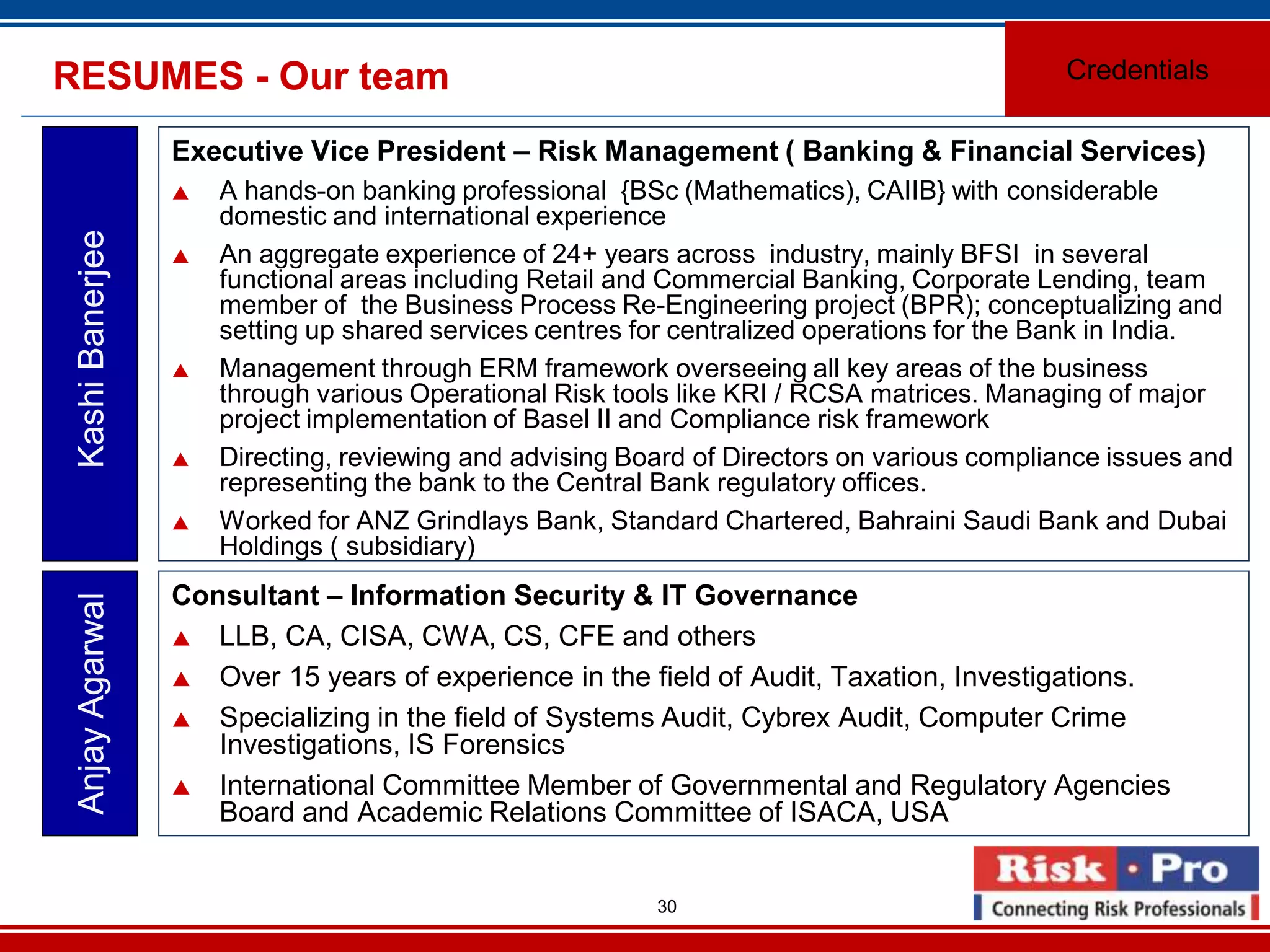

RESUMES - Our team Credentials

PhanindraPrakash

Vice President – Riskpro India

FCA [India], ACMA [India], CFE [USA], CertIFRS [UK]

Over 16 years of extensive consulting experience which includes financial & systems audit,

process transformation, implementation of internal controls, SOX compliance, fraud audits

& due diligence, US-India taxation

Engaged in consulting roles as trusted advisor to finance, internal audit and information

technology executives of multiple Fortune 1000 companies with project sites in US,

Canada, Europe & Asia

Worked with E&Y and Deloitte Consulting in USA

Some of the major clients served internationally are GE Capital, UBS, McKesson, Eaton,

Imation, Albertsons,

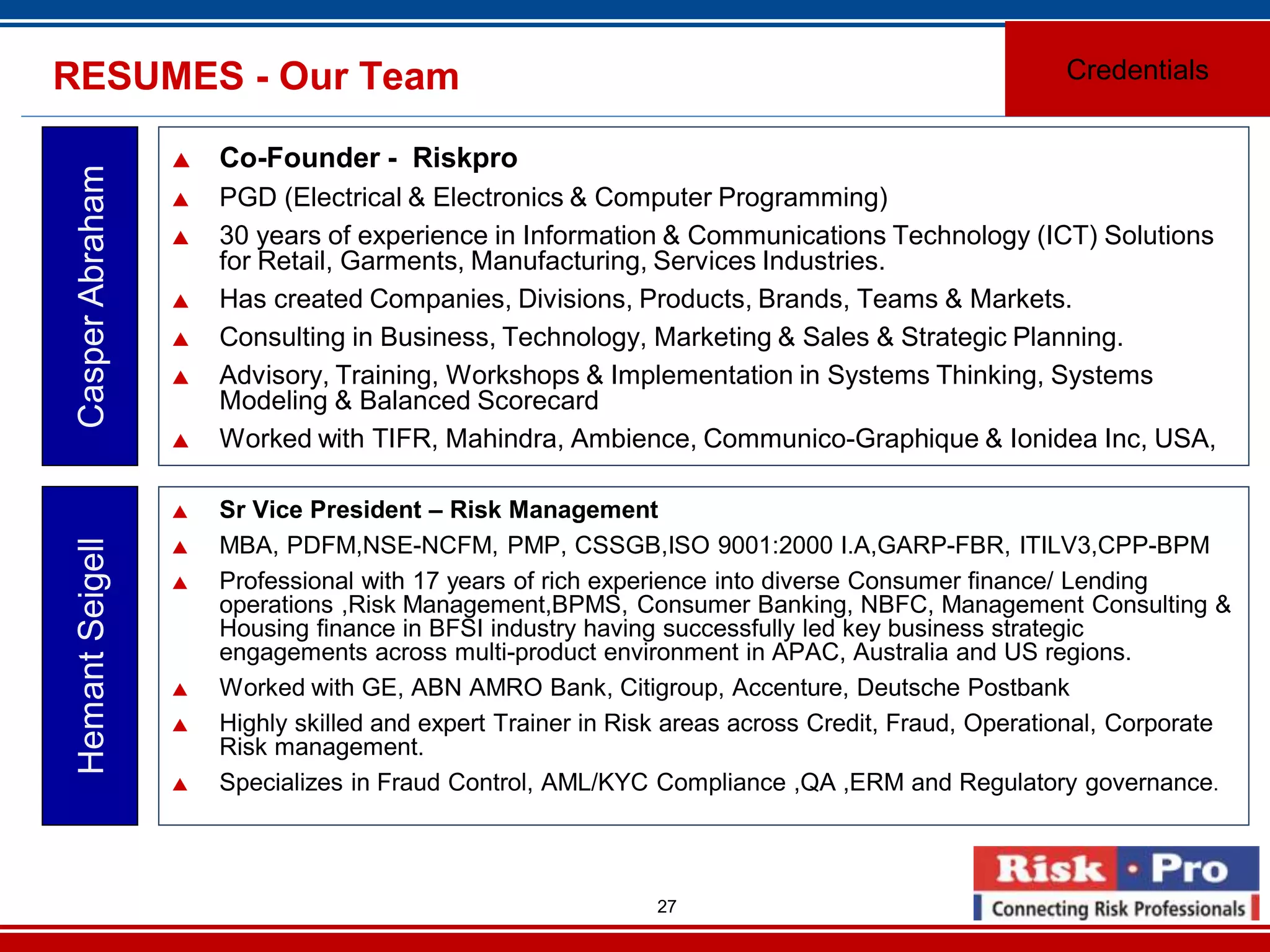

EVP and Head – Telecom Risk Advisory

M.Tech, IIT Kharagpur, India; IES; Doctoral study, research and teaching in Linkoping

University/Sweden; Lead Auditor (BVQI).

Over 30 years on International experience in networks and mobile Handsets from top

global companies /institutes like ISRO, Ericsson, Nokia, Nokia Siemens Networks and

based mostly in its head quarter locations in India, EU, USA.

Expertise: Setting up capability, behaviour, culture in turning Risk, Quality, Innovation for

competitive advantage, customer delight and sustainability; key skill sets are Engagement,

Handholding, Coaching, Mentoring and lot of best practices, benchmarking/standards like

CMMI, TL9000, Six Sigma, ISO, SAS 70 etc.

AsokSit](https://image.slidesharecdn.com/riskpro-corporaterestructuring2013-130703113702-phpapp02/75/Risk-pro-corporate-restructuring-2013-31-2048.jpg)