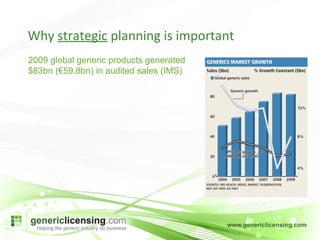

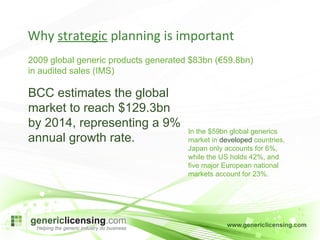

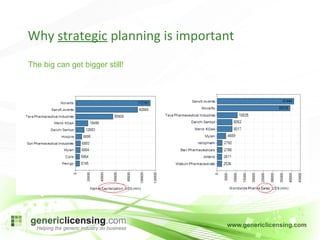

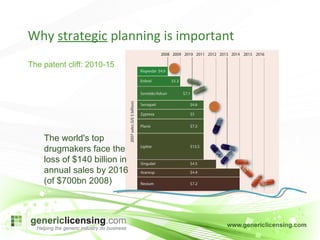

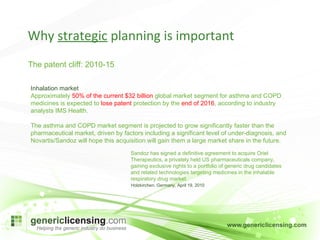

The document discusses the importance of strategic portfolio planning for generic drug companies. It notes that the global generic drug market was worth $83 billion in 2009 and is estimated to reach $129 billion by 2014. Strategic planning is important because the market is very competitive and the largest companies are continuing to grow in size through acquisitions. Companies need to plan which drugs to target for patent expiries, consider manufacturing and distribution channels, and prepare for increased biosimilars competition. Proper portfolio planning is crucial for success in the rapidly growing but challenging generic drug industry.