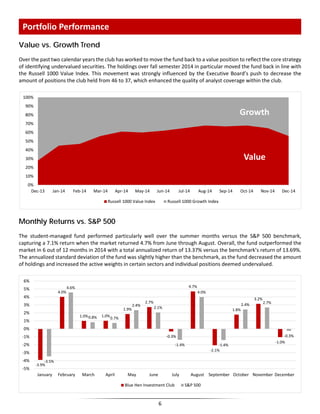

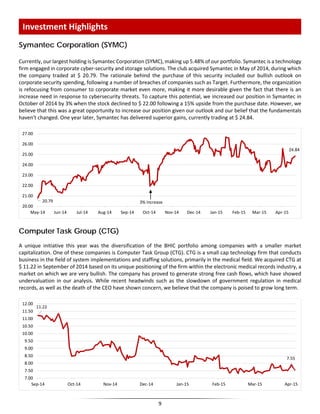

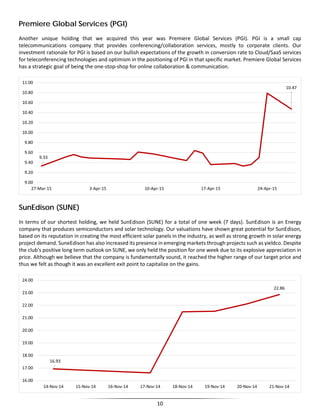

The Blue Hen Investment Club had a successful 2014. It saw record interest from students and optimized its recruitment process. It implemented new initiatives like performance evaluations, equity research reports, and financial modeling workshops that improved members' skills. The portfolio performed well against the S&P 500 in 2014, with a return of 13.37% versus 13.69% for the index. Top performing sectors were Health Care, Information Technology, Industrials & Materials, and Financials. The club also emphasized value stocks and reduced holdings to focus on fewer companies. Notable holdings included Symantec, Computer Task Group, and Premiere Global Services.