The document discusses the impact of Brexit on UK eCommerce businesses that sell to customers in the EU. Key points:

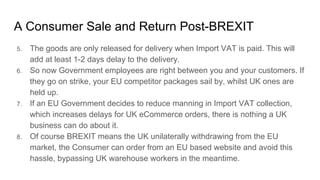

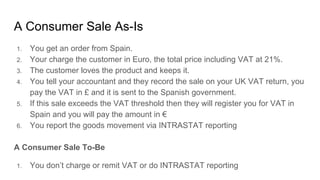

- Post-Brexit, the UK will no longer be part of the EU VAT system, adding complexity for sales to EU customers. Customers will have to pay import VAT and deal with paperwork for returns.

- This will negatively impact the customer experience and put EU governments between UK businesses and their customers.

- The obvious solution for UK businesses is to move warehouses and jobs to the EU to continue serving EU customers seamlessly.

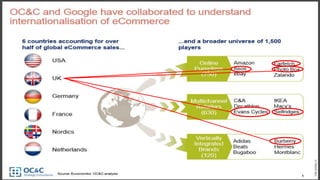

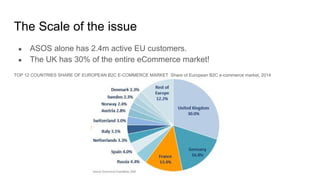

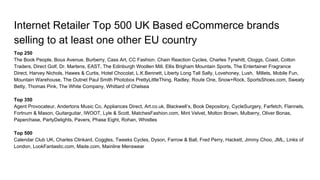

- Losing access to the EU's single market will significantly disadvantage UK eCommerce businesses compared to their EU competitors.