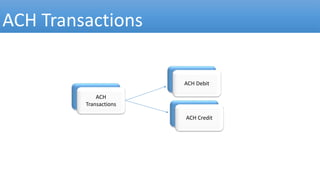

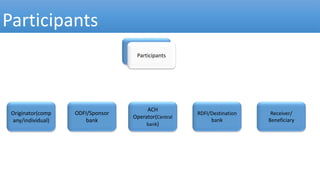

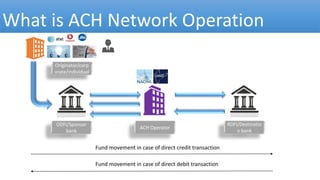

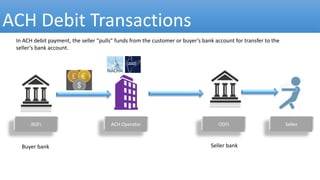

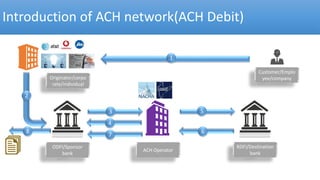

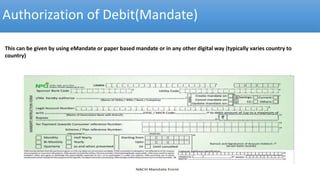

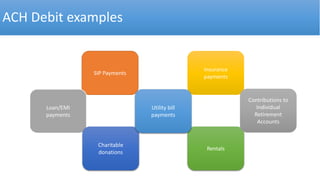

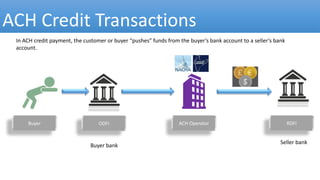

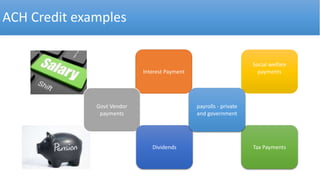

The ACH network is an electronic payment system that enables batch processing of transactions between financial institutions, providing faster processing than traditional checks. It comprises participants like originators and banks, facilitating both debit and credit transactions for various use cases including bill payments and payroll. Utilizing ACH allows for timely payments, reduced processing costs, and improved payment tracking without the need for physical checks.