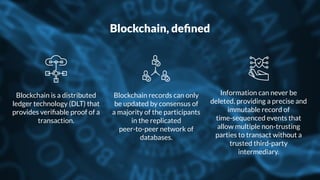

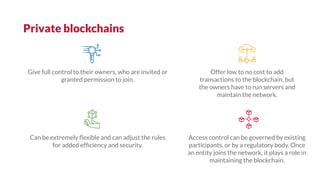

The document discusses the potential of blockchain technology to enhance efficiency in the financial services sector, addressing issues like reliance on aging infrastructure and third-party intermediaries. It differentiates blockchain from Bitcoin, highlighting its capabilities in secure transaction recording and two types of networks: public and private blockchains. Forecasts suggest that enterprise applications of blockchain technology could grow significantly from $2.5 billion in 2016 to $19.9 billion by 2025, with a CAGR of 26.2%.