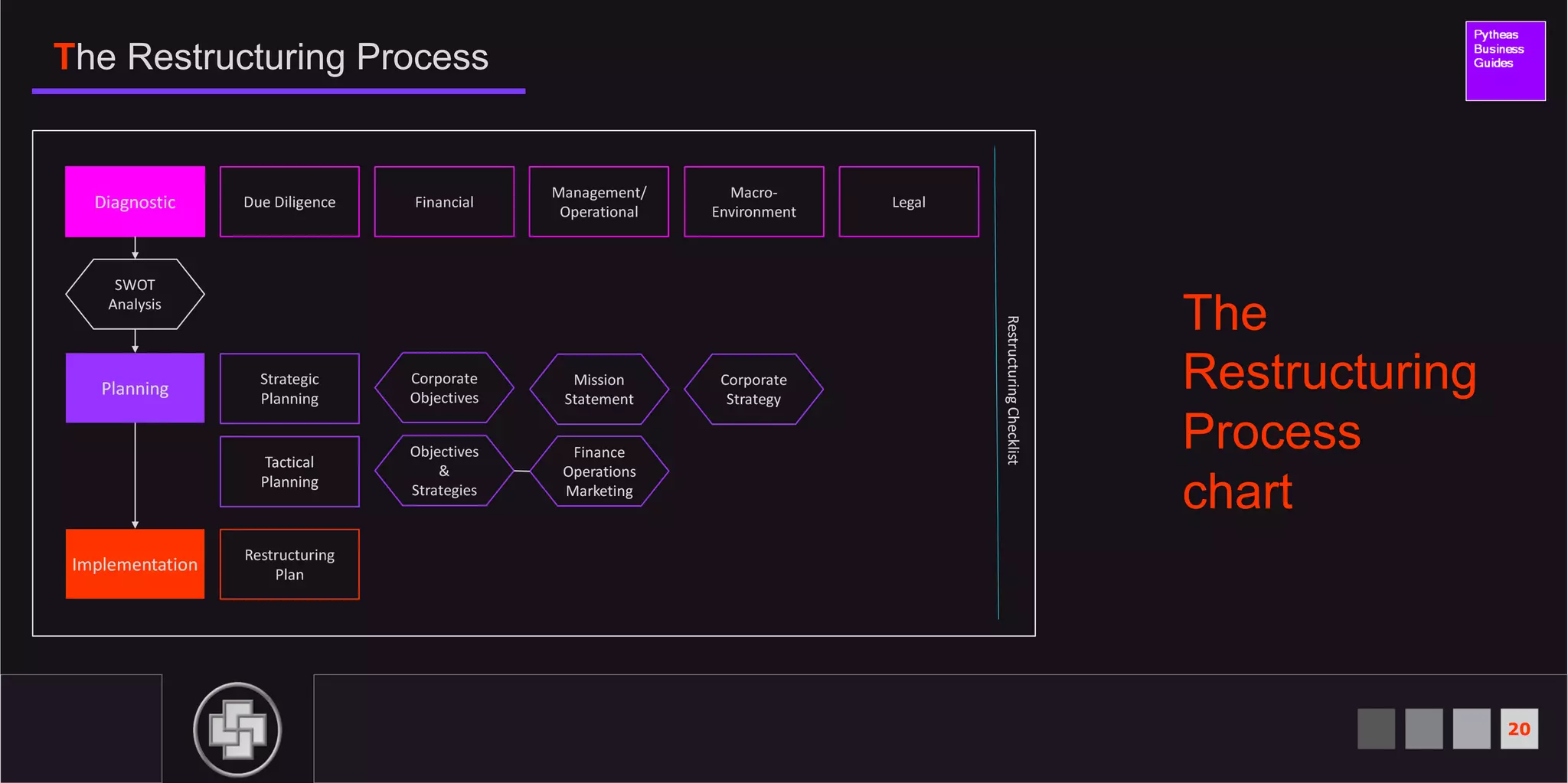

The document provides an overview of corporate restructuring. It discusses what restructuring is, common restructuring strategies like organizational, financial, and portfolio restructuring. It also outlines reasons for restructuring like poor financial performance, new corporate strategies, and correcting market valuation errors. Key factors for successful restructuring include setting objectives, focusing on the core business, and executing swiftly. The typical restructuring process involves stabilizing finances, strengthening the core business, and pursuing growth opportunities.