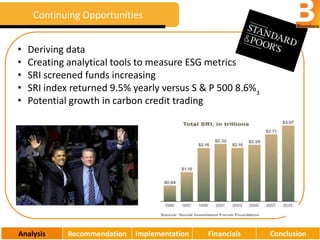

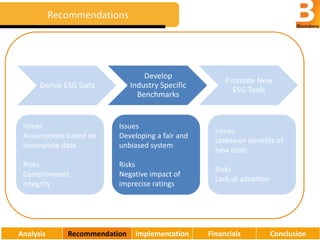

Bloomberg is considering ways to expand its environmental, social, and governance (ESG) offerings. The document analyzes Bloomberg's competitive advantages and weaknesses in ESG, identifies opportunities in the growing sustainable investing market, and recommends that Bloomberg derive ESG data, develop industry-specific benchmarks, and promote new analytical tools to track ESG metrics. An implementation plan and financial projections estimate that these recommendations could generate over $100 million in profit for Bloomberg over five years while increasing its small market share in ESG offerings substantially.