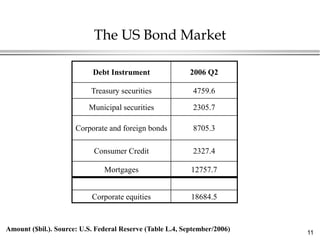

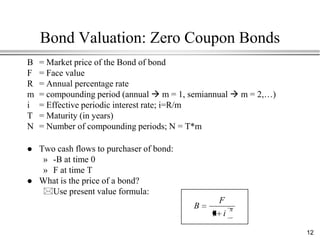

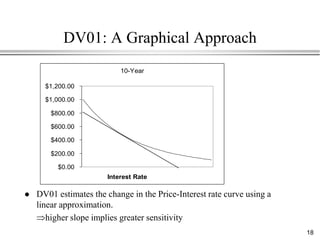

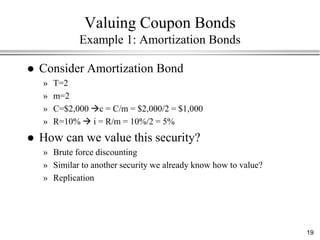

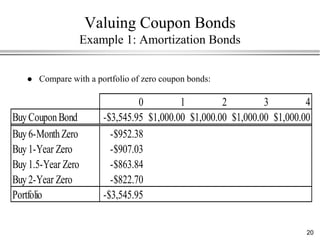

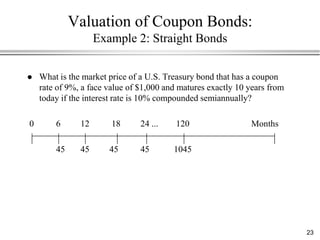

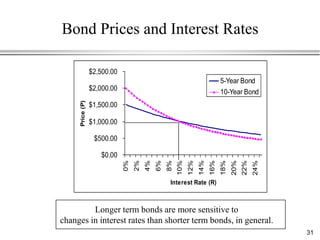

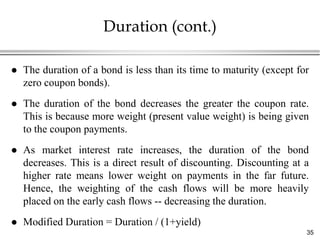

This document provides an overview of bond valuation and interest rate sensitivity. It begins with an introduction to bonds and bond markets, including different types of bonds such as zero-coupon bonds and coupon bonds. It then discusses how to value zero-coupon bonds and coupon bonds using present value calculations. The document also examines how bond prices are inversely related to interest rates and how duration can be used to measure a bond's interest rate sensitivity.