This document outlines Ujjivan Small Finance Bank's approach to strengthening environmental, social and governance (ESG) integration. It details the key activities the bank has undertaken, including a materiality assessment, benchmarking against peers, and assessments against the Dow Jones Sustainability Index and EY's Sustainable by Design framework. It establishes six pillars for the bank's ESG framework: sustainable operations, empowering communities, responsible finance, customer centricity, human capital, and effective governance. Under each pillar, focus areas and goals are defined for the short, medium and long term to guide the bank's sustainability strategy and reporting.

![Page 4

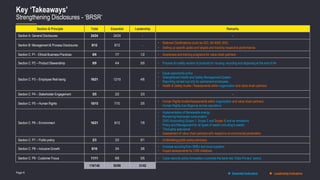

S. No. Activities Status Brief Update

1. Materiality Assessment Completed

• 177 stakeholders engaged i.e., 161 internal and 16 external

• Materiality matrix developed

2. Gap Assessment [ Benchmarking ] Completed

• Benchmarking completed using EY’s SbD criteria

• Four banks i.e. AU, IndusInd, HDFC & Cholamandalam

3. DJSI Assessment Completed

• Gap assessment conducted as per DJSI methodology

• Actions items identified under short, mid and long term

4. ESG Strategy and Roadmap In Progress

• Focus areas identified and ESG framework devised

• Long-term and short-term goals defined across focus areas

• Signoffs to be obtained for respective focus areas

• Implementation plan to be developed

5. Data Management In Progress

• Environment data collection template shared

• ESG dashboard (MIS) to be developed post finalization of goals / targets / implementation plan

6. Effective Governance In Progress

• Policies identified for updation / development

• OHS policy drafted; Sustainability, CoC, HR in progress

• Multi-tier governance to be developed

7. Capacity Building In Progress

• 1 workshop and 1 flyer released

• Other programs scheduled and to be taken subsequently

8. Drafting of BRSR Completed • Maiden BRSR drafted and finalized

9. Drafting of Sustainability Report In Progress • Data collection has been initiated; Draft report to be in place by end of August

Status Overview

Activities and Update](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-4-320.jpg)

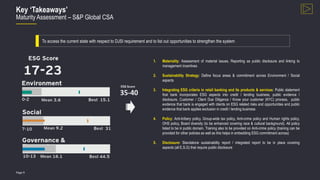

![Page 7

Key ‘Takeaways’

Defining ‘Materiality Assessment’

CV

To identify and prioritize aspects that are of relevance and significance to stakeholder and business

136

Employees

18

Department SPOC’s

5

NGOs

2

Investors

7

Customers

Engaged 170+ Internal & External Stakeholder

through various mediums

7

Leadership & Sr

Mgmt.

2

Suppliers

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANG

E]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

0.80

1.00

1.20

1.40

1.60

1.80

2.00

0.30 0.50 0.70 0.90 1.10 1.30 1.50 1.70 1.90 2.10

STAKEHOLDER

INFLUENCE

IMPACT ON USFB

Materiality Matrix

Responsible

Finance

Sustainable

Operations

Key Themes

Empowering

Communities

Effective

Governance

Governance Social

Environment](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-7-320.jpg)

![Page 15

Building the ‘Framework’

Pillar 1 – Sustainable Operations – Sustainable by Operations [ 1 / 2 ]

• Streamline monthly monitoring and establish accounting across environment

KPIs (energy, emissions, waste, water)

• Continue the rigour of data reporting and monitoring

mechanism through automation process

• Identify relevant Scope 3 emissions categories & sources

• Explore the feasibility of Scope 3 emissions accounting in

alignment with GHG Protocol

FY24 FY25 FY 26

Environment

Monitoring

Mechanism

Sustainable by

Operations*

Responsible

Waste

Management

• Identify & categorize the wastes

• Prepare an inventory of the waste

• Handle and dispose in adherence to the laid down regulatory requirements

• Waste handling vendor contracts to be in place

• Guidelines in place on waste handling, storage and disposal

• Continue the rigour of waste management handling across

operations

• Explore and implement waste reduction / reusing options

• Achieve “Zero waste to landfill” status

• Retain Zero waste to landfill status

Energy /

Emissions/

Water

• Explore opportunities for resource optimization (energy & water)

• Renewable energy options to be explored especially for branches where

consumption is minimum

• Conduct Energy audit to identify energy saving opportunities.

• 100% offices to be equipped with Energy efficient lighting systems to

conserve energy

• 100% employees will be provided training on energy and water conservation

practices through awareness campaigns, training programs etc

• SOP to be defined for Resource optimization and renewable

alternatives as default across operations.

• Install Renewable energy (Solar PV) for selected offices

• Implement energy audit findings (applicable ones) across

operations and measure the energy reduction achieved,

• Achieve 5% reduction in power consumption compared to

FY’23

• Achieve 10% reduction in power consumption compared to FY’23

• Explore opportunities to reduce Scope 3 emissions, which are

emission intensive (Ex: Employee commutation, Business travel

etc.)

Goal 2030 20% reduction in Power consumption

Target 2028 15% reduction in Power consumption

Target 2026 10% reduction in Power consumption

*Goals and targets are w.r.t to FY’2023 baseline

Focus Area SPOC

Ms. Almas Fatima,

National Manager

Admin & Infrastructure Dept](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-15-320.jpg)

![Page 16

Building the ‘Framework’

Pillar 1 – Sustainable Operations – Sustainable by Design [ 2 / 2 ]

• Develop guidelines on sustainable green design concepts

such as energy efficient fittings, alternate materials in

accordance with global frameworks

• Define KPIs scoring mechanism

• Address the gaps/opportunity areas basis the pilot

assessment.

• Automation of Internal processes : Moving towards

manual to automated process for processes (Ex: digital

invoices, Digital employee visiting cards, dual printing,

and digital application forms)

• Implement GREEN building guidelines for selected

office and declare it as a “Model Green branch“

• Review and update the guidelines as per the

learning’s from “model Green branch”

• Explore the feasibility of obtaining IGBC certification

(Green building) for selected office location

• 20% automation of Internal process across 100%

offices and reduce paper consumption by 20%

• Certification of select branches in alignment with national

standards - IGBC

• 50% automation of Internal process across 100% offices

and reduce paper consumption by 50%

FY24 FY25 FY 26

Green

Branches /

Offices

Sustainable by

Design

Goal 2030

10% of total office area (Ujjivan offices) to achieve ‘Green

Building’ certification

Target 2028

5% of total office area (Ujjivan offices) to achieve ‘Green Building’

certification

Target 2026 One select office as “GREEN Building” certified

Focus Area SPOC

Ms. Almas Fatima,

National Manager

Admin & Infrastructure Dept](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-16-320.jpg)

![Page 20

Building the ‘Framework’

Pillar 3 – Human Capital – Talent Management [ 1 / 4 ]

• Increase Training Hours per Employee - from 29

Hours to 30.5 Hours

• Creating ESG awareness as part of new employee

orientation

• Increase the participation % through E-learning

modules

• Increase Training Hours per Employee- from 30.5

Hours to 32 Hours

• Enable Global learning platform for self learning

• Increase Training Hours per Employee - from 32

Hours to 34 Hours

• Provide learning grant for individual development

areas

FY24 FY25 FY 26

Learning &

Development

Talent

Management

Talent attraction

and retention

• Achieve talent retention rate through:

o Job Rotation policy for key roles

o Career development programs

o Sabbatical Leave for individuals

o Introduction of work life balance policy

o Ensuring employee avail mandatory leave to

create work life balance across all levels (>60%)

o Disclose total Employee turnover rate with a

breakdown of Age, Gender, Management level

and Race

• Control voluntary employee attrition rate up to 25%

• Achieve talent retention rate through:

o Ensuring eligible employee avail mandatory

leave to create work life balance across all levels

(>70%)

o Implement policies and employee support

programs such as Work from home (WFH)

working options

• Control voluntary employee attrition rate up to 25%

• Achieve talent retention rate through:

o Ensuring eligible employee avail mandatory leave

to create work life balance across all levels (>80%)

o Track the usage of People Analytics for Strategic

Workforce Planning by:

o Identifying current workforce skills gaps

o Identifying flight risks to improve retention

• Control voluntary employee attrition rate up to 25%

Goal 2030 --

Target 2028 --

Target 2026 34 hours per employee training

Focus Area SPOC

Ms. Shini Ashok, National Manager –

Learning & Talent Management

HR Department](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-20-320.jpg)

![Page 21

Building the ‘Framework’

Pillar 3 – Human Capital – Diversity, Equity & Inclusion [ 2 / 4 ]

• Achieve *gender diversity upto 22%.

o Introduction of “Unpause” model to welcome

women with a career break

o Develop Diversity policy and communicate

across the organization

o Conduct training on gender neutrality for

supervisors for facilitating non-discrimination

awareness against married or pregnant women

• Achieve gender diversity upto 24%.

o Identification of “women only” position in

agreement with the HODs to drive women hiring

in their respective departments

o Derive action plan for hiring women/ disabled/

marginalised

o Introduce reward scheme for referring women in

leadership role

• Achieve gender diversity upto 26%.

o Conduct “women only” hiring campaigns

o Recognise teams, managers and leaders for driving

DE&I

FY24 FY25 FY 26

DE&I

Diversity, Equity &

Inclusion

Goal 2030 --

Target 2028 Achieve gender diversity upto 30%

Target 2026 Achieve gender diversity upto 26%

Focus Area SPOC

Manas Satapathy, National Manager

– Talent Acquisition

HR Department

*Gender diversity specified above, refers to women workforce only](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-21-320.jpg)

![Page 22

Building the ‘Framework’

Pillar 3 – Human Capital – Human rights [ 3 / 4 ]

FY24 FY25 FY 26

Human Rights

Goal 2030 -

Target 2028

Completion of the remediation actions of the identified

risk areas.

Target 2026 Complete implementation of the HRDD

• Develop the human rights policy and communicate

across relevant stakeholders

• Develop a human rights due diligence framework and

identification of the potential risks and impact of the

same.

• Conduct due diligence process to proactively identify

potential impacts and risk relating to respecting

human rights

• Report on human rights mitigation and remediation

activities

• Implement processes to mitigate human rights risks

• Number of sites with mitigation plans

• Type of remediation actions taken

Human Rights

Focus Area SPOC

Prasanna Venkatesen, National Manager –

HR operations

HR Department](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-22-320.jpg)

![Page 23

Building the ‘Framework’

Pillar 3 – Human Capital – Health, Safety and Wellbeing [ 4 / 4 ]

• Develop OHS management system

• Program Deployment (e.g., Ergonomics, healthy

lifestyle, health talks by experts, fitness programs,

defensive driving etc.,)

• Conduct accident investigation & preventive action at

Ujjivan office locations

• Conduct electrical safety audit across Ujjivan offices.

• Road safety focused program to be rolled out across

operations focussing more on field staff

• Monitor the accident rate at Ujjivan office locations

• Conduct employee Survey and develop Employee

Wellness Index

FY24 FY25 FY 26

Employee

Overall

Wellness

Initiatives

Health, Safety &

Wellbeing

Goal 2030

Zero Accidents – Ujjivan office locations

Target 2028

Target 2026

Focus Area SPOC

Manjunath V,

Lead – Payroll & Compliance

HR Department](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-23-320.jpg)

![Page 25

Building the ‘Framework’

Pillar 4 – Effective Governance – Data Privacy and Cyber Security [ 1 / 4 ]

Align policies and procedures with global standards

like ISO 27001:2022 (inclusive of business

contingency plan, incident response procedures

and periodic testing)

Obtaining ISO 27001:2022 Certification

Ensuring Sustenance of ISO 27001:2022

certification

Implementation of data Privacy Framework as per

Indian Privacy Law

Assessment in place to ensure alignment with ISO

27001:2022

Indian Privacy Law Compliance

Strengthen the security posture of the Bank to continue

to remain Cyber Attack/ Breach Free.

FY24 FY25 FY 26

Privacy and

Information

Security

Management

Data Privacy &

Cyber Security

Goal 2030

Zero Data Security Breaches

Target 2028

Target 2026

Focus Area SPOC

Mr. Shailesh Tiwari,

Cyber Governance Manager

Information Security Risk

Department](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-25-320.jpg)

![Page 26

Building the ‘Framework’

Pillar 4 – Effective Governance – Governance [ 2 / 4 ]

Design a multi-tier ESG governance structure

Develop roles and responsibilities for each

position

Increase the Board Independence further from

the current 66%

Continuous review and update of governance

structure

Further increase in board diversity ratio

To continue to adhere to highest standards of

governance to ensure 100% compliance

FY24 FY25 FY 26

Governance

Structure

Governance

Goal 2030

Robust Governance Structure, beyond compliance

Target 2028

Target 2026

Focus Area SPOC

Kshama Algure, Assistant Company

Secretary

Corporate Secretary Department](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-26-320.jpg)

![Page 27

Building the ‘Framework’

Pillar 4 – Effective Governance – Ethics & Compliance [ 3 / 4 ]

Identify, review and develop areas requiring policy as

per ESG trends/external requirements.

100% implementation of policies developed in

FY'24

Regular review and update of policies at set

frequencies

Regularly update policies at set frequencies

FY24 FY25 FY 26

Business Ethics

‘Programs and initiatives identified. However, no Goal / Target defined

for the same’

Ethics &

Compliance

Compliance

Management

Automation of Contract Management that reduces

turnaround time in execution of contracts and

streamlines the contract management system.

Implement Litigation Management Software that

eases monitoring of cases involving the Bank.

Digitisation of stamping through external vendor to

avoid storage of physical stamp papers.

Continue advisory in the best interest of Bank and mitigate

legal risks to avoid any fines, penal actions by statutory

authorities against the Bank.

Focus Area SPOC

Kshama Algure, Assistant Company Secretary

Ms. Megha, Manager - Legal

Corporate Secretary Department & Legal

Team](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-27-320.jpg)

![Page 28

Building the ‘Framework’

Pillar 4 – Effective Governance – Risk Management [ 4 / 4 ]

• Risk management education for non-executive

directors

• Enhance disclosure on risk management practices

(risk governance policy, risk training programs)

• Disclosure in accordance with TCFD requirements

• Develop a framework for ESG aspects in

credit/lending business

Integrating climate related risk in the risk

management process as per global frameworks

• Focused training throughout the organization on

risk management principles

• Inclusion of Risk management criteria in the HR review

process for all employees

• *Due diligence process to identify risk & impact relating

to human rights

• Assessment of potential human rights issues across

business activities

FY24 FY25 FY 26

Risk & Crisis

Management

Risk

Management

Goal 2030 Achieve transformative stage in the risk maturity ladder

Target 2028

-

Target 2026

Focus Area SPOC

Rakesh Kalyanram,

Lead - Risk

Risk Management Team

*This point is included in HR goals as well](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-28-320.jpg)

![Page 32

Building the ‘Framework’

Pillar 6 – Responsible Finance – Green Finance [ 1 / 2 ]

Conduct market survey and identify the

requirements of green products

Develop criteria for Green products/responsible

finance.

Identify responsible finance products (ex: lending

for rain water harvesting, Biogas plant, EV & CNG

vehicle, Solar water heater, ECO friendly buildings,

Solar PV, composting facility etc).

Develop KPIs on Green products outreach (e.g. no.

of beneficiaries, GHG emission

reduction, reduction in fresh water withdrawal etc.)

• Roll out the pilot product and monitor the impact

created across defined KPIs.

• Basis the pilot product, relook the criteria.

• Set goals and targets against the KPIs for

evaluation.

• Launch of green products portfolio.

• Measure the KPIs to assess the performance against the

targets.

• Communicate the performance both externally and

internally at fixed intervals (external assurance).

• Explore options releasing Green bonds/green deposits,

Sustainability linked loans.

FY24 FY25 FY 26

Green Finance

Green Finance

Goal 2030 xx% revenue from green product portfolio

Target 2028 xx% revenue from green product portfolio

Target 2026 Devise criteria for Green Finance

Focus Area SPOC

To be nominated

Business Team](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-32-320.jpg)

![Page 33

Building the ‘Framework’

Pillar 6 – Responsible Finance – Inclusive Finance [ 2 / 2 ]

• Simplifying loan application processes making it

easier for small businesses & individuals to access

financing

• Develop Strategy to provide financial services for

aspiring entrepreneurs/ MSME enterprises in rural

areas.

• Explore and define an action plan to expand the

micro-finance portfolio in Tier 2 & Tier 3 cities.

• Digital solutions and literacy programs to streamline

transactions in the micro-finance sector.

• Basis strategy, release financial products in the

market to support entrepreneurs/ MSME

enterprises.

• Collaborate with funds, foundations and development

finance Institutions to support projects in sectors like

agriculture, micro-finance, health care etc.

FY24 FY25 FY 26

Inclusive

Finance

Inclusive Finance

Goal 2030 Expanding reach & impact

Target 2028 -

Target 2026 -

Focus Area SPOC

To be nominated

Business Team](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-33-320.jpg)

![Page 35

Building the ‘Framework’

Aspects Cutting Across – Transparency & Disclosures [ 1 / 3 ]

• Dedicated webpage on sustainability to display the

activities under ESG domain

• In addition to the Sustainability Report and BRSR,

TCFD two pager to be appended to existing

Sustainability Report

• Continue the rigour on Sustainability Report in

alignment with GRI Standard, BRSR and TCFD

• External assurance as per ISAE 3000 and AA 1000

AS (2008) Standards

• Integrated reporting in alignment with global frameworks

like GRI/TCFD/IIRC

FY24 FY25 FY 26

Reporting

framework

Disclosures

ESG Indices

• Internal assessment and readiness towards S&P

Global CSA (DJSI) to reach ~40 score*

• Maiden S&P Global CSA (DJSI) assessment

• Continue to participate on S&P Global CSA

(DJSI) assessment

Goal 2030 Aspire to reach top quartile on S&P Global CSA (DJSI)

Target 2028 60 score on S&P Global CSA (DJSI)

Target 2026 -

Focus Area SPOC

D Srividhya, Manager, CSR

Kshama Algure, Assistant

Company Secretary

Social Service Department

and

Corporate Secretary Team

*Above is an indicative score as the DJSI questionnaire gets updated annually](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-35-320.jpg)

![Page 36

Building the ‘Framework’

Aspects Cutting Across – Stakeholder Engagement [ 2 / 3 ]

FY24 FY25 FY 26

Stakeholder

Engagement

Goal 2030

100% digital invoices from vendors with spend of Rs. 1 Cr or

higher

Target 2028 -

Target 2026 Top quartile across all stakeholder group satisfaction surveys

Quarterly engagement with investors - 5 among top 15

Quarterly engagement with Sell-side analyst (minimum

5 nos.)

Quarterly engagement with investors - 7 among top 15

Quarterly engagement with Sell-side analyst (minimum

7 nos.)

Quarterly engagement with investors - 10 among top 15

Quarterly engagement with Sell-side analyst (minimum 8

nos.)

Investors

Develop and incorporate ESG requirements in the

contracts/agreements executed with vendors through

vendor Code of Conduct

Develop SoP for vendor assessment and capture the

scores as part of the vendor assessment

Conduct capacity building on vendor code of

conduct and assessment for strategic vendor

partners

Shift to digital invoices to cover 50% vendors with

spend of Rs. 1 Cr or higher

Involve and engage with strategic vendors (50%) to

implement eco-friendly initiatives

Shift to digital invoices to cover 80% vendors with spend of

Rs. 1 Cr or higher

Vendors

Focus Area SPOCs

• Mr. Deepak Shivprakash Khetan, National Manager- Investor

Relations, Financial Planning & Strategy;

• Ms. Apoorva Padmanabh, Manager- Service Quality

Compliance;

• Mr. Sriram Srinivasan- Digital Banking;

• Mr. Zubair Ullah, Head- Digital Channels;

• Mr. Tahir Khan, National Manager- Procurement](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-36-320.jpg)

![Page 37

Building the ‘Framework’

Aspects Cutting Across – Digital Transformation [ 3 / 3 ]

Implement new digital solutions such as end-to-end

Digital Fixed Deposit, Digital Savings/Current

Account, personalised banking services using video

banking solutions

Bringing 35 lakhs+ customers into digital banking

space and achieve digital transactions (volume) of

35 crores by including 12 lakh+ new users on any

one of the digital platform

Bringing 50 lakhs+ customers into digital banking

space and achieve digital transactions (volume) of

50 crores by including 15 lakh+ new users on any

one of the digital platform

Bringing 65 lakhs+ customers into digital banking space

and achieve digital transactions (volume) of 75 crores by

including 18 lakh+ new users on any one of the digital

platform

100% digitalisation for Asset & Liability business and

Digital Lending Solutions, thereby moving towards paper

less banking services

FY24 FY25 FY 26

Digital

Transformation

Digital

Transformation

Goal 2030

Bringing 1 crore customers into digital banking space and achieve digital

transactions (volume) of 100 crores.

Target 2028 -

Target 2026

Bringing 65 lakhs+ customers into digital banking space and achieve

digital transactions (volume) of 75 crores.

Focus Area SPOCs

• Mr. Sriram Srinivasan- Digital Banking;

• Mr. Zubair Ullah, Head- Digital Channels;

Digital Banking Dept](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-37-320.jpg)

![Page 47

Building the ‘Framework’

Pillar 1 – Sustainable Operations – Sustainable by Operations [ 1 / 2 ]

Sustainable by

Operations

Establish and drive sustainable practices across built environment with an objective to minimize resource usage

and also impact associated – Emissions, Waste & Water

Key waste mgmt. measures:

• Introduce digital visiting cards

since FY22

• Replaced single use plastic

bottles with refillable glass

bottles at all offices

• Responsible usage of

compressed wood modulars in

all offices

• E-waste generated disposed only

through authorised entities &

recyclers

• Procure e-devices only from

certified manufacturers that

comply with regulations on

hazardous substances’ disposal

The Govt. notified various rules for Plastic

Waste Management, e-Waste Management,

Construction and Demolition Waste

Management, Metals Recycling etc.

Formed 11 committees, led by the concerned

line ministries & comprising officials from

MoEFCC, NITI Aayog, domain experts,

academics and industry representatives for 11

focus areas

The committees will prepare comprehensive

action plans for transitioning from a linear to a

circular economy in their respective focus areas

India Driving Transition from Linear to

Circular Economy](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-47-320.jpg)

![Page 48

Building the ‘Framework’

Pillar 1 – Sustainable Operations – Sustainable by Design [ 2 / 2 ]

Sustainable by

Design

Environmentally conscious or responsible built space, which is purposefully designed to reduce the overall

environment footprint during & after its construction phase

Key sustainable workspace initiatives:

• Recycle old furniture & utilise only certified green-

wood furnishings

• Afforestation Strategy: Focused on enhancing green

cover in offices & beyond its periphery

• Insulation in offices to reduce heat at workplaces to

reduce energy consumption

• Adopted energy-efficient systems by installing LEDs

in offices, branches & outlets

• Natural ventilation through modern architectural

designs

• Variable Refrigerant Flow (VRF) & Variable

Refrigerant Volume (VRV) systems are integrated &

installed in the ACs in all Offices

• Responsible usage of compressed wood modulars in

AU’s offices which are environmentally benign,

reusable, & recyclable.

LEED Gold certified offices in Mumbai and

Bhubaneswar.

In addition, new buildings in Mohali, Kolkata

Palava and Mumbai (Maharashtra) premises

are being constructed to meet IGBC Gold

certification standards.](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-48-320.jpg)

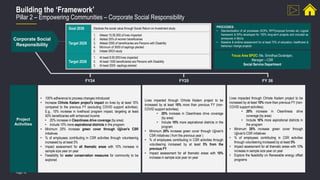

![Page 49

Corporate Social

Responsibility

Supporting essential workers and vulnerable sections of society

through focused interventions like education, skilling, healthcare

Building the ‘Framework’

Pillar 2 – Empowering Communities – Corporate Social Responsibility [ 1 / 1 ]](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-49-320.jpg)

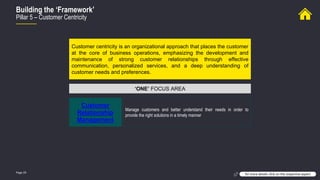

![Page 50

Building the ‘Framework’

Pillar 3 – Human Capital – Talent Management [ 1 / 4 ]

Talent

Management

Companies are evaluated on their workforce talent requirements and their ability to

attract, retain, and develop a highly skilled workforce.](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-50-320.jpg)

![Page 51

Building the ‘Framework’

Pillar 3 – Human Capital – Diversity, Equity & Inclusion [ 2 / 4 ]

Diversity, Equity &

Inclusion

Culture of inclusion and belonging for everyone in an organization irrespective of

gender, ethnicity, race, religion, etc.](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-51-320.jpg)

![Page 52

Building the ‘Framework’

Pillar 3 – Human Capital – Human Rights [ 3 / 4 ]

Human Rights

Rights inherent to all human beings, regardless of race, sex, nationality, ethnicity,

language, religion, or any other status.](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-52-320.jpg)

![Page 53

Building the ‘Framework’

Pillar 3 – Human Capital – Health, Safety and Wellbeing [ 4 / 4 ]

Health, Safety &

Wellbeing

Promoting resilient and transformative culture where workplace allows people to

perform and develop in a safe and healthy ecosystem

FY2021-22 was again a very

challenging year for the entire

nation and the global economy in

particular, due to repeated waves of

COVID-19 pandemic, global

conflicts & ensuing economic

disruptions.

One of the key focus areas of the

Human Resources function during

the financial year was to enable

employee well-being and also

ensure business continuity for

superior customer service.](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-53-320.jpg)

![Page 54

Building the ‘Framework’

Pillar 4 – Effective Governance – Data Privacy and Cyber Security [ 1 / 4 ]

Data Privacy &

Cyber Security

Due to the current trend of digitization, it is crucial that access to network, IT systems and data is assured at all times eliminating

threat to confidential data and customer privacy in terms of data theft & loss

Data

Privacy &

Cyber

Security](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-54-320.jpg)

![Page 55

Building the ‘Framework’

Pillar 4 – Effective Governance – Governance [ 2 / 4 ]

Governance

This pillar evaluates the impact companies' corporate governance and business ethics practices have on investors.

The companies are assessed on all Governance Key Issues, including Ownership & Control, Board, Pay, Accounting,

Business Ethics, and Tax Transparency.](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-55-320.jpg)

![Page 56

Building the ‘Framework’

Pillar 4 – Effective Governance – Ethics & Compliance [ 3 / 4 ]

Ethics & Compliance An ongoing process of monitoring and assessing systems to ensure they comply with regulatory and industry requirements

UK

• FCA is consulting on corporate disclosure of

climate risks and is focusing on ‘greenwashing’

• TCFD mandated for companies listed on

premium exchange from January 1, 2021 and to

extend to all UK companies by 2025

• Social value legislation and climate legislation for

procurement

• Non-Financial Reporting Directive – expected to

cover 50k entities

• EU Taxonomy for Sustainable Activities

Hong Kong

• The Securities & Futures Commission announced its

Strategic Framework for Green Finance in 2018, with

a focus on climate-related disclosure and the

integration of ESG into investment processes by asset

managers

Germany

• Bafin published guidance in December

2019 on how FS firms should manage

sustainability risks, with a focus on climate

Singapore

• Monetary Authority of Singapore - exploring ways to

incorporate climate-related risks

• SGX introduced sustainability on a “comply-or-

explain” basis to its listing rules.

• SGX is aligning its disclosure requirements in line

with TCFD

Australia

• Australian Securities & Investments

Commission - disclosure provisions to

climate-related risks, reflecting TCFD

recommendations

India

• SEBI introduced Business Responsibility and

Sustainability Reporting (BRSR) regulations.

• It will be mandatory for top 1000 listed

companies (by net-worth) from FY23 (voluntary

from FY22)

United States

• US Senate - ESG Disclosure Simplification Act

of 2021

• SEC Announces Enforcement Task Force

Focused on Climate and ESG Issues

• SEC requests Public input on Climate

Disclosures

Europe Union

• Sustainable Finance Action Plan

• Sustainable Finance Disclosure Regulations

Switzerland

• Mandates Climate Reporting for

public companies, banks and

insurance entities over a

threshold – aligned with TCFD](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-56-320.jpg)

![Page 57

Building the ‘Framework’

Pillar 4 – Effective Governance – Risk Management [ 4 / 4 ]

Risk & Crisis

Management

Assessment and management of the risks associated

with climate change/extreme weather and its impacts](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-57-320.jpg)

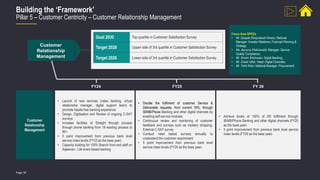

![Page 58

Building the ‘Framework’

Pillar 5 – Customer Centricity – Customer Relationship Management [ 1 / 1 ]

Customer Relationship

Management

Manage customers and better understand their needs in order to

provide the right solutions in a timely manner

• Customer-centric approach

• Seamless, easy, fast & transparent service

• Continuous client interaction by using

both digital and non-digital channels

• More than 70% of client requests in March

2022 were raised through digital channels

and overall 95% of the requests got resolved

within one day](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-58-320.jpg)

![Page 59

Building the ‘Framework’

Pillar 6 – Responsible Finance – Green Finance [ 1 / 2 ]

Green Finance Green financing is to increase level of financial flows to sustainable development priorities

• In 2017, the State Bank of India (SBI) launched a green bond worth ₹1,000 crore (US$125 million). The proceeds

from the bond were used to finance renewable energy projects

• In 2018, HDFC Bank launched a green loan scheme worth ₹5,000 crore (US$625 million). The scheme is designed

to finance energy efficiency projects in commercial buildings

• In 2019, ICICI Bank launched a sustainable investment fund worth ₹1,000 crore (US$125 million). The fund invests in

companies that are working to promote sustainable development](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-59-320.jpg)

![Page 60

Building the ‘Framework’

Pillar 6 – Responsible Finance – Inclusive Finance [ 2 / 2 ]

Inclusive

Finance

Availability and equality of opportunities to access financial services. It refers to a process by which individuals and businesses can

access appropriate, affordable, and timely financial products and services.

Improving

Access

Improving

Usage

Enhancing

Quality

Financial

Inclusion

31% branches in

unbanked rural

centres

1,93,000+

customers

provided financial

services under

Jan Dhan Yojana

600+ financial

literacy camps

at rural

branches

Digital

Inclusion

39,000+ AU 0101

registration in

unbanked rural

centres

40,000+ UPI

transacting

customers in

unbanked rural

centres

20,000+

merchants

onboarded on

UPI QR codes

in unbanked

rural centers](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-60-320.jpg)

![Page 61

Building the ‘Framework’

Aspects Cutting Across – Transparency & Disclosures [ 1 / 3 ]

Transparency &

Disclosures

Ensuring data completeness, accountability and data transparency to all

relevant stakeholders and available in a timely manner.

Disclosures- India

BRSR is mandatory for the top

1000 listed entities

ESG investing to tackle the risk

of greenwashing including

mandating ESG schemes to

invest at least 65% of AUM

Core BRSR mandates 49

parameters for ESG reporting

Reasonable assurance made

mandatory under core BRSR](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-61-320.jpg)

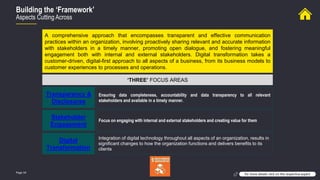

![Page 62

Building the ‘Framework’

Aspects Cutting Across – Stakeholder Engagement [ 2 / 3 ]

Stakeholder

Engagement

Focus on engaging with internal and external stakeholders and creating value for them](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-62-320.jpg)

![Page 63

Building the ‘Framework’

Aspects Cutting Across – Digital Transformation [ 3 / 3 ]

Digital

Transformation

Integration of digital technology throughout all aspects of an organization, results in

significant changes to how the organization functions and delivers benefits to its clients](https://image.slidesharecdn.com/esgframework-231008035123-ac5259a1/85/ESG-Framework-pptx-63-320.jpg)