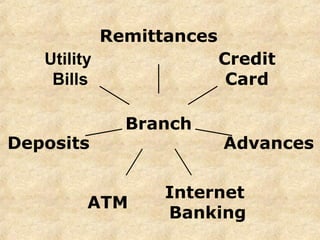

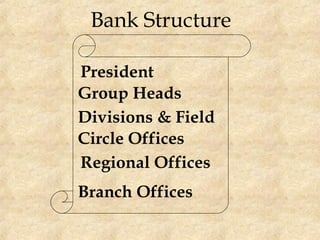

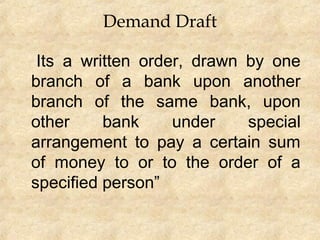

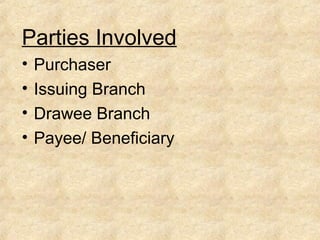

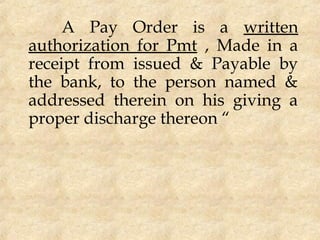

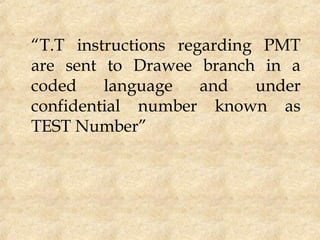

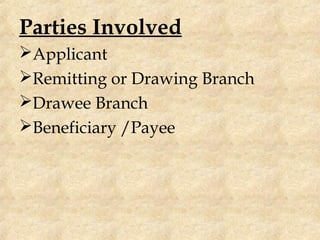

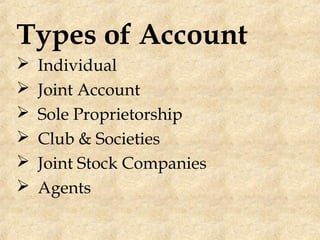

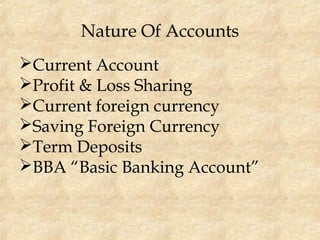

This document summarizes branch banking and financial services offered by banks in Pakistan. It discusses the different types of accounts banks provide like current accounts, savings accounts, and term deposits. It also outlines the various payment and remittance services offered, including demand drafts, pay orders, telegraphic transfers, and online fund transfers. The document then discusses personal and business loan facilities that banks offer, including secured loans like mortgages and vehicle loans, as well as personal, mortgage, and business finance options.