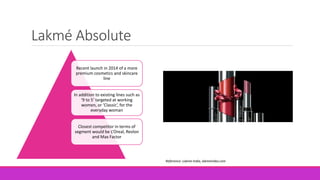

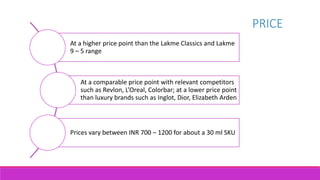

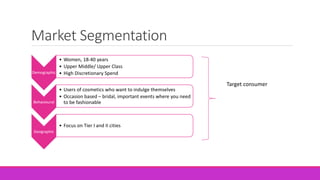

Hindustan Unilever launched Lakmé Absolute, a premium cosmetics and skincare line, in 2014. Lakmé Absolute targets women ages 18-40 from upper middle and upper class backgrounds with high discretionary spending. It positions itself as an indulgent brand offering long-lasting, hydrating formulas suitable for Indian skin at price points comparable to international brands but lower than luxury brands. Lakmé promotes Absolute through magazines, newspapers, digital platforms, and in-store displays to reach its target demographic.