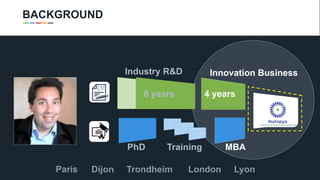

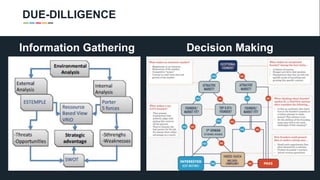

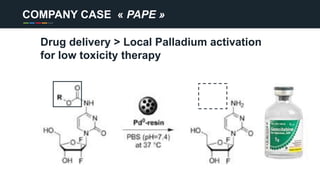

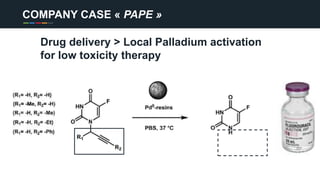

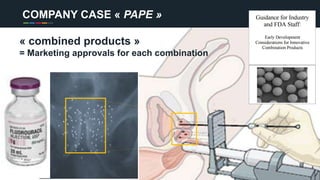

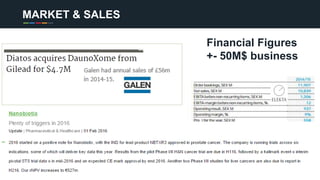

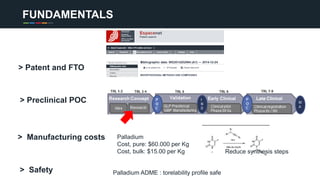

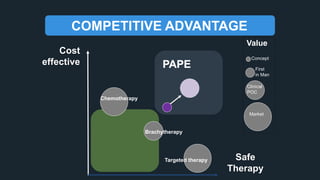

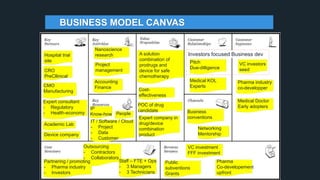

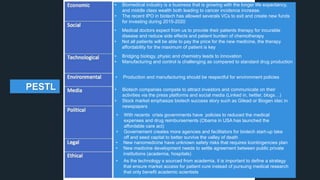

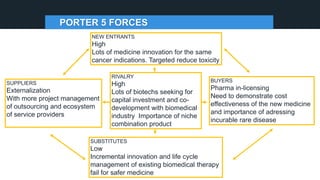

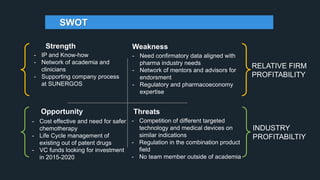

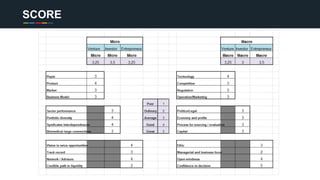

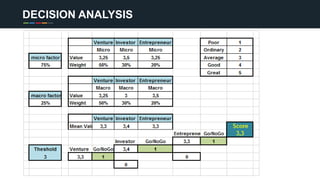

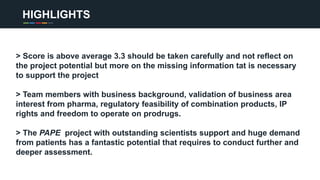

The document profiles Sabin C. Carme, a transdisciplinary scientist with experience in industry R&D, innovation, and business. It discusses two company cases he has evaluated: PAPE, which involves a drug delivery system using local palladium activation for low toxicity therapy, and opportunities for building strategic advantages. It also includes an analysis of the company's competitive advantage, business model, market forces, strengths, weaknesses and opportunities for further assessment.